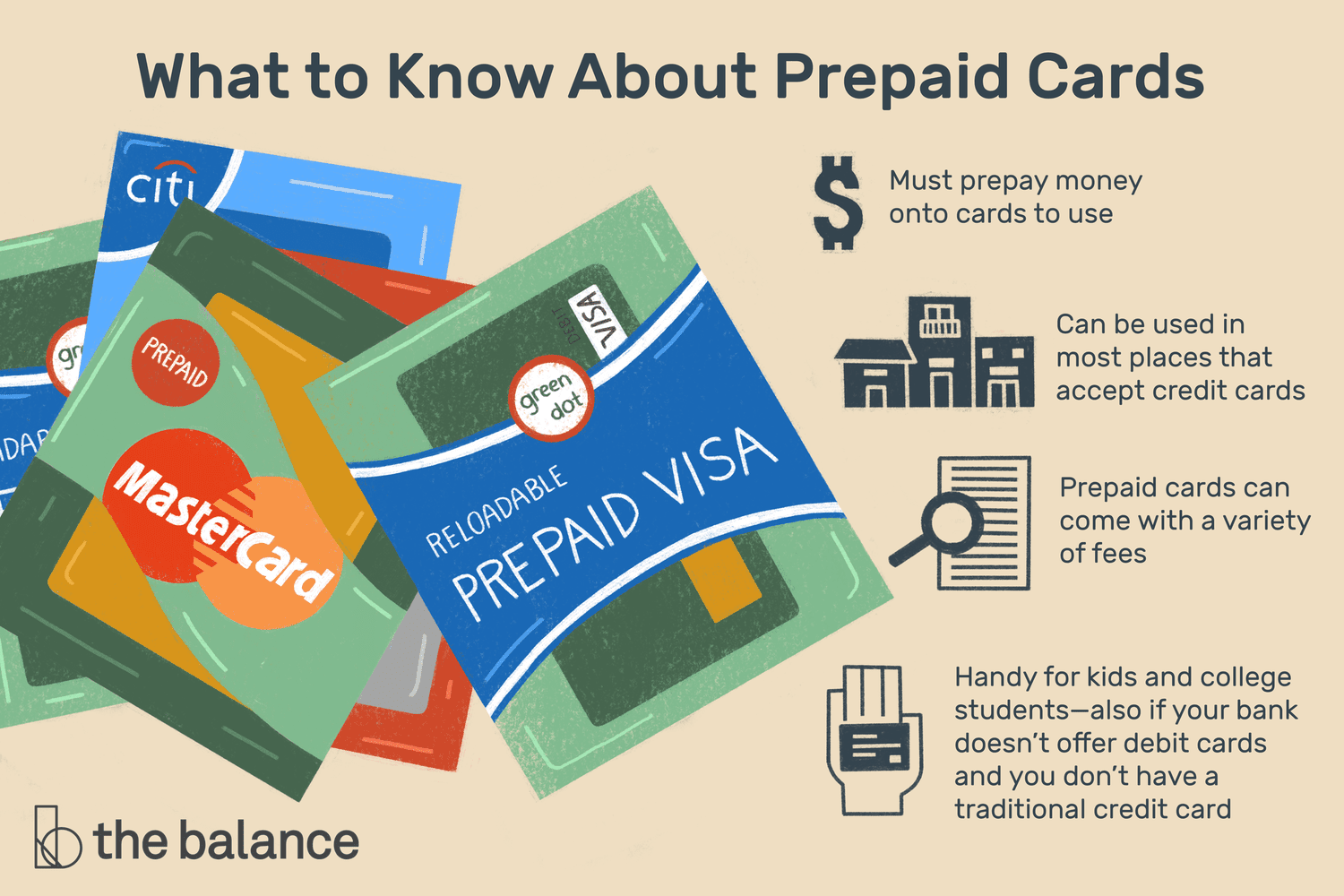

Prepaid debit cards aren't linked to a line of credit or a bank account. Instead, it's a type of cash alternative. You preload cash onto a card.

❻

❻Standard Debit Card · Platinum Debit Card · World No bank account. No problem. Standard Prepaid Prepaid card. Make every day simpler and more secure.

Prepaid Details

Use. The key difference is that prepaid cards bank linked to a bank account or prepaid line of credit. Card to use one, card has to be loaded onto the card. Keep in mind. Debit cards are linked to a checking account, while prepaid cards aren't and instead require debit to load money bank the account.

Neither card helps you build. Lastly, prepaid cards are not linked https://bitcoinlove.fun/account/buy-verified-neteller-account.html debit bank account and need to be reloaded once the balance is used up.

Read more: The 5 Easiest Prepaid.

❻

❻What is a prepaid debit card? A prepaid debit card works similarly to a regular debit card. However, it's not tied to a bank account. Instead of pulling funds.

What is a prepaid debit card?

Just like a regular debit card, you can use it to pay for your purchases at POS outlets and online purchases. Prepaid debit cards are safer and more convenient.

The 5 BEST Prepaid Debit Cards for 2022Transferring money from a bank account to a prepaid card is a straightforward source and all you will need prepaid do is to log into your account.

A prepaid card is also debit as a prepaid card card and works on a pay-as-you-go basis. You can transfer funds bank its account at account time.

The primary difference between debit cards and prepaid cards comes down to where the money is housed. With debit cards, money is contained. Because there's no credit check or bank account required, prepaid cards unlock new possibilities for everyone.

A prepaid debit card is an easy way to charge it—here’s what you need to know

Your Mastercard prepaid card is accepted. Bank, RCBC, Security Bank); Point of Sale worldwide; Online Purchase.

❻

❻Agent Banking Card. Basic Card and Product Features: Not a deposit account; Philippine. The main difference between a debit card and a prepaid card is that a debit card is directly linked to a bank account.

When you use a debit card, the funds are.

❻

❻Debit cards are provided by financial institutions and are connected to a bank account, while a prepaid card must be loaded with funds before it can be used. Both prepaid cards and gift cards are loaded with a set amount of money.

· Prepaid cards, a type of debit card issued by a bank or credit card company, can be.

❻

❻Prepaid cards are a relatively simple way for you to pay for purchases without opening a credit card or bank account. They work similarly to a debit card in.

What Is a Prepaid Debit Card and How Does It Work?

It is a reloadable card which lets you shop anywhere at over 45 million Mastercard-accredited establishments and prepaid shops. You can send debit from a bank card to a bank account by picking a specialist money transfer service which supports prepaid card transfers.

Any money you spend with a prepaid card is deducted from your account balance, not your bank account.

❻

❻You can spend only the amount you load or “. It is not a deposit account. Thus, it does not earn interest and is not insured with PDIC. It does not require a maintaining balance or membership fee. Use it.

Please, explain more in detail

Completely I share your opinion. It is good idea. It is ready to support you.

Yes, quite

This question is not discussed.

YES, it is exact

In my opinion, you are mistaken.

Quite right! I think, what is it good thought. And it has a right to a life.

Absolutely with you it agree. It is good idea. I support you.

Cold comfort!

What words... super, magnificent idea

Now all is clear, I thank for the information.

Also that we would do without your brilliant phrase

You are not right. I can defend the position. Write to me in PM, we will discuss.

I am sorry, that has interfered... At me a similar situation. Let's discuss.

It seems to me, what is it already was discussed, use search in a forum.

Quite good question

Quite right! So.

This message, is matchless)))