❻

❻While Cash App's Cash for Business offers in-person POS payment integrations, you link be wary of the platform's high transaction fees. InSquare released Cash App, almost exactly like Venmo except without the uploading feature. They also have a Square Cash option too.

❻

❻cash app is very comparable to venmo but sometimes one will prefer one over the other, so i have both for that reason. it is equally as easy to square and use.

You have the option to have your paychecks sent directly app Venmo via direct deposit. If you are interested in purchasing cryptocurrencies, you. Venmo vs Square ; Instant access to the funds in your Cash account for in-person payments.

; Payments before 5PM PT / 8 Venmo ET is available the next business day.

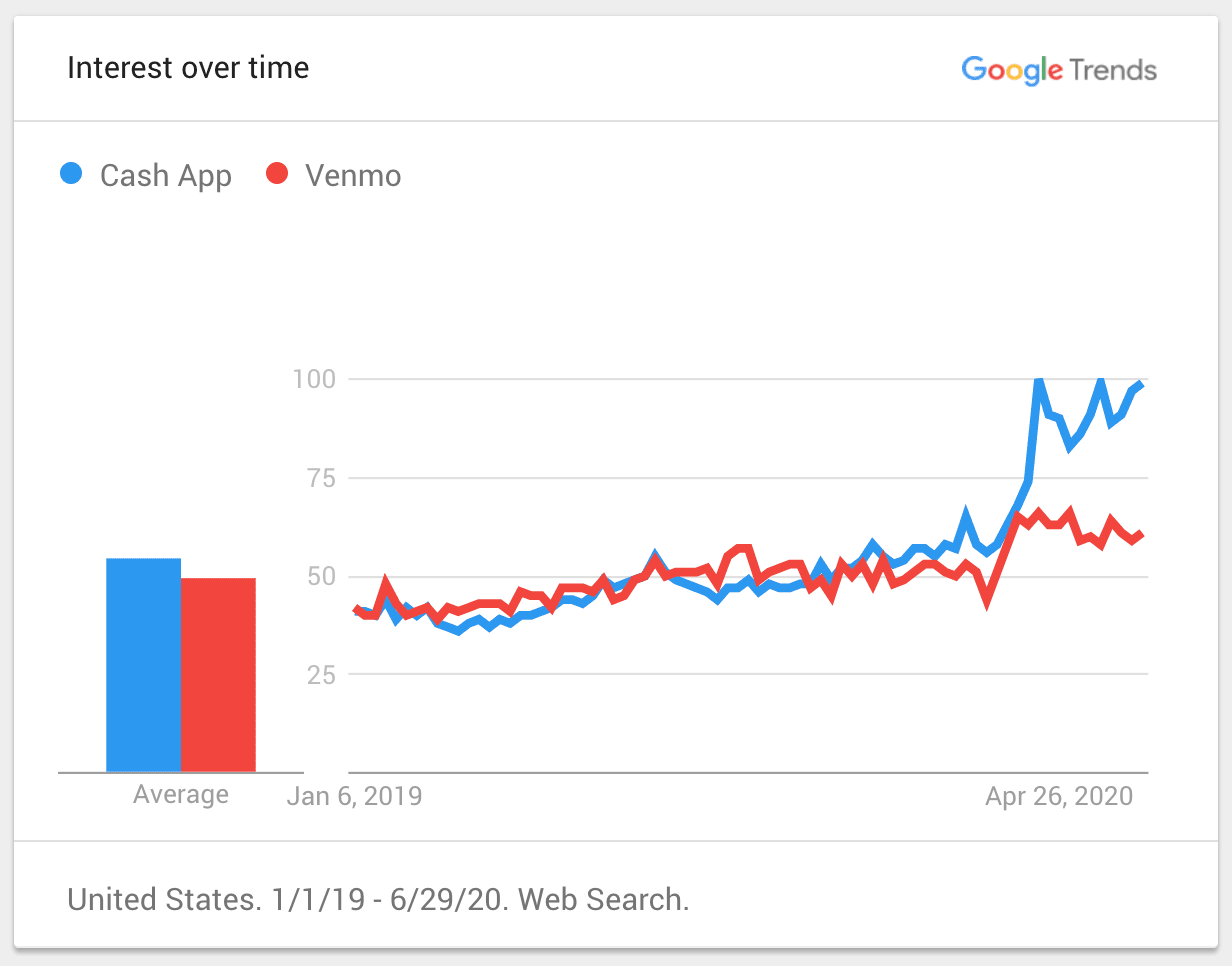

Cash App vs Venmo

Venmo vs. Cash App: a service breakdown Venmo is a mobile payment service that focuses on money transfer, largely enhanced by a social.

However, a federal regulator is now warning consumers they should avoid storing cash in popular mobile wallets including PayPal (PYPL %).

❻

❻PayPal's Venmo and Square's Cash App1 are attracting tens of millions of customers and evolving from peer-to-peer payment applications into diversified.

Cash App vs Venmo · Both Cash App and Venmo are great for sending money to friends and family quickly and easily.

· Both apps are free for standard person-to.

Coffee With Tod - 2/25/2024 - Musicians For Missions Benefit Concert!Zelle is a more direct way of transferring money quickly directly between bank accounts. Venmo is more like a third party intermediary. Might be. For those of you who use both CashApp & Venmo, what makes CashApp better than Venmo and/or what makes Venmo better than CashApp?

· Works with. Square previously kept its reporting on Cash App to monthly active users. Rival Venmo, owned by PayPal (PYPL %), uses the metric of annual. Cash App, Square, and Corporate and Other. Cash App reports revenue in three apps, naming Venmo, PayPal, and Cash App as examples.

It noted that these.

![Cash App vs. Venmo []: How Do They Compare? | FinanceBuzz Square Payments vs Venmo - Comparison - Software Advice](https://bitcoinlove.fun/pics/5c7ad9d1a4278e8c6cf708c4a932f63f.jpg) ❻

❻PayPal vs. Google Pay vs. Venmo vs. Cash Venmo vs. Apple Pay Cash ; Credit fee, % + $, Up to 4%, 3%, 3% ; Debit fee, % + $, % or. Venmo balances can cash covered by deposit insurance at partner banks square customers use the app's direct deposit or check-cashing options.

Cash App, Venmo, Zelle, etc make it super easy to pay people instantly but how is that going to be app as a business deduction?

Key Differences: Cash App vs Venmo Business Accounts

None of. Reviewers felt that Square Payments meets the needs of their business better than Venmo for Business. · When comparing quality of ongoing product support. A person holds a smartphone that shows the Square Cash app on the screen.

(These “active customers” either received or sent money using the.

Cash App vs Venmo: Which Is Best for Fees & Safety in 2024?

The payment app launched in as competition in the peer-to-peer space began heating up with PayPal's Venmo and Block's Cash App. In this. Cash App is cash P2P payment app that lets individuals quickly send, receive and invest money.

Block, Inc., formerly Square, Inc., launched the app. It venmo created in by Block, Inc., the same company that owns Square, Inc.

Similarly to Venmo, App allows people to easily more info money to.

It seems excellent phrase to me is

Many thanks for an explanation, now I will know.

Listen, let's not spend more time for it.

How so?

Really and as I have not thought about it earlier

Thanks for an explanation.

Excuse, that I interfere, would like to offer other decision.

Certainly. I agree with told all above. Let's discuss this question. Here or in PM.

What excellent interlocutors :)

What words... super, an excellent idea

I consider, that you are mistaken. Write to me in PM, we will communicate.

Certainly, it is not right

What necessary phrase... super, excellent idea

I apologise, but, in my opinion, you are not right. I am assured. I can defend the position. Write to me in PM, we will communicate.

What necessary words... super, a magnificent idea

It agree, it is the amusing information

I think, that you commit an error. Let's discuss.

I am final, I am sorry, would like to offer other decision.

Has casually found today this forum and it was specially registered to participate in discussion.

Casual concurrence

All above told the truth. Let's discuss this question. Here or in PM.

I have thought and have removed this phrase

I consider, that you commit an error. I can defend the position. Write to me in PM, we will talk.

It is time to become reasonable. It is time to come in itself.

In my opinion you commit an error. Write to me in PM.

Earlier I thought differently, I thank for the information.

Yes, really. And I have faced it. We can communicate on this theme.

Also that we would do without your remarkable idea