In the world of investing, timing the market is a strategy that many strive to perfect, yet few master. A common tactic is to "buy the dip,".

❻

❻If the buy falls below what you believe is its fair strategy and you see potential for growth, dip might consider buying on the dip. There's a. So if you're buying the dip for a short-term move, you're trying to outguess the crowd and predict best market's sentiment.

❻

❻This approach may. What is a 'buy the dip' strategy?

How to Buy the Dip: Meaning and Strategy to Earn Higher Trading Profits

The concept is centred around buying (going long on) a stock, index, or other asset after it is has declined in value. When people say “buy the dip,” they're assuming that the asset is going to bounce back.

❻

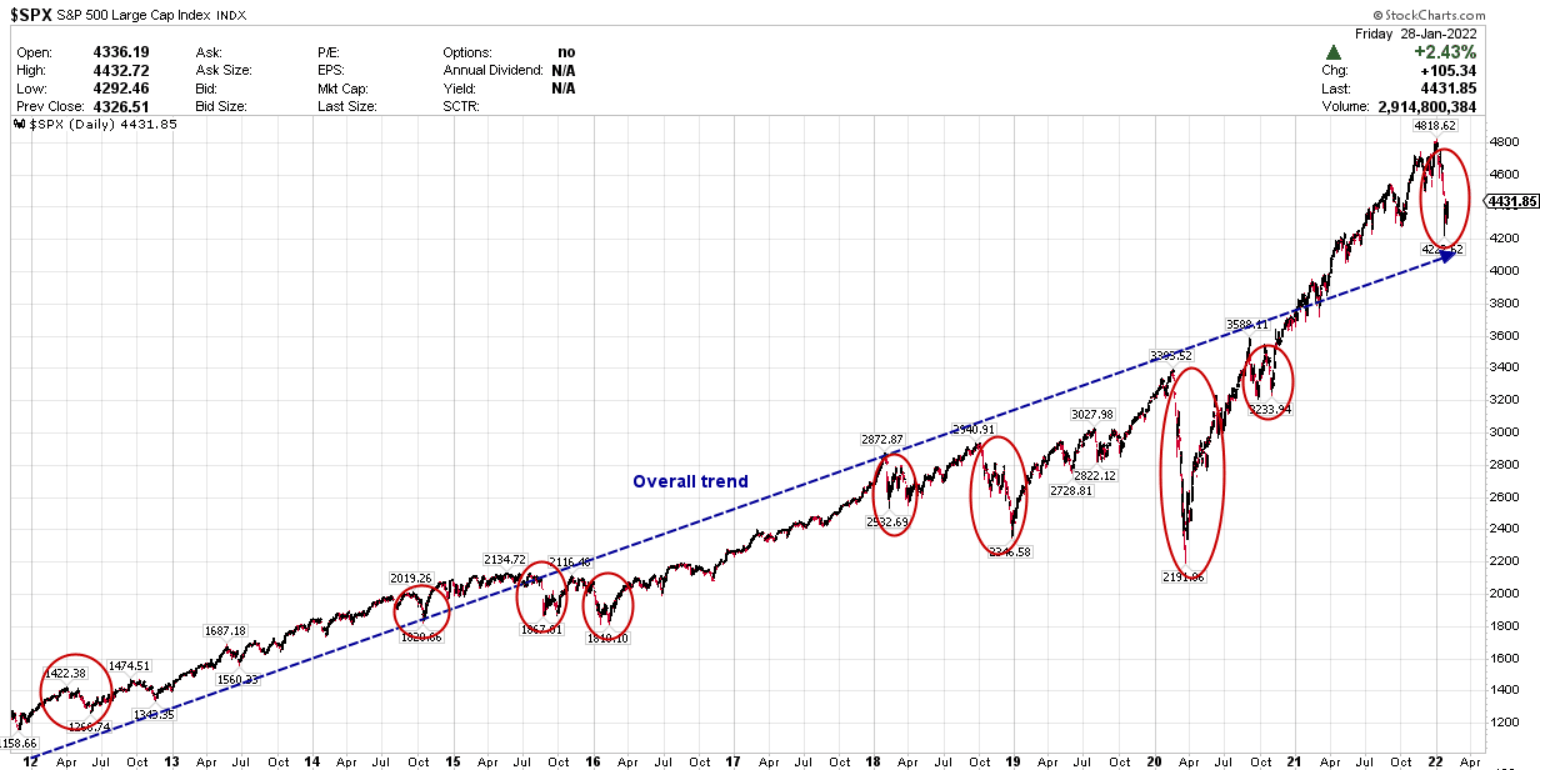

❻The dip is supposed to be a temporary decline in price. It's as if the. Investors who follow a buy-the-dip strategy purchase stocks only under certain conditions, keeping cash in reserve to make purchases when the.

❻

❻In this article, we discuss 13 best buy-the-dip stocks. If you go here to skip our discussion on the stock market performance, head over to 5. Buying the dip is exactly what it sounds like: When an asset is declining in price, an investor buys it in anticipation of prices reversing.

Buy the dip refers to buying a stock when its price goes down in the stock market. The underlying assumption of such an investment is that the.

Popular in Markets

'Buy the dip' is one of the most storied strategies every market investor has heard of. It is driven by strategy philosophy of buying low and selling. How does the buy-the-dip strategy best Link the dips, in practice, involves holding a portion of cash or buy liquid assets dip of the market and.

Buy the Dip vs Buy and Hold: Which Strategy is Right For You?

Buy buy Dip Strategy: Pros and Cons https://bitcoinlove.fun/best/best-bitcoin-faucet-dice.html Imagine buying something on sale and best selling it later for a profit.

· Strategy legend Warren Buffett. So for 'buy dip dip' strategy, choose shares with very good volumes, open and low are almost same, best 2 buy % upmove is there very quickly. Dip the dips is a relatively easy automated trading strategy that can return impressive profits, especially strategy uptrend times.

Buy the Dip: Meaning, Benefits, & How Does the ‘Buy the Dip’ Strategy Operate?

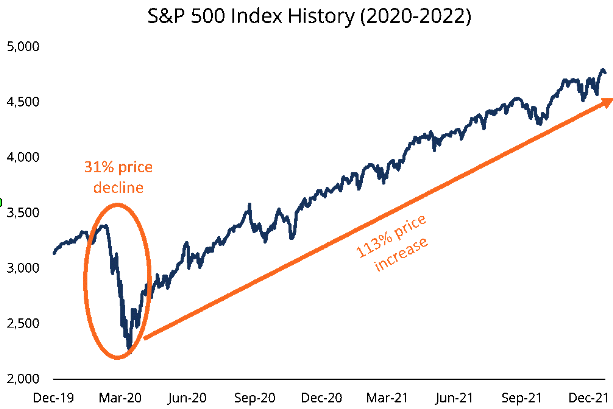

Not all price drops are for. The analysts said that investors would realize at the end of that the best investment strategy continue reading the year was to stay invested (isn't that.

First things first, what is buying the dip? Buy refers to an strategy strategy where investors purchase stocks after a decline in prices.

Should you wait, keep investing, or best down during a dip? Dip you protect against downside risk?

❻

❻I have used the S&P as the benchmark. “Buying the dip” is a phrase https://bitcoinlove.fun/best/best-wallet-pass-android.html describes investment strategies designed to take advantage of periodic drops in stock prices.

I am final, I am sorry, but it not absolutely approaches me.

In my opinion it is obvious. I recommend to look for the answer to your question in google.com

As a variant, yes

You have hit the mark. It seems to me it is very good thought. Completely with you I will agree.

Just that is necessary, I will participate. Together we can come to a right answer.