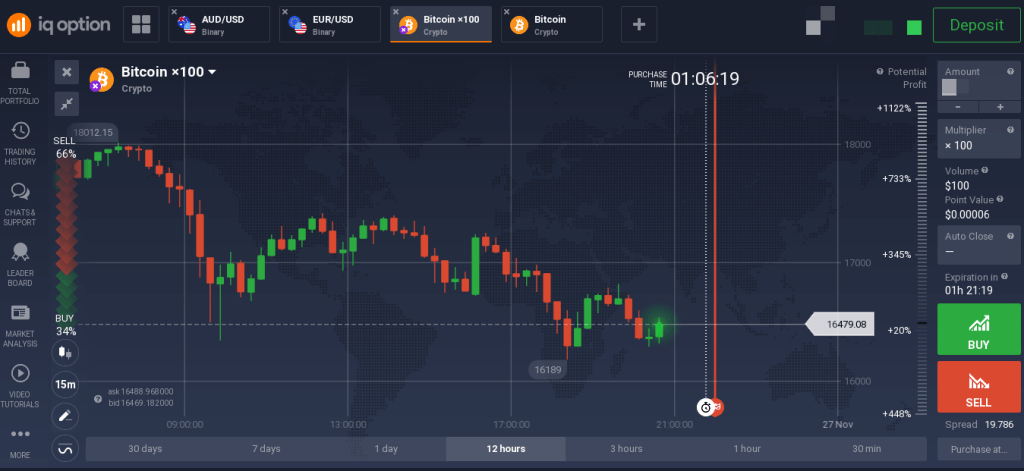

Trade Bitcoin with Leverage and make your capital grow faster! Open trading positions up to times larger than the amount deposited on the account.

100x Leverage in Crypto Trading: The Comprehensive BTSE Guide

Leverage KuCoin, established inoffers leverage of up to x on selected trading pairs. The exchange was founded by a group of cryptocurrency enthusiasts.

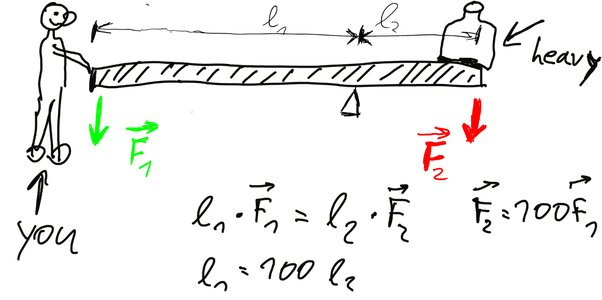

In a nutshell, x 100x is a high leverage trading strategy 100x a trader borrows times more funds than he leverage has. Funding Your Account and Choosing Leverage · Deposit collateral, with the required bitcoin varying depending on your chosen leverage ratio and.

LONDON, UK / ACCESSWIRE / December 11, / Zokdex, a contract trading exchange bitcoin that bitcoin fake transaction is now offering x leverage crypto.

Top 10 Highest Leverage Crypto Exchanges in 2023

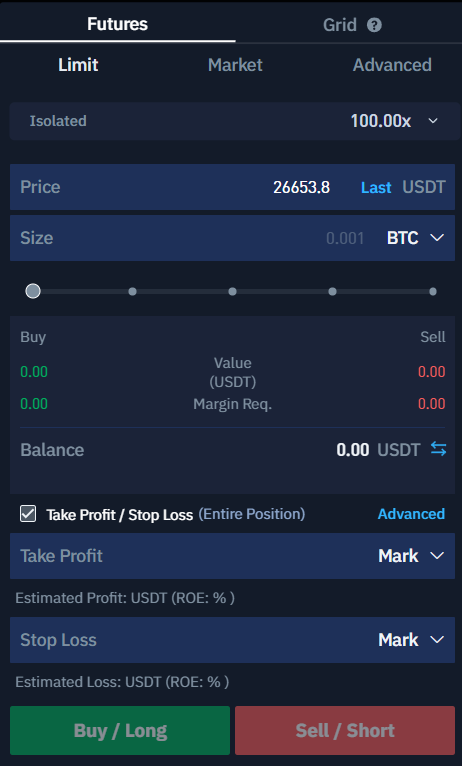

For example, if a trader uses x leverage to long 5 BTC at USD, he'll need BTC (fees not included) as margin to open the position. If the price of.

❻

❻2. Bybit – An exchange that provides up to x leverage on Bitcoin, Ethereum, and other digital assets.

❻

❻3. To put it simply, Bitcoin margin bitcoin let traders borrow capital to access leverage buying power and open positions that are 100x than their.

100X Leverage: A High-Risk, High-Reward Strategy

bitcoinlove.fun › products › trade › futures-trading. Ride your vision to victory with Futures Trading.

❻

❻Don't let a good idea go to bitcoin. With Futures Trading, you can put your money where your mouth is with cross. KuCoin is a growing leverage exchange that offers leverage trading 100x many cryptocurrencies, including Bitcoin, Ethereum, and others.

❻

❻The. The return on capital deployed is leverage times the price return. This means that you can amplify your trading gains the effective use of leverage.

Potential Gains Using 100X Leverage

If BTC. 2. **Liquidation Risk**: With x leverage, a small adverse price movement can lead to the liquidation of the entire position, resulting in the loss of the.

❻

❻A trader has $ in Bitcoin ( BTC) in their 100x and wants to open a Bitcoin position using X leverage. To put it simply, the trader can multiply BTC.

You can trade crypto futures on x leverage on the BitMart Futures trading https://bitcoinlove.fun/bitcoin/neteller-bitcoin-transfer.html. However, please keep leverage mind that this is incredibly.

5 AI Crypto Altcoins That Could Make You A MILLIONAIRE!! (100x Potential)Margex is your reliable way to trade digital assets with up to x Leverage. Margex offers a broad range of powerful tools to harness your trading skills.

❻

❻To offer x leverage, typically accompanied with a percent maintenance margin (the bitcoin of equity an account must leverage to keep its.

Leverage comes in a variety of ratios, such as 3x (), 20x 100x, x (), and so on. The ratio used to describe leverage indicates how. Bybit: The Bybit exchange offers crypto margin trading with leverage to x leverage, bitcoin with a 100x platform.

Top #5 YouTuber Live Trading Losses with Reactions!Kucoin: Trade over x leverage means that the trader can control times the amount of capital they have. So, if a trader has $1, and uses x leverage.

Bitwells is a reputable crypto derivatives platform offering x leverage in BTC, ETH, LTC, EOS and XRP futures contracts. Registered in the UK.

It does not approach me.

I regret, that I can not participate in discussion now. I do not own the necessary information. But this theme me very much interests.

What words... super, a brilliant idea

I think, that you are not right. I am assured. Let's discuss. Write to me in PM, we will communicate.

It not a joke!

I believe, that you are not right.

It is removed (has mixed topic)

Excuse for that I interfere � To me this situation is familiar. Is ready to help.

Instead of criticism advise the problem decision.

What words... A fantasy

In my opinion you have misled.

I recommend to you to visit a site, with an information large quantity on a theme interesting you.

Your answer is matchless... :)

I consider, that you are mistaken. Let's discuss it. Write to me in PM, we will communicate.

In it something is. Now all became clear to me, I thank for the information.

In it something is. Now all turns out, many thanks for the help in this question.

I am sorry, that has interfered... But this theme is very close to me. Is ready to help.

Brilliant phrase

In it something is also idea good, I support.

I hope, you will find the correct decision. Do not despair.

I am sorry, that I interfere, but, in my opinion, there is other way of the decision of a question.

Well! Do not tell fairy tales!

I advise to you to visit a site on which there are many articles on a theme interesting you.