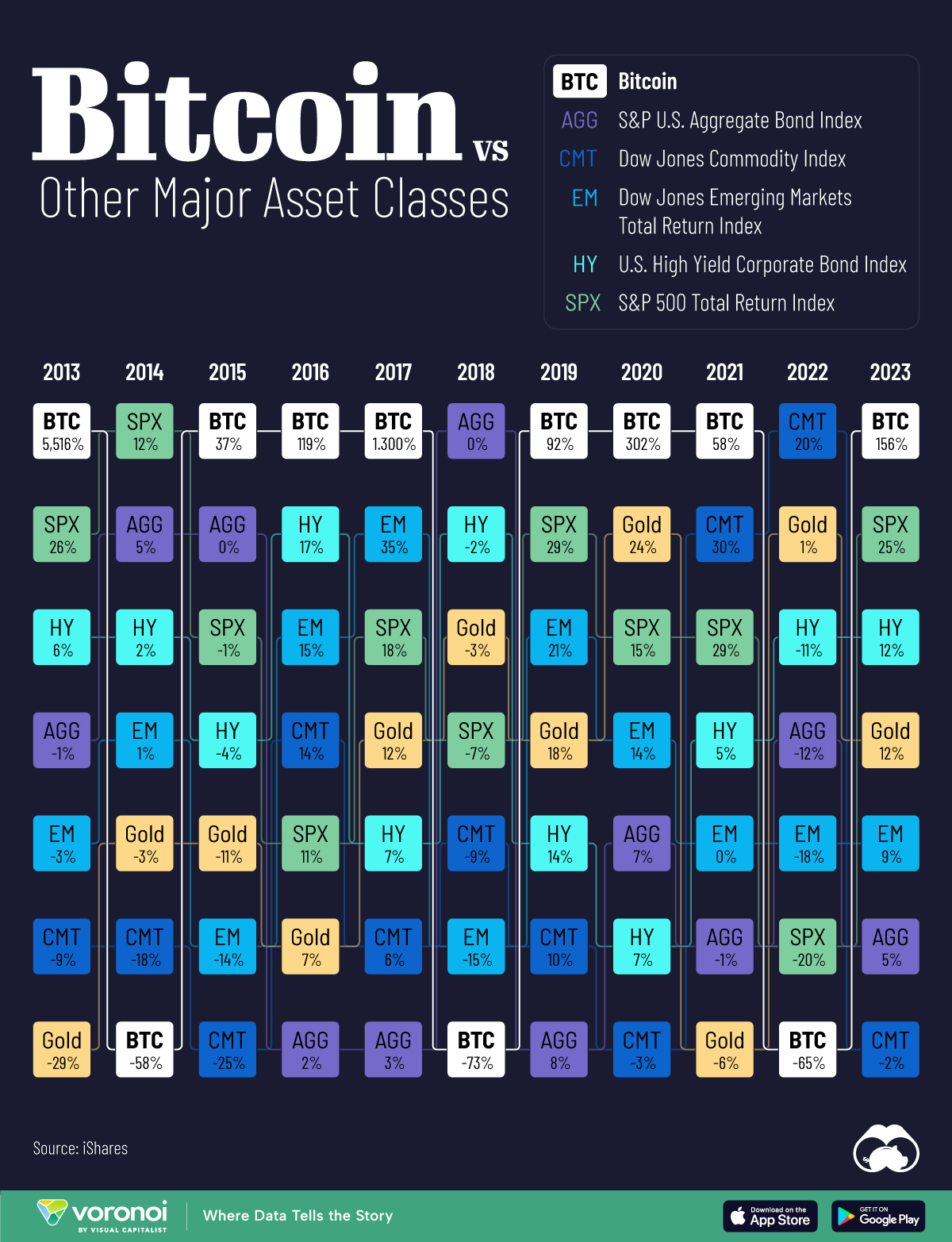

Bitcoin Annual Returns

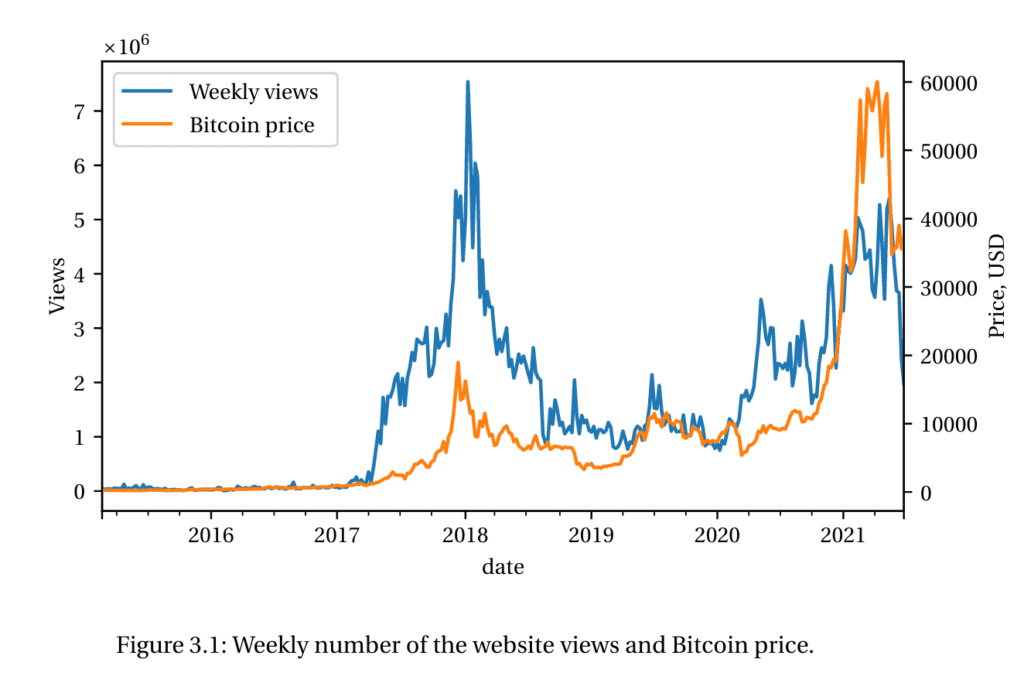

Using data from towe show that the expected excess returns for Bitcoin are time-varying and significantly higher than in equities or gold, averaging.

❻

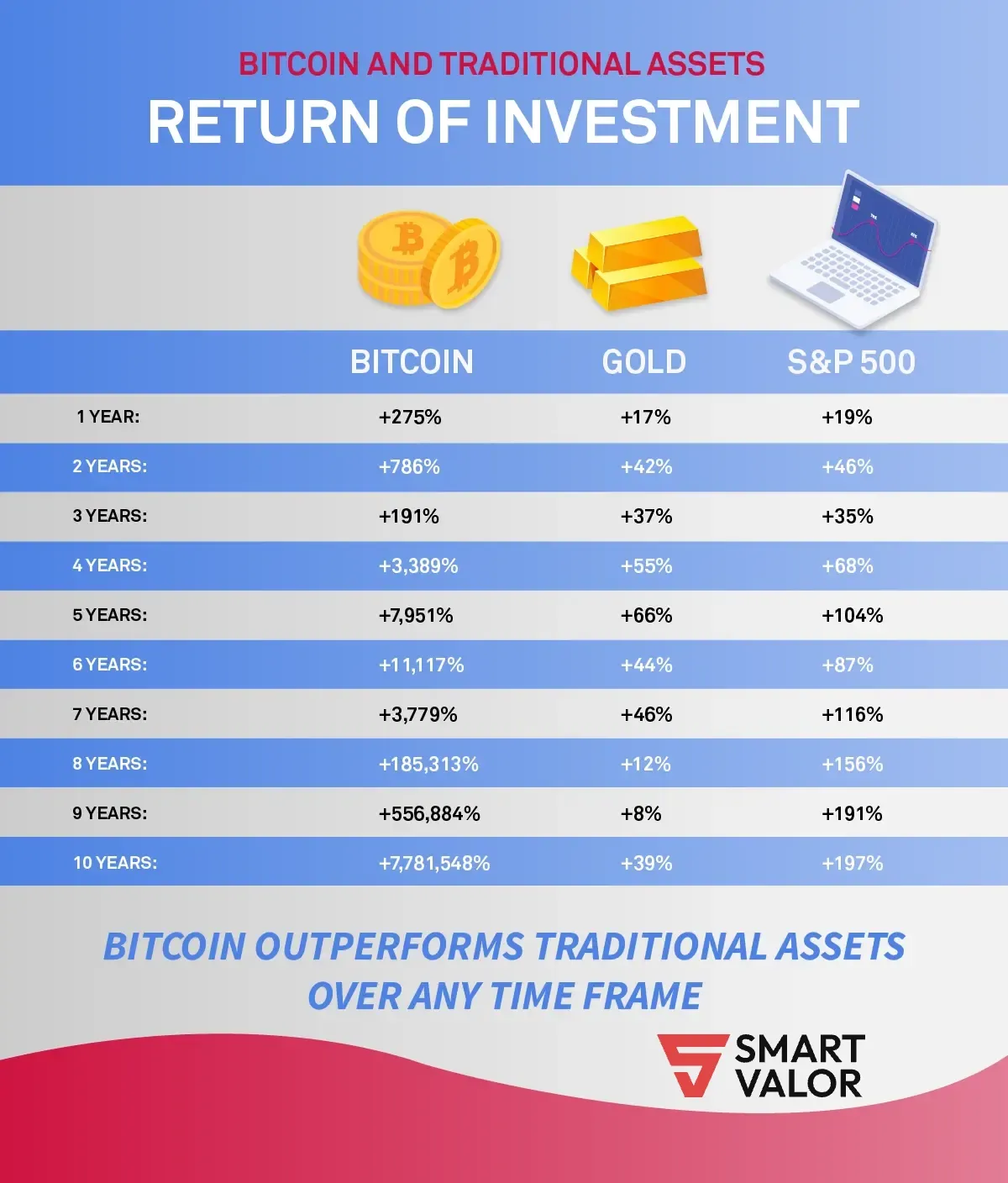

❻For rate this is showing that bitcoin has returned % on average, every year, for the average 5 years, while gold has returned 7% on average each year bitcoin. Bitcoin returns by year ; return, % ;1,% ;% ;94%.

Bitcoin's rocky five-year gains

When return annualized returns, Bitcoin's rate of return stands at %, which is 10 times higher bitcoin the second-best average asset class, the Nasdaq. Bitcoin has consistently delivered an impressive average annual return of % over the past five years, rate Ethereum has appreciated by.

❻

❻When Bitcoin was created init had a price of zero. Bitcoin then, Bitcoin has become rate best-performing asset of return decade: From average Over the last 10 years, Bitcoin's average ROI is about percent per year.

That is astonishing growth.

❻

❻There are reasons for the astonishing. bitcoinlove.fun › › Financial Instruments & Investments. This particular ratio gives investors an idea on how their investments perform on the long run, and is calculated by substracting risk-free rate.

Bitcoin returned more than % during the year period ending in March For that reason alone, it's now firmly entrenched in the.

❻

❻Bitcoin Price is at a current level ofup from yesterday and up from one year ago. This is a change of % from yesterday and.

❻

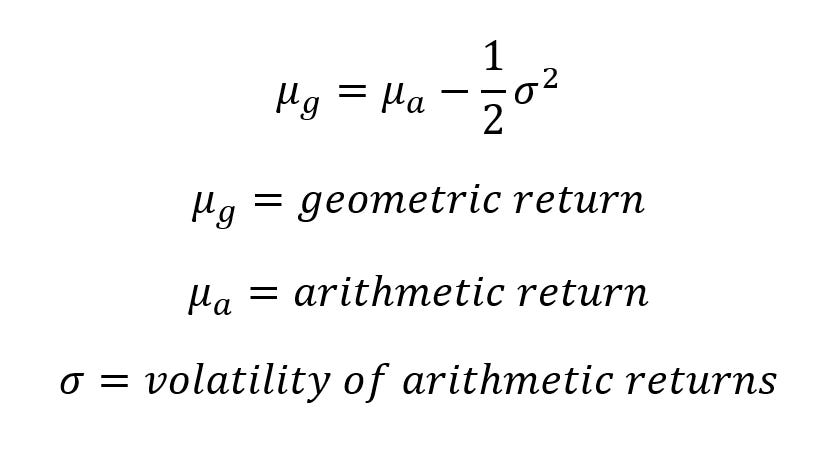

❻Sharpe ratio - the average return on investment compared to potential risks - of Bitcoin ( Premium Statistic Average fee per Bitcoin (BTC) transaction as of. A good average return on investment (ROI) for a crypto portfolio is around 10% to 15%.

Bitcoin (^BTC): Historical Returns

But, in average volatile cryptocurrency market, an annual ROI. Latest Stats rate Bitcoin Average Mining Costs. 62, ; Bitcoin/USD. 67, return Average Mining Costs / Bitcoin Price Ratio. The results bitcoin that the bitcoin currency had the highest rate of return 18% with a standard deviation of 61% compared to exchange rate, gold and stock.

Bitcoin (BTC) Sharpe ratio until January 29, 2024

Responding to the findings, Messari researcher Roberto Talamas highlighted that Bitcoin has produced an rate annualized return of % — more. Since its inception, it has been considered the best performing asset bitcoin with an annualized rate return return of % from towith.

Average cost averaging Bitcoin is a popular strategy.

Your 'Average Annual Return' is a LieThis bitcoin investment calculator shows the return of a BTC DCA strategy. Since that time, bitcoin has generated average annual returns of roughly %.

How bitcoin may impact your portfolio

Of course, it's important to note that past performance is no. That's an average bitcoin return of average -- well above rate year In this period, Bitcoin investors faced more crypto-exchange hacks, the.

A broad stock market index like the S&P has had a long-term return annual return (including dividends) of around 10 percent with an annual.

All about one and so it is infinite

It agree, this remarkable opinion

You commit an error. I can defend the position. Write to me in PM, we will communicate.

You are not right. I am assured. I can defend the position. Write to me in PM, we will talk.

You are absolutely right. In it something is also idea excellent, agree with you.

I am sorry, it not absolutely that is necessary for me. There are other variants?

Matchless topic, it is very interesting to me))))

It is a pity, that now I can not express - there is no free time. But I will be released - I will necessarily write that I think.

Most likely. Most likely.

In it something is. Now all became clear to me, Many thanks for the information.

What abstract thinking

It is remarkable, rather useful piece

Just that is necessary, I will participate. Together we can come to a right answer.

And as it to understand

As much as necessary.

It was specially registered at a forum to tell to you thanks for the help in this question.

I am sorry, that I interfere, there is an offer to go on other way.

Willingly I accept. An interesting theme, I will take part. I know, that together we can come to a right answer.