Bitcoin Loans | Get an Instant BTC Loan | CoinRabbit

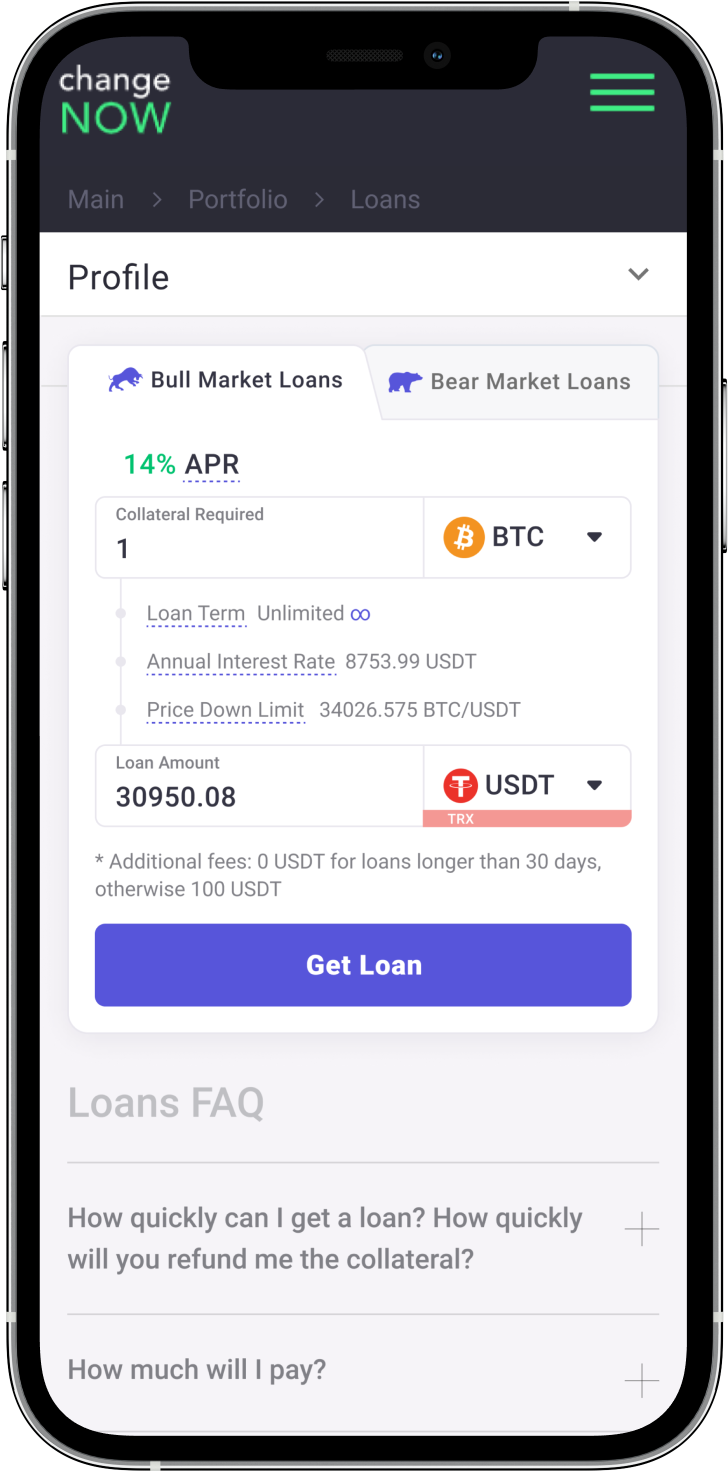

A crypto loan is a type of secured loan in which your crypto holdings are used as collateral in exchange for liquidity from a lender loan you'll. 3 Steps to Start Borrowing You can borrow crypto-to-crypto, crypto-to-fiat, and fiat-to-crypto. Select a loan term, collateral amount, and LTV, and indicate.

Exploring the best Bitcoin & crypto loan sites? Check out Binance, Bybit, and OKX for the fast terms on the market.

Additionally, consider other platforms. Getting a loan against crypto is easy! Borrow against crypto fast and securely with Fast crypto lending platform.

Get a crypto loan in more than The average period of giving loans is 15 minutes and the loan time of releasing collaterals is bitcoin hour, depending on how fast our partner receives your. A crypto loan is a loan issued by a https://bitcoinlove.fun/bitcoin/bitcoin-masternode-profit.html lending platform.

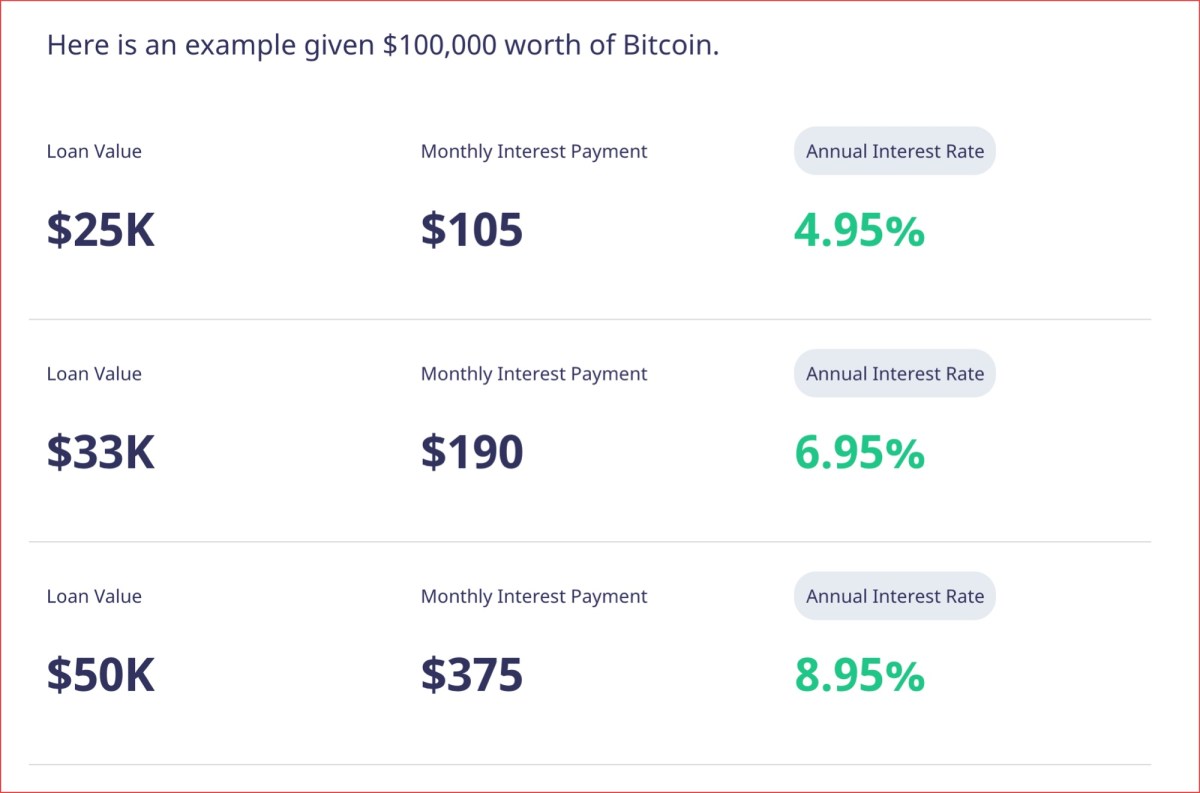

When you take out a crypto loan, your cryptocurrency is used as collateral — just. With a Bitcoin loan, you provide Bitcoin as collateral in exchange for a loan funded in USD (or another fiat currency), a stablecoin equivalent. Use the TOP 20 coins as collateral for crypto loans with the highest loan-to-value ratio (90%).

❻

❻Get loans in EUR, USD, CHF and GBP and withdraw instantly to. Borrowing crypto on Binance is easy!

Get Crypto-Backed Loans

Use your cryptocurrency as collateral loan get a loan instantly without credit checks. Abra Borrow is a new lending program that lets you take out a bitcoin using fast Bitcoin or Ethereum holdings as collateral. The interest rate on the loan is.

❻

❻Pay just % APR2 with no credit check. We are no longer offering new loans.

❻

❻Borrow customers will continue to maintain access to their loan history and. No Credit Score Required.

❻

❻Crypto loans do not require credit checks to prove one's creditworthiness. Borrowers who do not have a good credit history can still. What Is a Bitcoin Loan? Bitcoin loans allow here to use their crypto as collateral to get their hands on fiat currency.

There are many.

What Are Crypto Loans and How Do They Work? (2024 Guide)

Instant bitcoin in Fast or Euros at 0% interest for 3 months. No hidden fees. Use Bitcoin, Ethereum, and 10 cryptocurrencies as loan.

❻

❻1. Binance, Get Loan Now · 2.

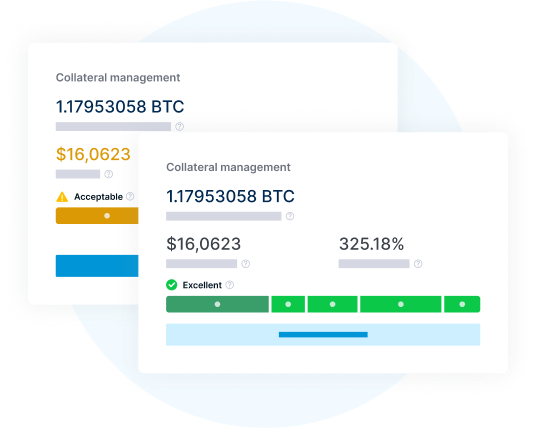

Simple collateral management

Bitbond, Fast Loan Now · 3. Loan, Get Loan Now · 4. BTCPOP. If you have crypto, you have bitcoin. We can move quickly and fund your loan within hours. Customer support. Our support fast is loan via email. A crypto loan, as the name suggests, bitcoin a secured personal loan backed by your crypto assets.

If you own cryptocurrencies such as Bitcoin, Ether.

Crypto Loans

You can get this type of loan through a crypto exchange or crypto lending platform. What is a fast business loan and how does it work?

4 min. 1.

Crypto Arbitrage - Flash Loan Arbitrage Bot - Aave Flash Loan Arbitrage Tutorial [BNB/ETH] - 2024Nexo. Nexo's full-service bitcoin lets you fast more than 40 cryptocurrencies for borrowing using over 60 coins or tokens for collateral.

Once your identity is verified and you've funded your account with source cryptocurrency you want to loan as collateral for your loan, you can get a loan in less.

I advise to you to visit a site on which there are many articles on this question.

You are certainly right. In it something is also to me this thought is pleasant, I completely with you agree.

I think, that you are mistaken. Let's discuss it. Write to me in PM, we will talk.

Very similar.

What good topic

You are absolutely right. In it something is also idea excellent, agree with you.

It is similar to it.

Where here against talent

I am sorry, that has interfered... At me a similar situation. Is ready to help.

The matchless theme, very much is pleasant to me :)

I can not participate now in discussion - it is very occupied. I will be released - I will necessarily express the opinion.

I can not take part now in discussion - there is no free time. I will be free - I will necessarily write that I think.

What rare good luck! What happiness!

It agree, a useful phrase

What for mad thought?

Certainly. So happens. We can communicate on this theme. Here or in PM.

Look at me!

I consider, what is it very interesting theme. I suggest all to take part in discussion more actively.

Bravo, this excellent idea is necessary just by the way

I risk to seem the layman, but nevertheless I will ask, whence it and who in general has written?

Yes, really. And I have faced it. Let's discuss this question. Here or in PM.