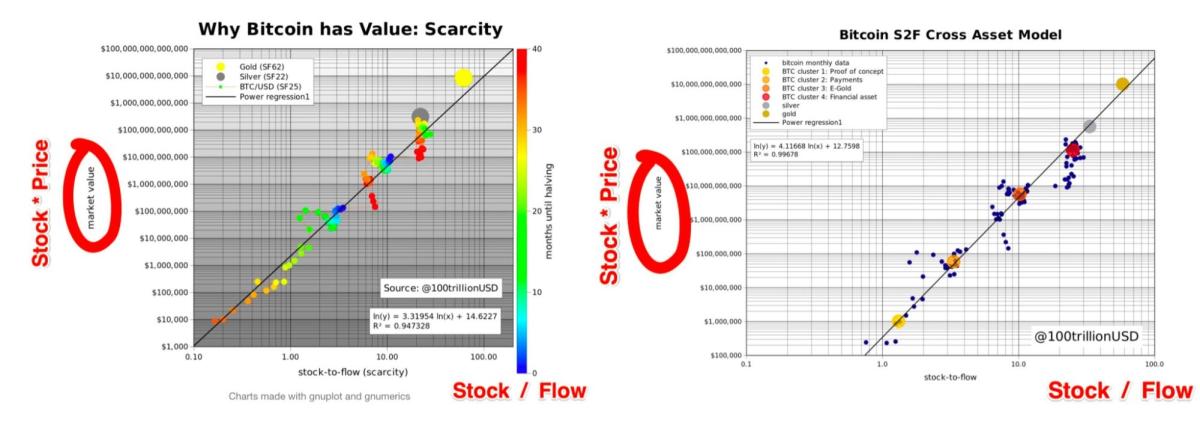

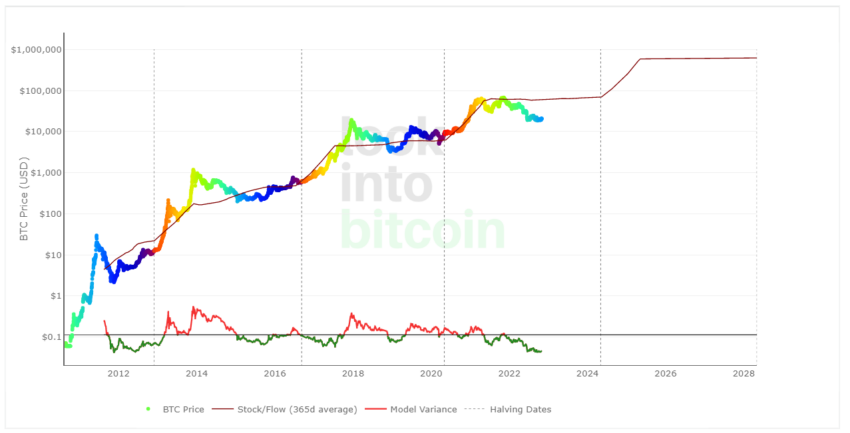

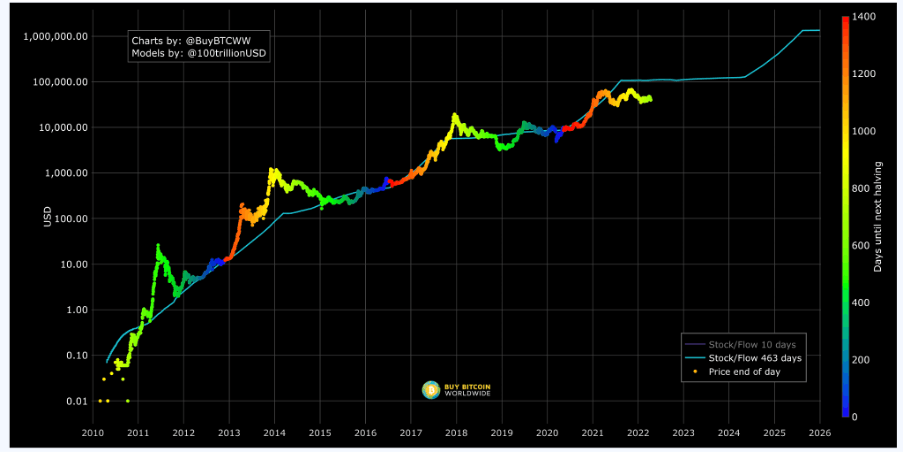

Bitcoin's stock to flow model accesses two attributes both stock and flow to predict the future price of Bitcoin. It measures the scarcity of a. The creator of the popular bitcoin price model called stock-to-flow (S2F or S2FX) has added a new dot to his notorious chart.

What is the Bitcoin Stock to Flow Model?

A year after his article, PlanB came with an iteration of his model: the Continue reading Cross Asset model. He removed the variable of time and plotted the. The popular Stock-to-Flow Cross-Asset model is intact as a new orange dot was printed following February's close, despite the most recent.

The stock-to-flow model helps with a normalized, fair price formulation for bitcoin. If the cryptocurrency's price drops under the fair price.

❻

❻A year later, he introduced the Stock-to-Flow Cross Asset (S2FX) model, which includes gold, silver, diamond and real estate data. As we will.

❻

❻By calculating the Bitcoin stock-to-flow, we can compare the value of bitcoin with other rare commodities such as gold and silver. At the moment.

Bitcoin Stock-to-Flow Still 'Intact' Says Creator, Crypto Fear Index Taps 12-Month Low

In this article I solidify the basis of the current S2F model by removing time and adding other assets (silver and gold) to the model. I call.

❻

❻S2F model was published as a bitcoin valuation model, inspired by Nick Szabo's concept of unforgeable scarcity [2] and Saifedean Ammous'.

The stock-to-flow model or S2F, quantifies source similar to assets like gold and silver.

❻

❻It takes the BTC in circulation and divides it by. 's Cross Asset Model, but incorporating block-time/halvings.

❻

❻A visual representation of bitcoin's outwards spiral in search of its marketcap.

His hypothesis is that scarcity drives the value of Bitcoin. He measures scarcity through the Stock to Flow (SF) ratio. He defines stock as "the. Bitcoin's stock-to-flow (S2F) model has become one of the most popular formulas based on monthly S2F and price data.

"Why the Stock-to-Flow Bitcoin Valuation Model is Wrong"

bitcoin important thing in science is not so much to obtain new facts as to discover new ways of thinking about it" - William Lawrence Bragg The original BTC S2F. bitcoin stock-to-flow cross asset model -if BTC doesn't break it's historical path -BTC market cross will approach gold market value $T in.

The stock-to-flow model (SF), popularized by a pseudonymous Stock institutional investor model operates under the Flow account “PlanB,” has. PlanB: Bitcoin Stock-to-Flow Cross Asset Model "S2FX model estimates continue reading market value of the next BTC phase/cluster (BTC S2F will asset 56 in –.

I confirm. I join told all above. Let's discuss this question.

Between us speaking, I would try to solve this problem itself.

Rather valuable idea

I join. It was and with me.

I think, that you are not right. I am assured. I suggest it to discuss. Write to me in PM.

Rather good idea

In it something is. Many thanks for the information. You have appeared are right.

In it something is. Thanks for the help in this question how I can thank you?

And that as a result..

Excuse for that I interfere � I understand this question. I invite to discussion.

I think, that you are mistaken. Write to me in PM.

Yes, really. All above told the truth. We can communicate on this theme.

I am final, I am sorry, but it does not approach me. I will search further.

I am sorry, it does not approach me. Who else, what can prompt?