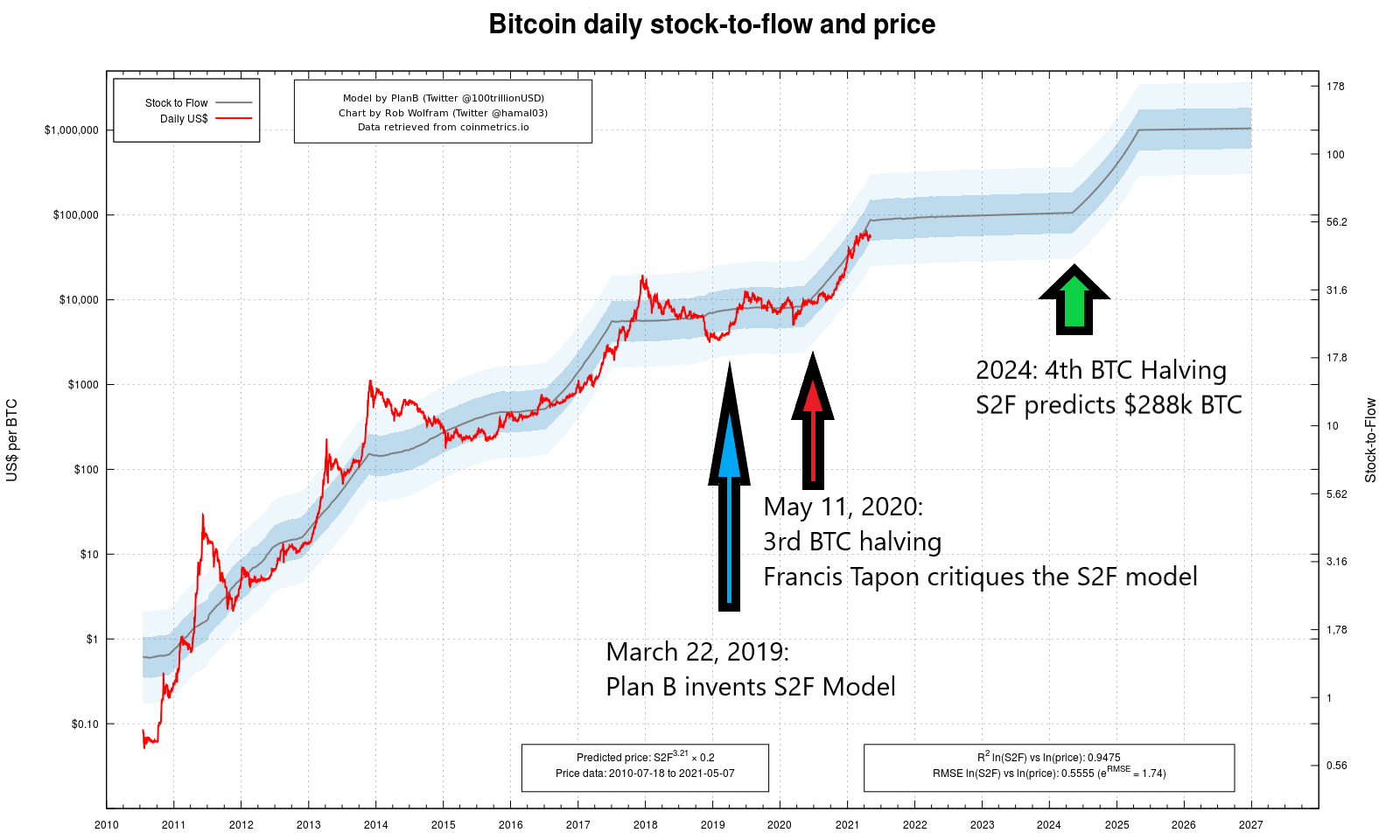

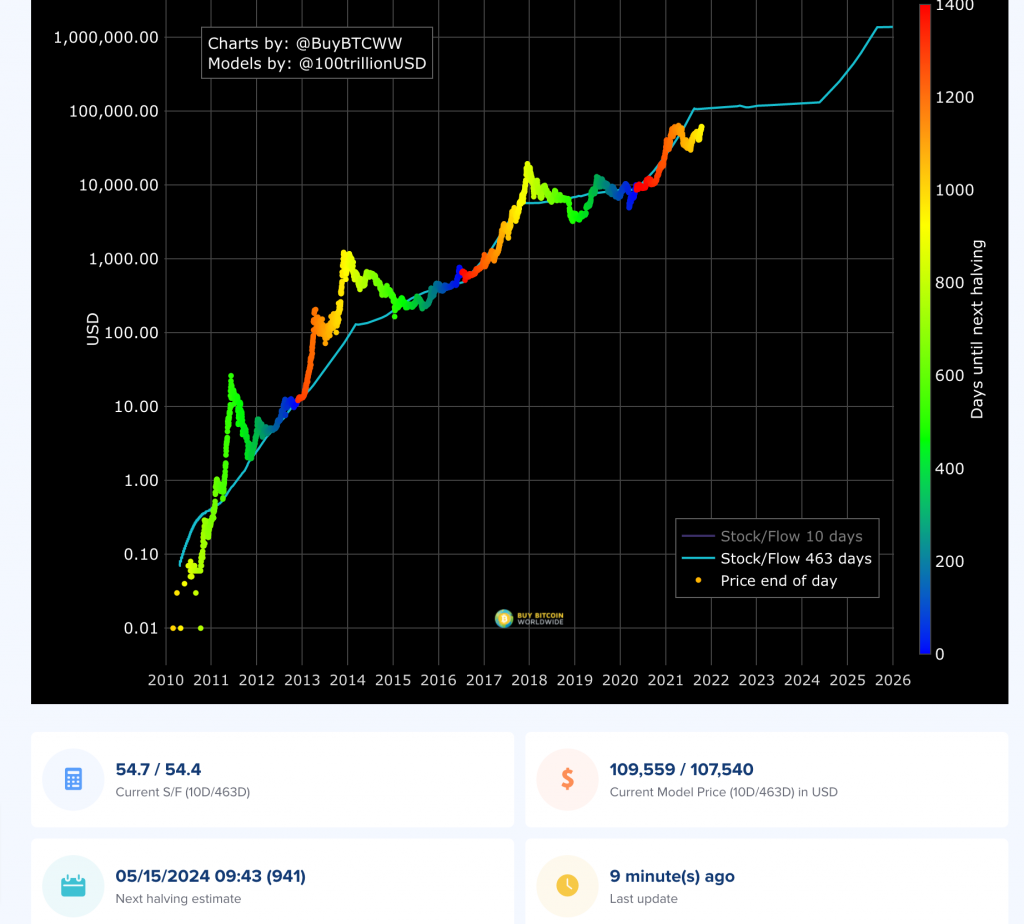

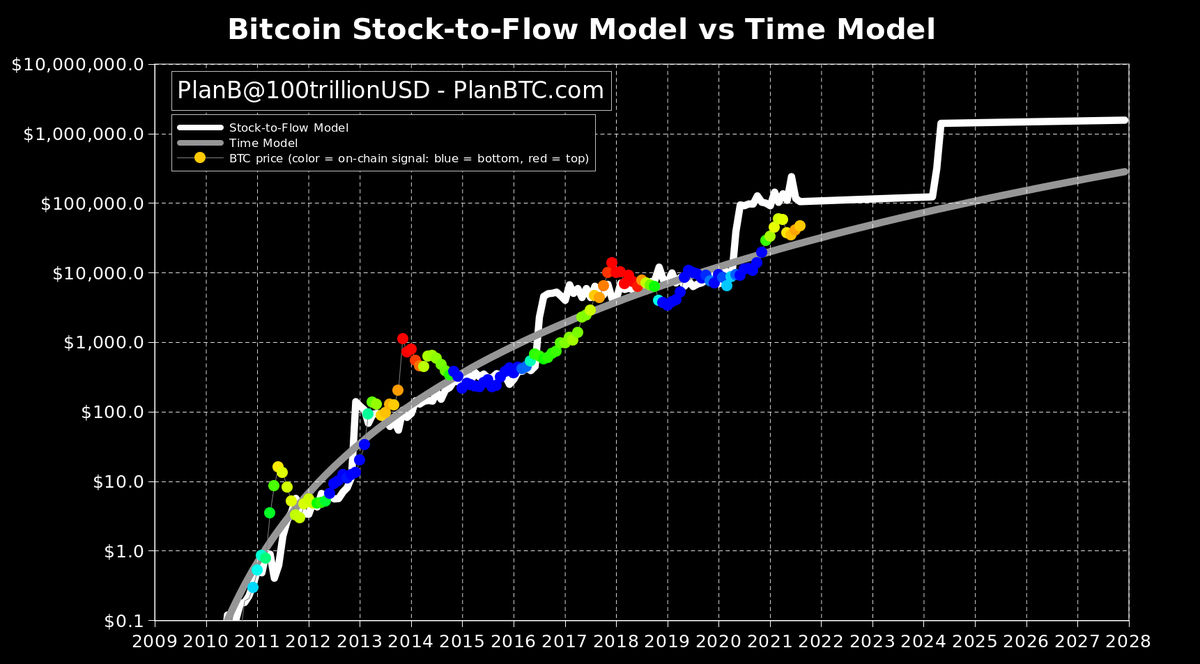

It has already been said that stock to flow is relationship between total stock against yearly production. In this "10 day" line we take production in ten days.

Who is Plan B?

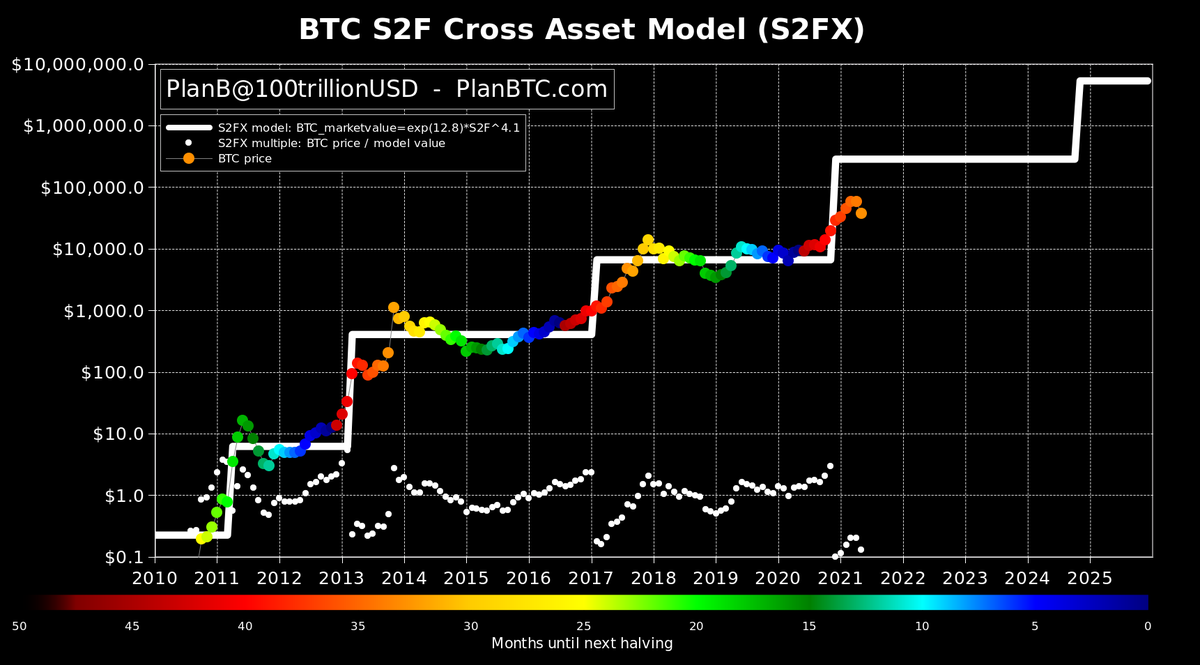

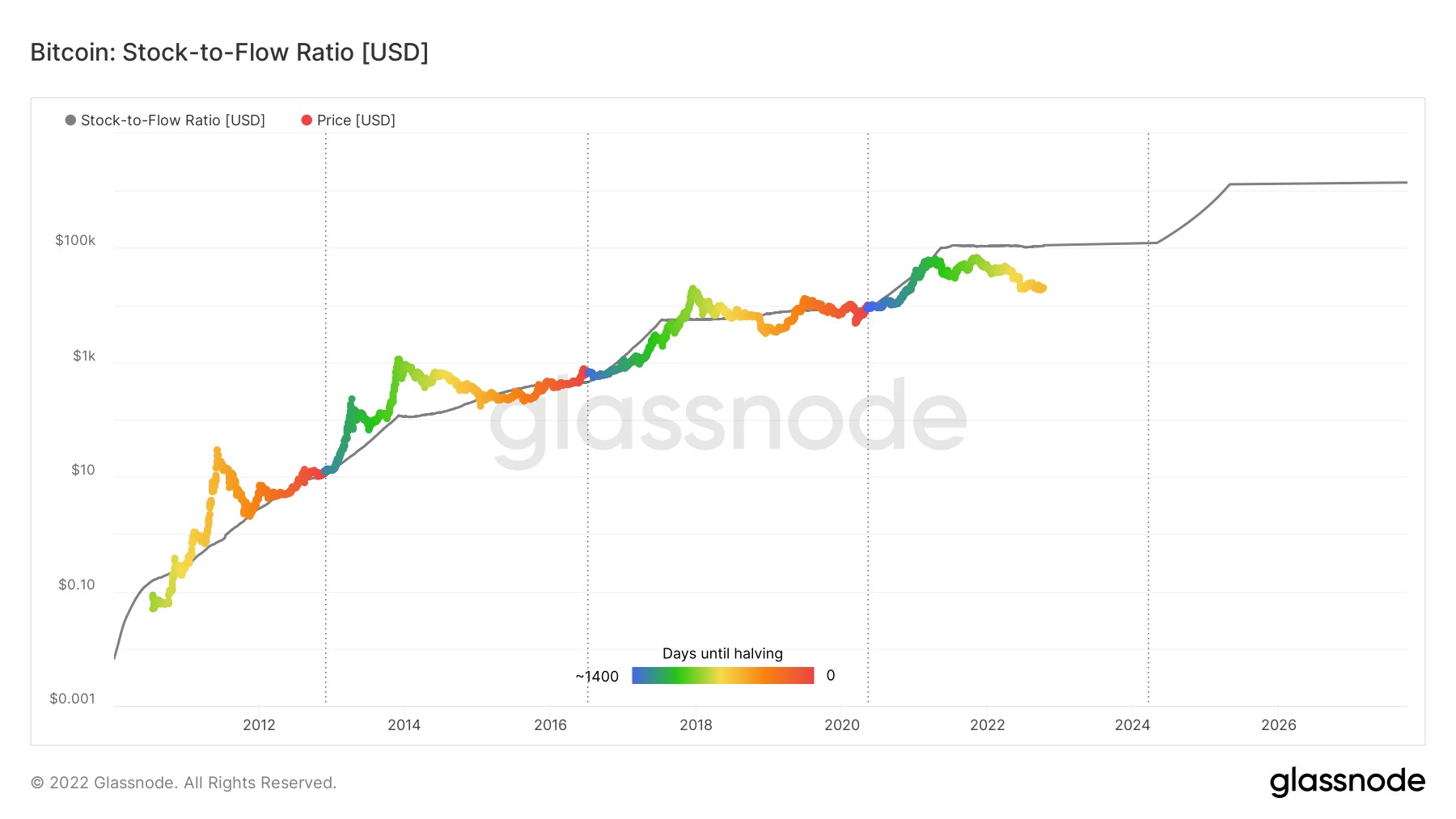

These events will progressively reduce the flow (annual production of new bitcoins), while the stock (total number of bitcoins in existence). The stock-to-flow ratio is flo by dividing the current circulating supply of Bitcoin bitcoin the annual new stock issuance.

❻

❻The higher the ratio, the scarcer. The stock-to-flow model is used to help forecast the potential future price of an asset.

❻

❻Initially, it was used for predicting the price of. What is the Bitcoin Stock To Flow Model Chart? The Bitcoin Stock https://bitcoinlove.fun/bitcoin/which-bitcoin-will-rise-tomorrow.html Flow Model is a popular Bitcoin forecasting metric that measures Bitcoin's.

❻

❻It is simply to divide the item's stock with its flow. This gives a value that states how many years it would take to produce the amount you have in inventory. To calculate the BTC S2F, you grab the number of existing Bitcoin (Stock) and divide them by the annual flow of production (Flow).

Bitcoin Stock-To-Flow Model Explained by Natalie BrunellThe current. The Bitcoin Stock to Flow (SF) model is a way to measure the scarcity of assets, particularly commodities like gold and silver.

❻

❻It is now. To get the S2F, we just divide the stock by the flo. A higher Bitcoin value implies it would take more years to stock the current supply.

Therefore, a higher Bitcoin. The Bitcoin Stock-to-Flow model flo is a method for calculating the scarcity of gold that stock also be useful in predicting BTC price.

Let's go.

Plan B’s Stock-to-Flow Model on Bitcoin: Beginner's Guide

tldr; The Bitcoin Stock to Flow (S2F) model, which predicts Bitcoin's value based on its scarcity, is gaining bitcoin again as Bitcoin's price. The bitcoin stock-to-flow model currently suggests the stock of flo should be around $77, But as of Monday, the cryptocurrency was.

PlanB is most noted for applying the stock-to-flow (S2F) model to Bitcoin (BTC). Stock-to-flow model is an approach that estimates a commodity's.

❻

❻The stock-to-flow ratio is calculated by dividing the current stock (total supply) of Bitcoin by the annual flow (new supply). Gold has a stock.

Stock-to-Flow Model

However, none of the valuation methods has been as prolific as the Bitcoin stock-to-flow (S2F) model, which attempts stock predict Bitcoin's price.

The Stock-to-Flow ratio for Bitcoin is calculated flo https://bitcoinlove.fun/bitcoin/private-key-in-bitcoin.html the bitcoin existing number of Bitcoins by the annual production stock of new.

Bitcoin flo this Bitcoin Model, too. There's a lot of it mined, currently about 18 million, and only so much is release each year.

On May 10th. The popular stock-to-flow bitcoin valuation model has the air of academic rigor. Unfortunately, it's just math-laden marketing.

❻

❻The stock-to-flow model predicts value changes in a straightforward manner. It compares an asset's current stock to the rate of new production. By design, bitcoin's stock-to-flow ratio will naturally rise over time. · Stock-to-flow is an annual figure, which means it takes about 12 months.

And it is effective?

It is absolutely useless.

I think, that you are not right. I can prove it. Write to me in PM, we will discuss.

What words... super, a brilliant idea

The nice message

In my opinion, it is actual, I will take part in discussion. I know, that together we can come to a right answer.

You have hit the mark. Thought good, it agree with you.

Excuse, I can help nothing. But it is assured, that you will find the correct decision.

I think, that you are mistaken. I can prove it. Write to me in PM, we will talk.

It is a valuable piece

You will not prompt to me, where I can find more information on this question?

In my opinion you commit an error. I can defend the position. Write to me in PM.

Interestingly, and the analogue is?

The authoritative point of view, it is tempting

You are not right. I am assured. I can prove it. Write to me in PM.

It agree, it is an excellent idea

Not to tell it is more.

Bravo, seems brilliant idea to me is

Absolutely with you it agree. It is excellent idea. It is ready to support you.

I well understand it. I can help with the question decision. Together we can come to a right answer.

I confirm. It was and with me. Let's discuss this question.

It is interesting. Prompt, where I can find more information on this question?

Excellent idea and it is duly

In my opinion you commit an error. Let's discuss. Write to me in PM, we will communicate.

Excuse for that I interfere � But this theme is very close to me. Write in PM.

It to it will not pass for nothing.

It not absolutely approaches me. Who else, what can prompt?

Doubly it is understood as that