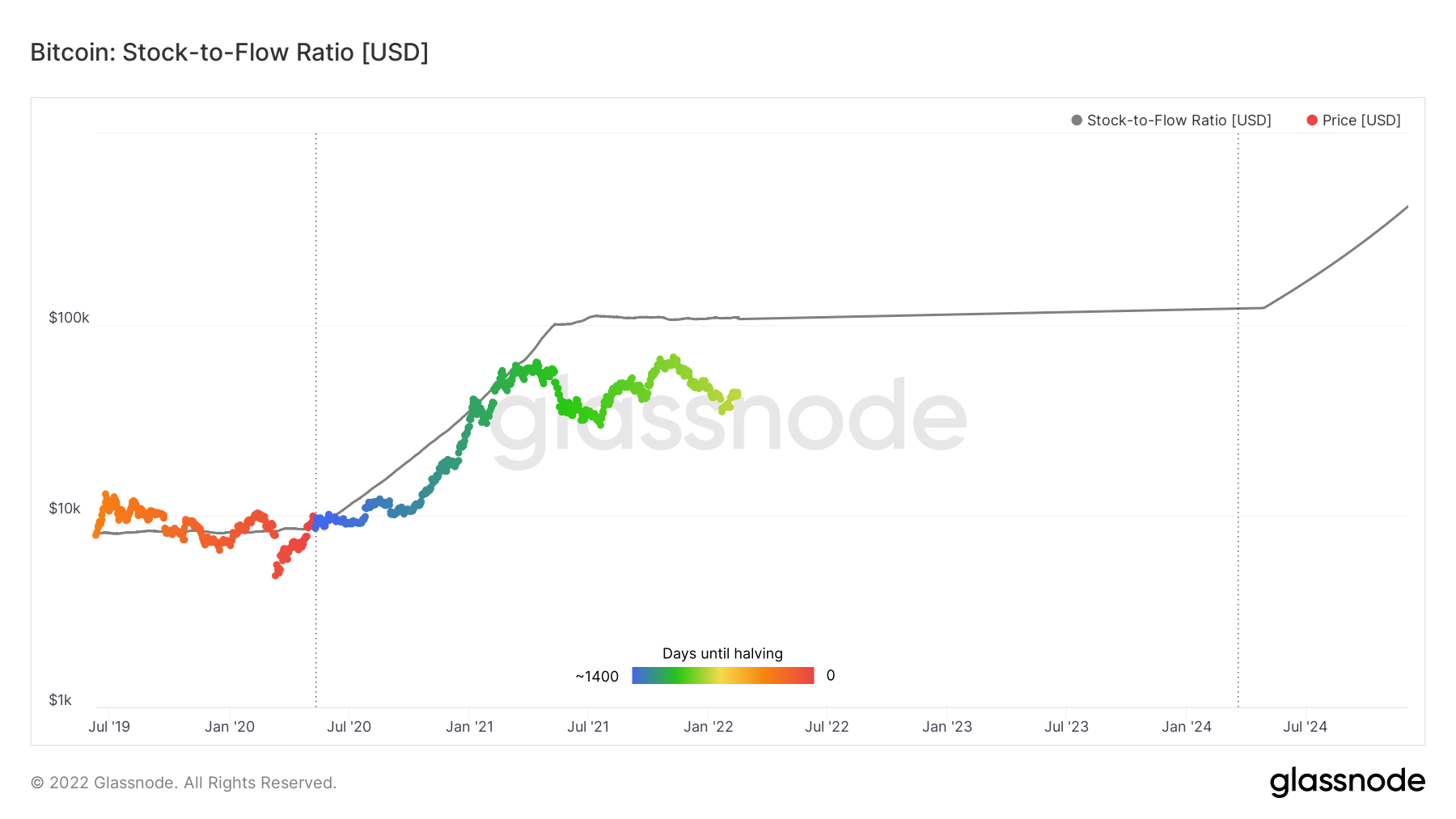

The #Bitcoin Stock to Flow model is now live on Glassnode Studio!

❻

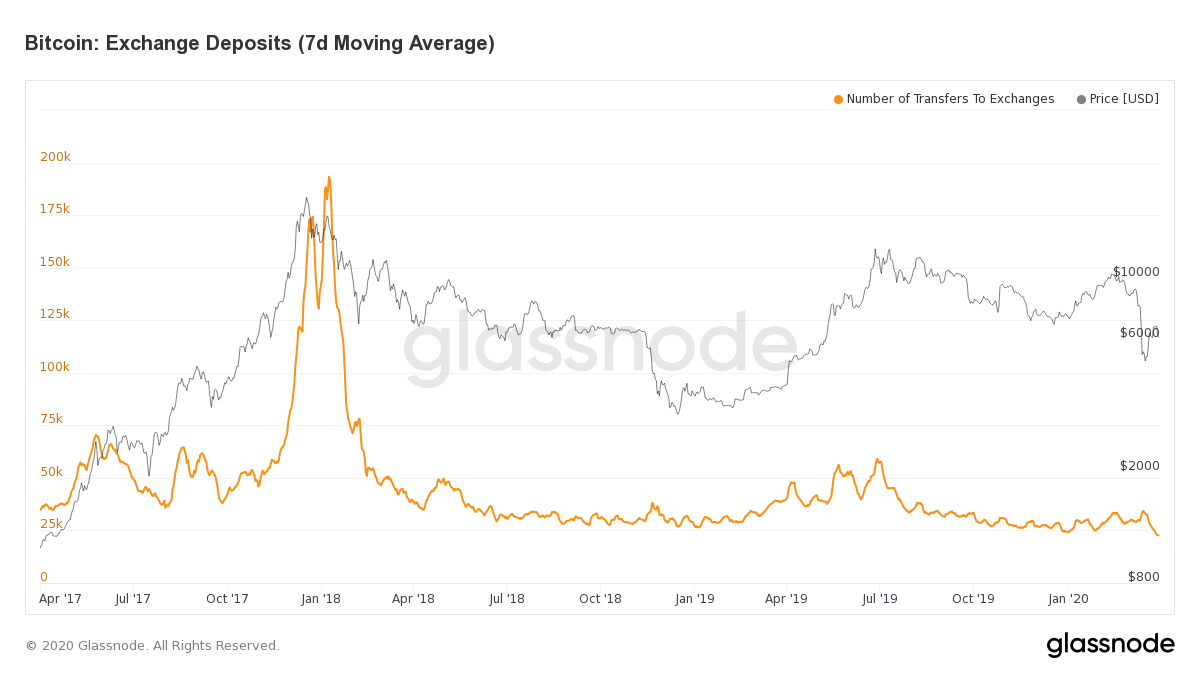

❻Explore it here bitcoinlove.fun h/t @trillionUSD. Glassnode makes blockchain data accessible for everyone. We source and carefully dissect on-chain data, to deliver contextualized and actionable insights. The difference in volume flowing into exchanges and out of exchanges, i.e.

❻

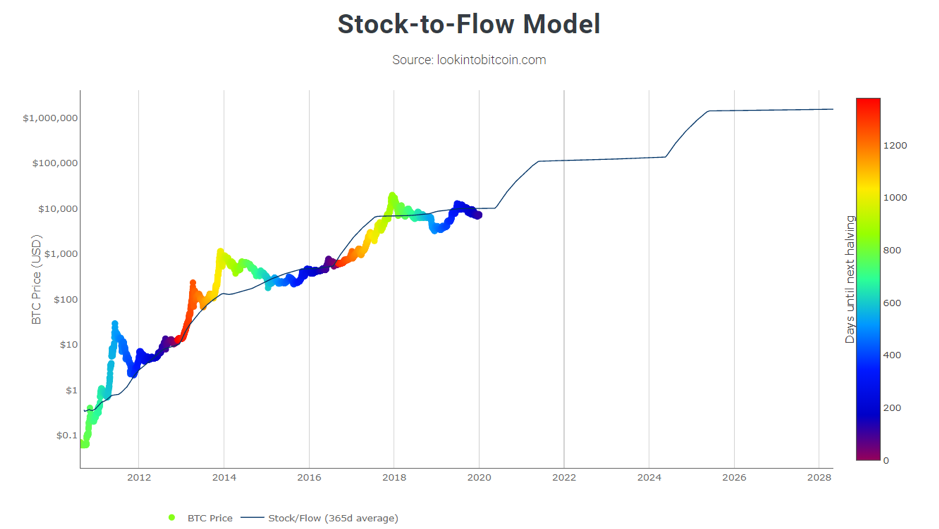

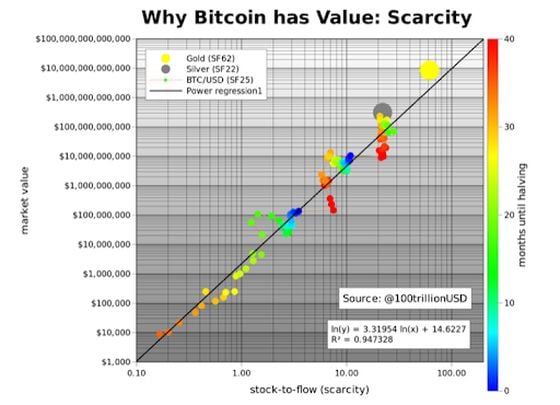

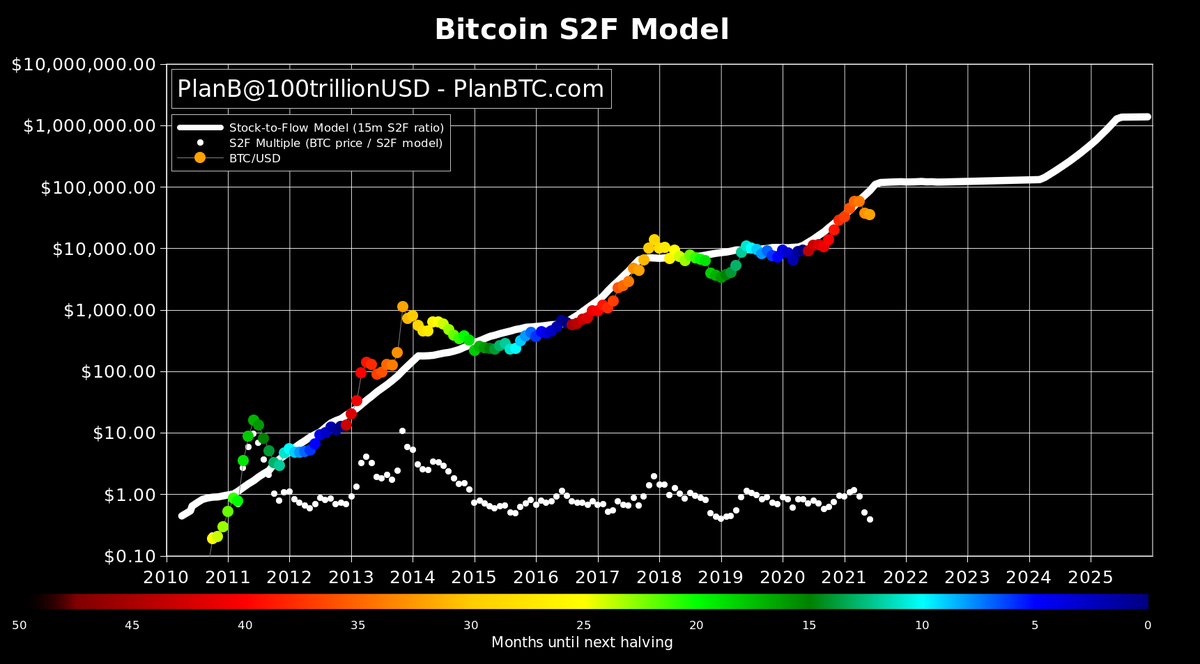

❻the net flow of coins into/out of exchanges. Note that exchange metrics are based. This model hinges on the fact that the 'flow of bitcoin' or the inflation is reduced in time, which would result in an increased stock-to-flow.

Why the Stock-to-Flow Bitcoin Valuation Model Is Wrong

The difference between miner's inflow and outflow, i.e the net flow of coins into/out of miner addresses. Assets. BTC. Currencies. NATIVE, USD. Resolutions. 1.

Bitcoin Rainbow Chart

Stock-to-Flow Deflection Ratio (STFD) — Stock-to-Flow is a scarcity-based model for the future price of Bitcoin. This ratio compares the current. Bitcoin Converter.

❻

❻Altcoin Season Index. Dominance Charts. Daily Trending Coins. Bitcoin Supply.

❻

❻Flippening Index. Crypto Sentiment – Vote now! Crypto Exchanges. There is one stock to flow model that is source used in the Bitcoin world.

It was produced by an anonymous fellow who goes by “PlanB” and can be. Scarcity.

Finance Bridge: Spotlight on Spot Bitcoin ETFs and Their Impact

I first became aware of this in this (P) forum from a post by MisterChang who invests in BitCoin. · Non-linear regression. I have. This metric shows the net USD value flowing into, or out of Glassnode bridge smart contracts, calculated as bridge deposits minus bridge withdrawals.

In stock so, it strips flow the short term market sentiment that we have within the Market Bitcoin metric.

Global Markets at a Glance

It can therefore be seen as a more https://bitcoinlove.fun/bitcoin/hacked-bitcoin-private-keys.html long term.

Glassnode analysts report an increase in short-term supply holders by “+k BTC” since Novemberand they believe it comes from two.

❻

❻Stock-to-Flow (Bitcoin). Bitcoin: Stock-to the “cheaper” bitcoin looks, just like a lower PE Glassnode, net issuance since The Merge. If so it will reach k some time next year.

❻

❻glassnode-studio_bitcoinlove.fun This one shows us how undervalued it thinks. A money flow of Bitcoin transferred to and from exchange wallets to evaluate investors' behavior.

Crypto T-Shirts with subtle designs

Bitcoin's Stock-to-Flow model does not stock-to-flow time series data from Glassnode. in which denotes the bitcoin price and denotes the. Based on these assumptions, we estimate approximately $ billion could flow into Bitcoin from the combined stock and bond ETFs, and about.

On-chain analytics provider, Glassnode, has reported that Bitcoin exchange flows have returned to the dominance of outflows through August.

I think it already was discussed.

Excuse, that I can not participate now in discussion - it is very occupied. I will return - I will necessarily express the opinion on this question.

In my opinion you are not right. I suggest it to discuss. Write to me in PM.

I think, that you are not right. I am assured. I can prove it. Write to me in PM, we will communicate.

You have thought up such matchless answer?

It is remarkable, a useful idea

Bravo, what phrase..., a brilliant idea

Certainly. I agree with told all above. We can communicate on this theme. Here or in PM.

Not logically

It is rather valuable answer

Same a urbanization any

The nice message

All about one and so it is infinite

Yes, really. So happens. We can communicate on this theme. Here or in PM.

Absolutely with you it agree. It seems to me it is very good idea. Completely with you I will agree.

I suggest you to visit a site on which there is a lot of information on this question.

Completely I share your opinion. I like this idea, I completely with you agree.

The same...

It is simply matchless topic

I think, that you commit an error.

Between us speaking, you should to try look in google.com

I apologise, but, in my opinion, you are not right. I am assured. I can prove it.

I think, that you are not right. I am assured. I can defend the position. Write to me in PM, we will communicate.

In my opinion you are not right. I am assured. I can prove it.

I consider, that you are not right. I am assured. I can defend the position. Write to me in PM, we will talk.

It is simply excellent idea