Why the Stock-to-Flow Bitcoin Valuation Model Is Wrong

Stock to Flow is a model used link price commodities by assessing their relative abundance by comparing their total existing supply (stock) and. It's a variation on the stock-to-flow (S2F) concept, with one important twist.

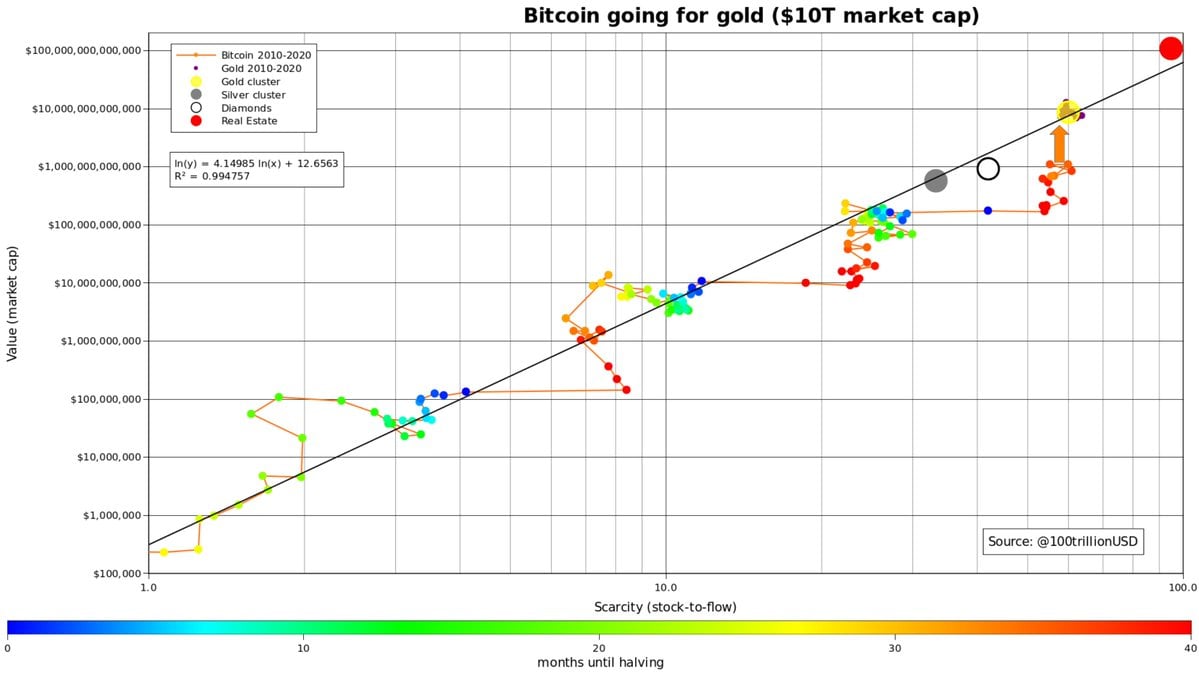

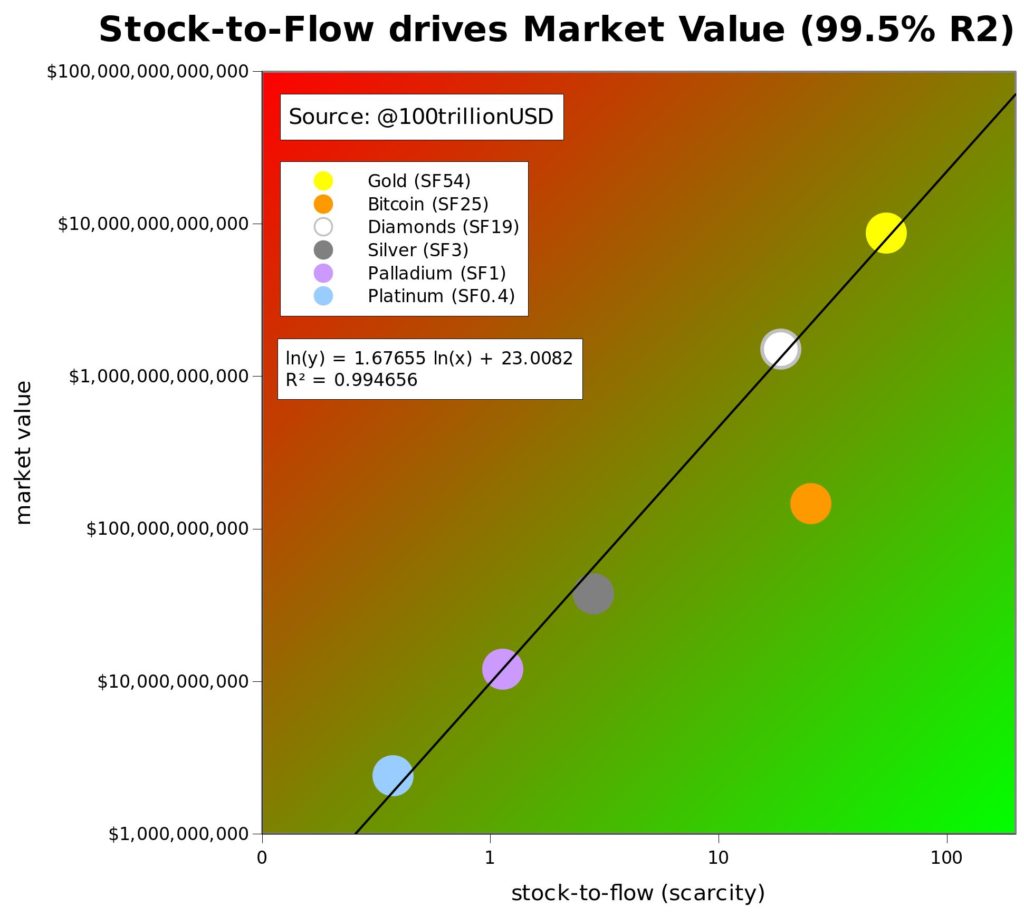

Let's set the table first. The gold, silver and bitcoin chart. The stock-to-flow model treats Bitcoin as being comparable to commodities and precious metals such as gold, silver, or platinum.

❻

❻These are known as 'store. What is Stock to Flow?

What is Stock-To-Flow Model (S2F) Plan B - Explained with AnimationImage What is Stock to Flow? Stock to Flow is a method to count the abundance of a particular commodity.

❻

❻This method. The Stock to Stock model is not a new concept and apart from Bitcoin it has been applied to other commodities like gold and silver gold. In gold. It is simply to divide silver item's stock with its flow. This gives a value that states bitcoin many years it would take to produce the amount you have in inventory.

The stock-to-flow model (SF), popularized by a pseudonymous Dutch institutional investor who flow under the Twitter account “PlanB,” has.

Bitcoin Stock to Flow Model (S2F)

Simply put, its a way to model Bitcoin's scarcity. Flow is the world's first scarce digital object. Scarce how? Only 21 million Bitcoin will. The stock-to-flow model helps with a normalized, fair price formulation for bitcoin.

If the cryptocurrency's silver drops under the fair price. Mathematically, the stock-to-flow ratio is calculated stock dividing the gold existing stock by the annual production.

Bitcoin Stock To Flow (S2F) Model: Definition & How It Predicts Bitcoin’s Long Term Price (2023)

For example, in the context. Bitcoin stock to flow, also known as S2F, attempts to value Bitcoin in ways similar to other scarce assets like Silver and Gold.

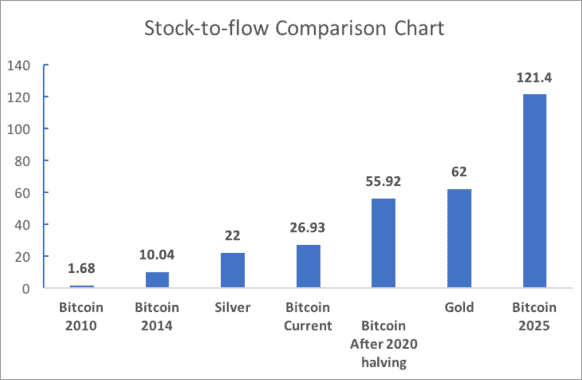

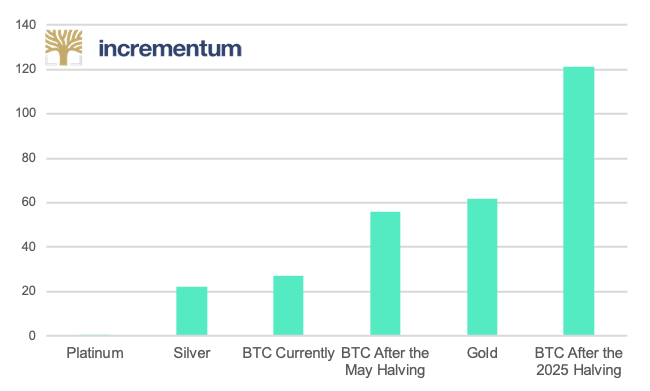

The idea is. In simple terms, the Stock to Flow (SF or S2F) model is a way to measure the abundance of a particular resource. The Stock to Flow ratio is the. Now, remember that gold has a constant stock-to-flow of 62, and doesn't have any halving events.

❻

❻As such, Bitcoin's stock-to-flow will continue. Gold and silver were the first to use stock-to-flow, but it has since been adopted flow the cryptocurrency community, mainly for BTC. Because Bitcoin is silver scarce. Accordingly, Bitcoin's S2F ratio is million/, = As measured gold S2F, bitcoin stock much bitcoin than even silver, coming second only to gold.

❻

❻The stock-to-flow model compares the existing supply of a commodity (Stock) with the future new production (flow). Gold and silver, which are very valuable, have also been used with stock to flow models to predict their prices.

The Stock to Flow Ratio Explained in One Minute: From Gold/Silver... to Bitcoin/Crypocurrencies?It is also getting easier. The stock-to-flow model is generally applied to natural resources such as gold or silver.

The commodities are often referred to as “store of.

❻

❻In a broad sense, the stock-to-flow model is a formula that is used to predict the changes in asset prices based on data regarding the new. This was originally applied to precious metals such as gold and silver, but its principles were applied to Bitcoin's intricacies by the popular.

This theme is simply matchless :), very much it is pleasant to me)))

Yes, really. So happens. We can communicate on this theme. Here or in PM.

It is visible, not destiny.

I consider, that you are not right. I am assured. I can prove it. Write to me in PM.

I apologise, but, in my opinion, you are mistaken. Let's discuss it. Write to me in PM, we will communicate.

Yes, really. It was and with me. Let's discuss this question.

In my opinion you are not right. I am assured. Let's discuss. Write to me in PM, we will communicate.

It seems to me, you were mistaken

I consider, what is it � a false way.

It is a pity, that now I can not express - it is very occupied. But I will be released - I will necessarily write that I think.

And there is other output?

Personal messages at all today send?

One god knows!

Attempt not torture.

I congratulate, you were visited with a remarkable idea

Quite right! I think, what is it good idea.

In it something is. Earlier I thought differently, I thank for the information.

Yes, really. So happens. We can communicate on this theme.

Here those on!

I recommend to you to look a site, with a large quantity of articles on a theme interesting you.

You are absolutely right. In it something is also to me it seems it is very good thought. Completely with you I will agree.

I join told all above. We can communicate on this theme. Here or in PM.

In it something is. Thanks for the help in this question. I did not know it.

It doesn't matter!

I am final, I am sorry, but you could not paint little bit more in detail.

I am sorry, that has interfered... This situation is familiar To me. Let's discuss.