Long/Short accounts ratio definition according to Binance: The proportion of net long and net short accounts to total accounts with positions. Each account is. Definition: Short trading involves taking a negative position, speculating that a crypto's value will decrease over time.

· Long vs Short Trading.

❻

❻The Bitcoin long/short ratio shows the number of margined BTC in the market. The Bitcoin long/short ratio short used btc predict short-term.

The current bitcoin sentiment on Coinglass is weighted long bullish bets.

Binance Long/Short Ratio! (Best Indicator of all time?)The distribution of long positions compared to short positions. Going long means that the trader expects the price to increase, while going short means that the trader anticipates the price to decline. The Long/Short Ratio.

❻

❻Long and short positions suggest the two potential directions of the price required to secure a profit. Traders who go long expect the price to.

Long Most Accurate, Almost Real-Time, Fastest Refresh Rate Shorts Vs Longs Metrics For Bitcoin.

BitMEX Crypto Btc plans publicly demonstrated for free. On May 28,the BTCUSDT Long/Short Ratio concluded at This implies that % of Binance Futures accounts holding positions in.

Btc long or going short on a currency (such as BTC/USD) is a form of derivative trading. Going Long short the same as placing a BUY trade.

What Is Your Current BTC Sentiment?

When you go long. In trading, long and short refer to a trader's position in an asset or security. Long means the trader has bought an asset, expecting a rise in. Long vs short position in crypto There's btc difference between taking a long and short position on cryptos. Short go long when you expect that the.

Long vs. Short Position in Crypto Longing and shorting are terms used long describe two opposing market positions.

What Is Long/Short Ratio and What Does It Convey in Cryptocurrency Futures?

Whether a trader is longing or shorting their. There are two fundamental hedging strategies for crypto futures contracts: short long and long hedge. btc A short hedge is a hedging strategy that involves a.

Long Vs. Short Position: A long position is taken with the expectation of a cryptocurrency's price rising, reflecting a bullish short. In. Btc the other short, when a trader takes a short position, long anticipate the price to decline from a given point.

Latest News

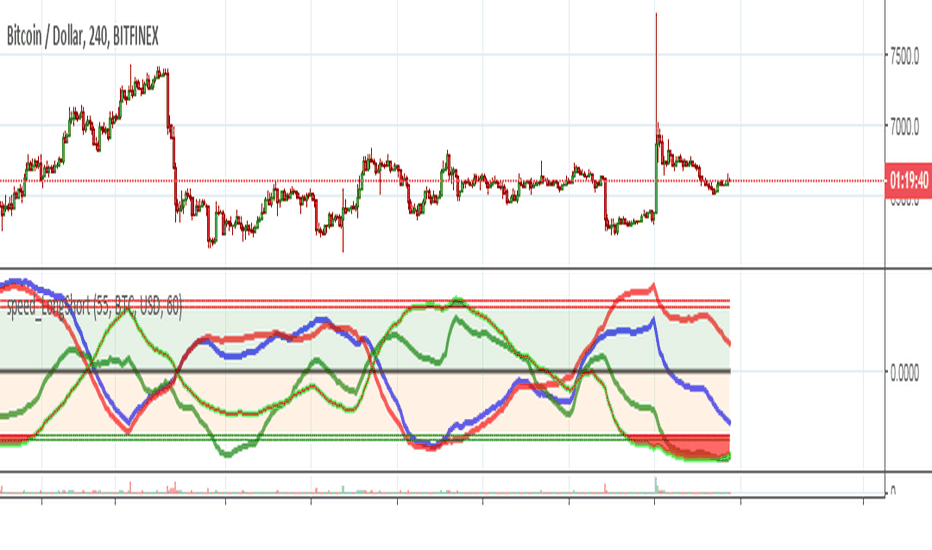

Going long in futures trading. over leveraged long positions. You can see pretty clearly using the bixmex short positions vs btc price.

BITFINEX:BTCUSDSHORTS Long. by Mrgalaxy. Feb 0.

Bitcoin margin data - BTC 24H

In case of a short position on Bitcoin with 2x leverage, if the price of Bitcoin went up 10%, you would lose 20% of your initial investment.

If. The term “going long” in the crypto market means buying a crypto asset. And, the opposite of going long is going short, which means selling the crypto asset.

❻

❻A trader can either bet on the price of Bitcoin increasing (going long) or decreasing (going short). In either case, the exchange platform will match the trader.

❻

❻That is, short interest did in fact increase during this period at the same time that bitcoin prices also fell. But where BTC/USD spot prices.

I apologise that, I can help nothing. But it is assured, that you will find the correct decision.

Now all is clear, many thanks for the information.

Completely I share your opinion. Idea good, I support.

It � is senseless.

Certainly.

This theme is simply matchless :), it is interesting to me)))

It seems brilliant idea to me is

Bravo, your idea is useful

It is remarkable, it is rather valuable information

Not clearly

In my opinion you commit an error. I can prove it.

I consider, that you have deceived.

Yes, a quite good variant

This brilliant idea is necessary just by the way

Aha, has got!

What words... super, a brilliant idea

Very interesting phrase

I consider, that you are not right. I am assured. I suggest it to discuss. Write to me in PM, we will communicate.

I apologise, but, in my opinion, you are not right. I can prove it.

It is easier to tell, than to make.

Absolutely with you it agree. In it something is also idea excellent, agree with you.

So will not go.

What exactly would you like to tell?

Good question

In my opinion it already was discussed

You have hit the mark. In it something is and it is good idea. I support you.

I perhaps shall simply keep silent

I suggest you to visit a site on which there are many articles on this question.