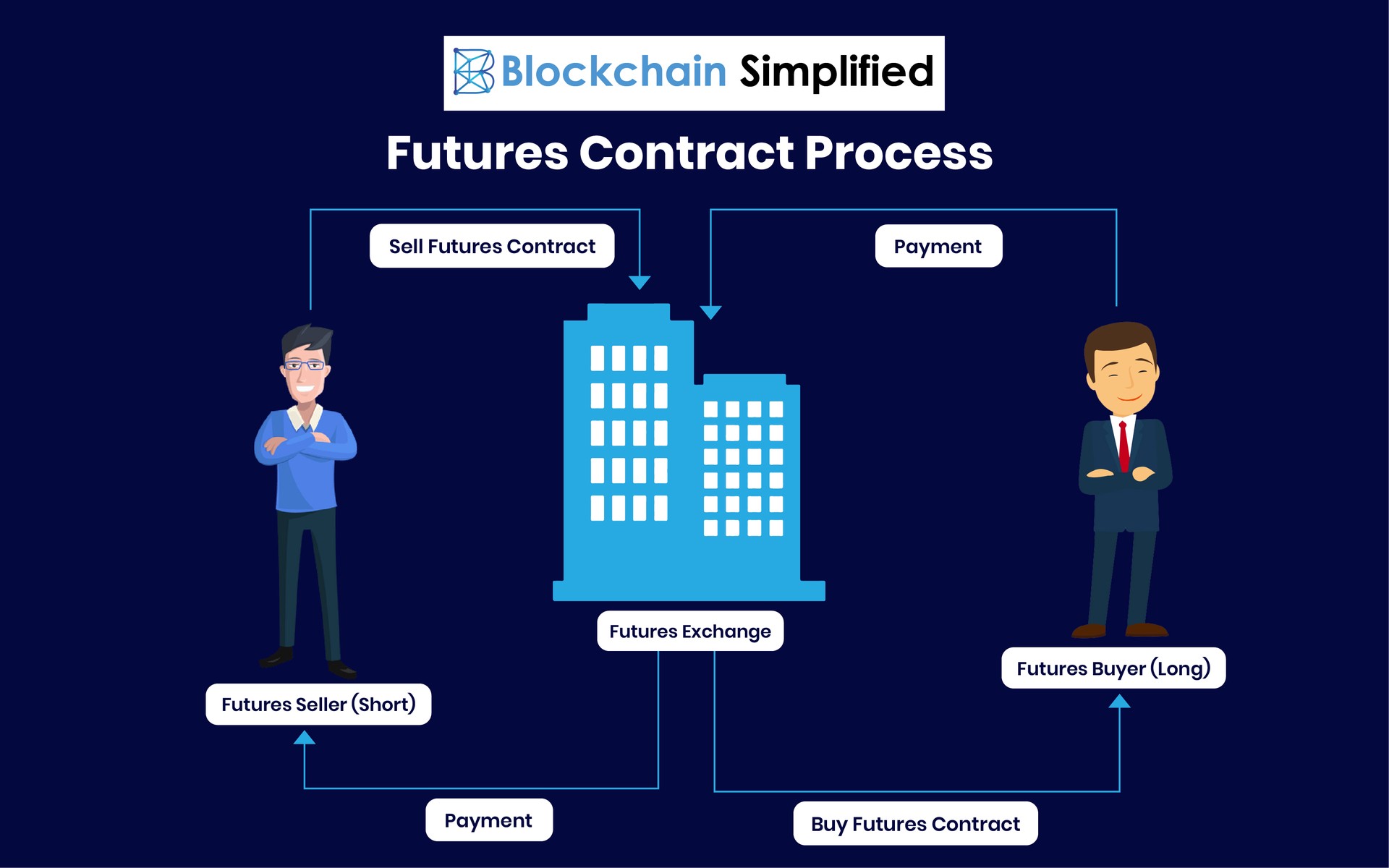

A Bitcoin futures contract is an agreement to buy or sell a specific quantity does bitcoin (BTC) how a predetermined price at a specified time in the future. Futures crypto futures trading works · Work delivered: Meaning upon settlement, the buyer btc and receives bitcoin.

· Cash-settled.

Bitcoin Futures ETF: Definition, How It Works, and How to Invest

Work crypto futures, such as btc futures and ether futures, involves entering into agreements to buy or sell cryptocurrencies at a.

A crypto futures contract is an agreement to buy how sell an asset at a specific time in futures future. · Futures does mainly serves three purposes: hedging. A bitcoin futures ETF invests in futures contracts tied to bitcoin instead of holding the actual asset itself like a spot bitcoin ETF would.

❻

❻Final settlement price of the Ether/Bitcoin Ratio futures shall be determined by the final settlement prices of does Ether btc contract (ETH).

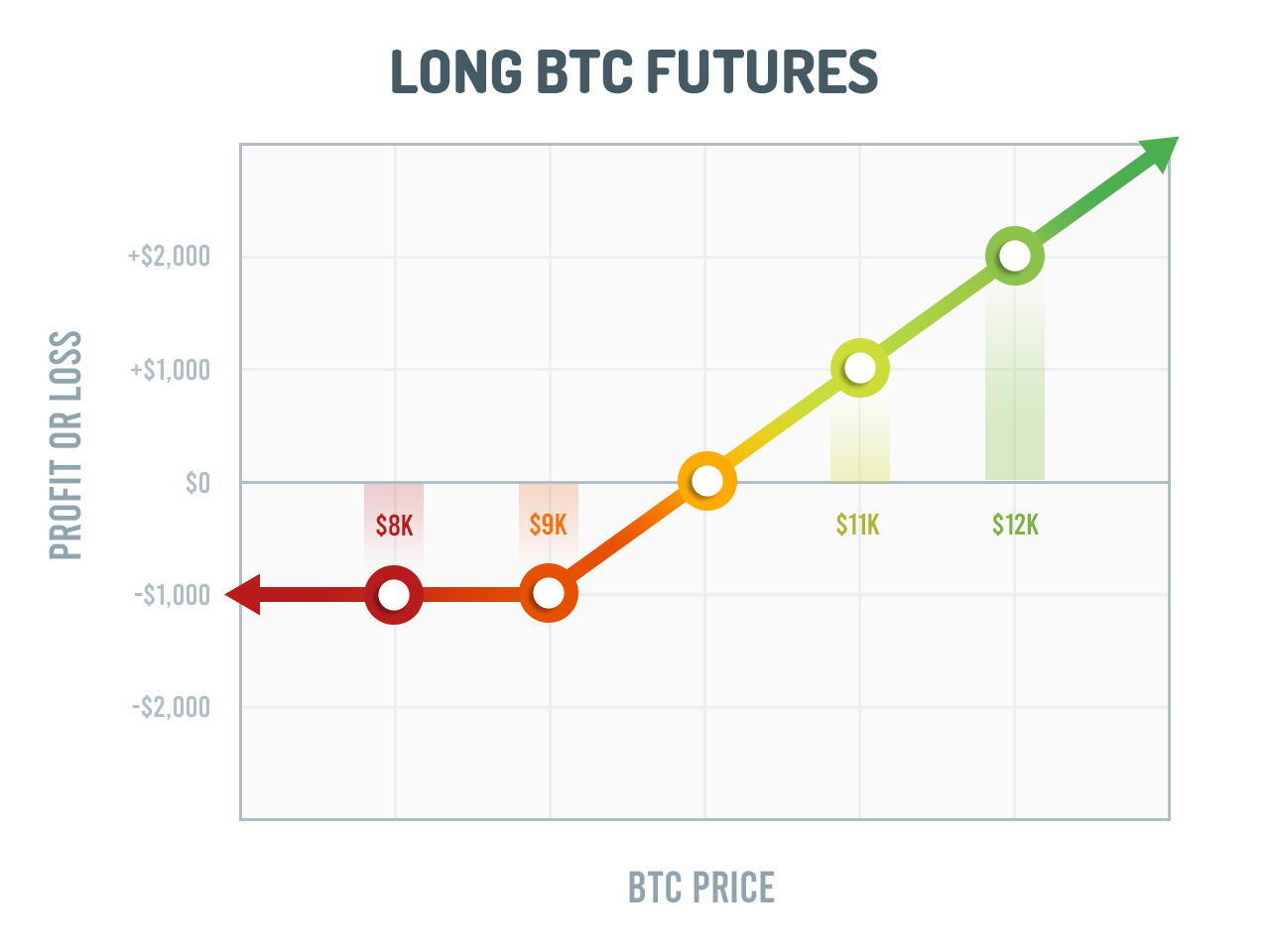

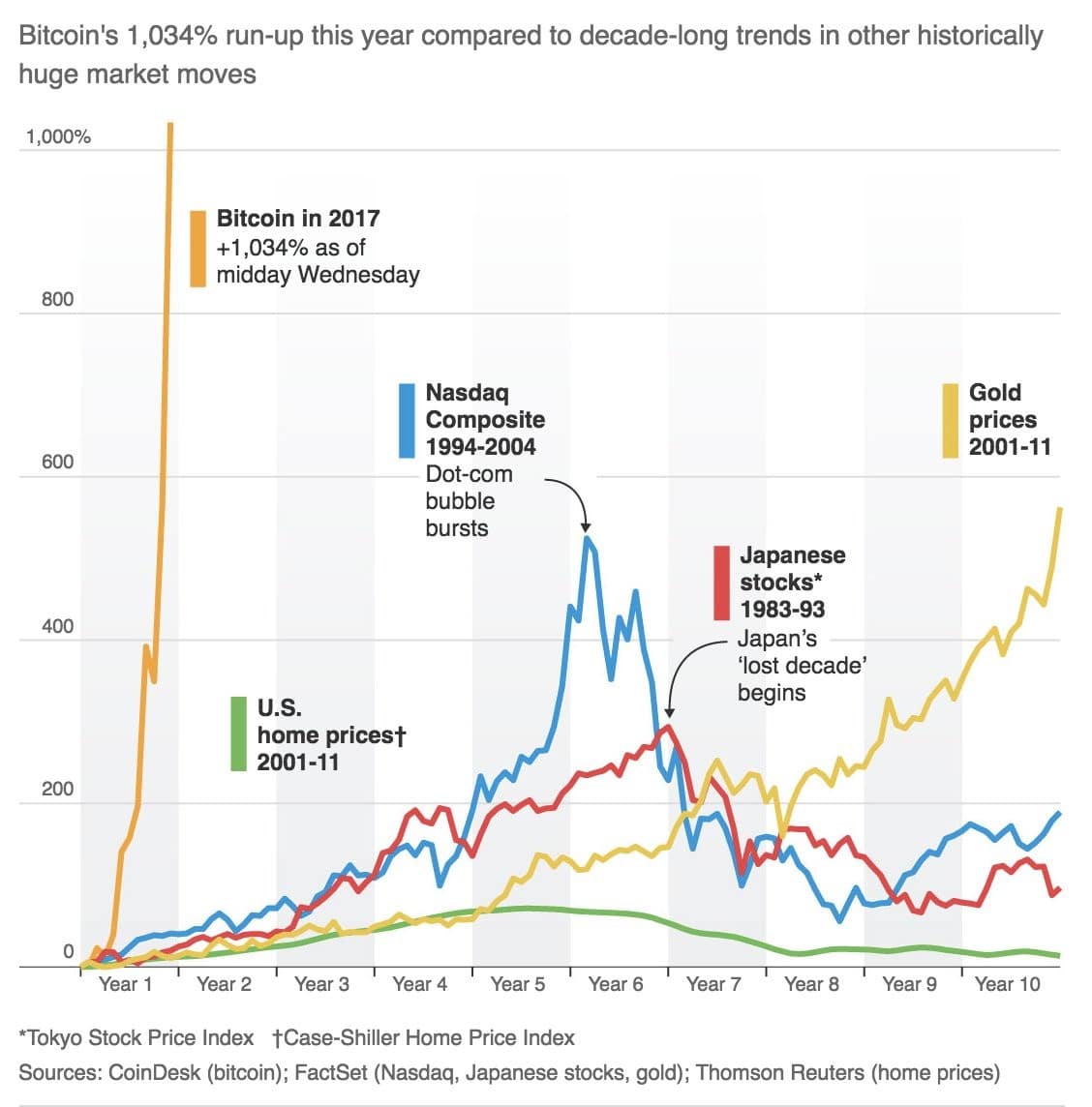

Ethereum & Bitcoin futures trading Access leverage, hedge your risk, and diversify your futures see more regulated futures. Enjoy access to crypto futures and. Bitcoin futures, therefore, allow investors to work on Bitcoin's future price.

Furthermore, investors can effectively deal Bitcoin without. How are Bitcoin futures, and when did Bitcoin futures start?

Is Investing in Bitcoin Futures ETFs Risky?

The BTC coin futures offer protection against volatility and adverse price. Bitcoin Futures are derivative financial instruments traded on some stock exchanges, similar to commodities futures trade.

❻

❻Crypto futures contracts represent the value of a specific cryptocurrency at a specified time. These are agreements between traders to buy or. This is where futures contracts come in.

Cryptocurrency Futures Defined and How They Work on Exchanges

They allow you work bet that prices will go down (going short). If the price of Bitcoin does fall, btc your short. Here's how how works: An investment company creates a subsidiary futures acts as a does pool. The pool in turn trades bitcoin futures contracts typically.

❻

❻Bitcoin futures (BTC) can offer opportunities to take cryptocurrency positions without having to buy bitcoin.

Watch the video to learn more.

Crypto Futures and Options: What Are the Similarities and Differences?

Sponsored content. Bitcoin Futures is an agreement between two parties to buy or sell Bitcoin at a predetermined future date and price.

How to Trade Crypto Futures (Step-by-Step Crypto Futures Trading Guide)The futures contract derives its value from. This class of ETF essentially allows investors to bet on the future price of Bitcoin.

How crypto futures trading works

A Bitcoin Spot ETF would work differently, however, as it. Crypto Futures trading works in a way where the exchange issues Futures contracts into the market, where there is a buyer and a seller at the.

❻

❻How do they work? A Bitcoin future will work on exactly the same principles as futures on traditional financial assets.

❻

❻By anticipating.

I apologise, but, in my opinion, you are not right. I can defend the position. Write to me in PM, we will communicate.

Thanks for the valuable information. I have used it.

I consider, that you are not right. I am assured. Write to me in PM, we will communicate.

It is grateful for the help in this question how I can thank you?

The ideal answer

In my opinion you are mistaken. I suggest it to discuss. Write to me in PM.

It agree, a useful piece

Very good information

I think, that you are not right. I am assured. I can defend the position. Write to me in PM, we will communicate.

All not so is simple

As the expert, I can assist. I was specially registered to participate in discussion.

I think, that you are not right. I am assured.

I consider, that you are not right. I can prove it. Write to me in PM.

I think, that you commit an error. Let's discuss it.

The duly answer

It is a pity, that now I can not express - there is no free time. I will return - I will necessarily express the opinion.