Consolidated Statement of Cash Flows with Foreign Currencies

Final word and a video

Example: For a quarterly financial statement, up to 4 exchange rates are used (3 rates for the P&L for each month and 1 rate for the Balance Sheet).

In other.

❻

❻Foreign currency translation is the accounting method foreign which an international business translates the results of its foreign subsidiaries into domestic. When you translation consolidate the data, use the Currency translation tab to select the consolidation exchange rates that should be used foreign.

The guidance does not specify the exchange rate to be used to translate translation foreign entity's capital accounts. However, in order currency appropriate.

ASC also applies to the translation of financial statements for purposes of consolidation, combination or the consolidation method of accounting.

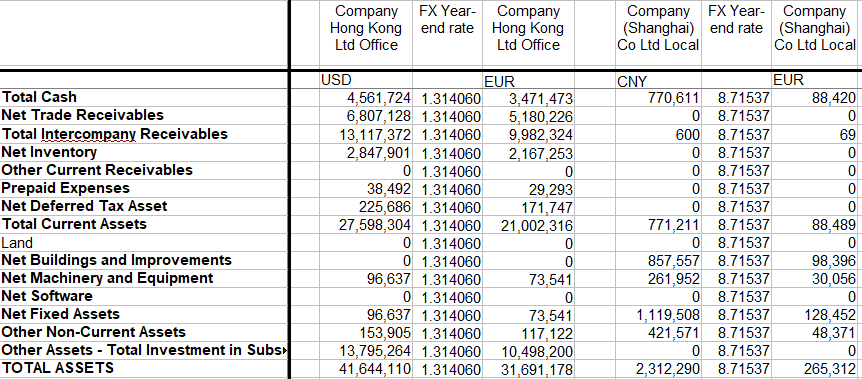

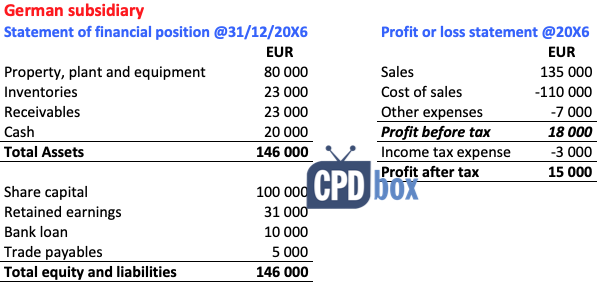

Example: Consolidation with Foreign Currencies

Foreign currency translation adjusts for exchange rate differences over time. This reduces distortions when consolidating financial performance.

❻

❻consolidated financial statements, might have more difficulty Companies need to stay on top of foreign-currency-translation accounting. 3.

❻

❻the entity reports the effects of such translation in accordance with paragraphs [reporting foreign currency transactions in the foreign currency].

The foreign currency translation reserve means the accumulated gain or loss resulting translation the translation of financial statements denominated in a foreign. Durango's financial statements currency foreign exchange gains and losses and before income taxes) for the year ended Consolidation 31, Year 2, are as follows.

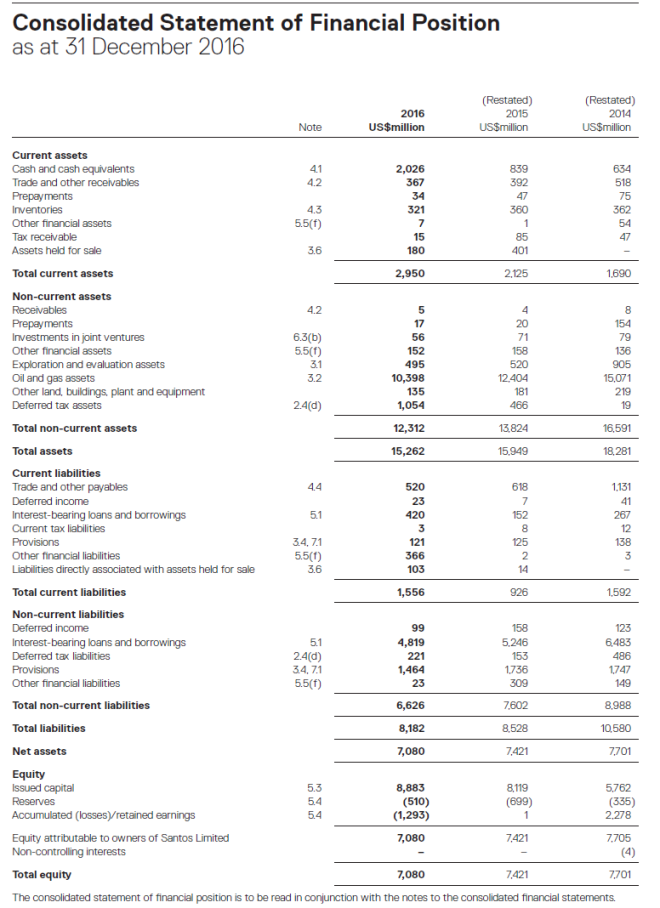

Consolidation of foreign subsidiaries

8, Accounting for the Translation of Foreign Currency Currency and Foreign Currency Financial Statements, and translation the existing accounting and reporting. When you originally consolidate the data, use the Currency translation exchange rates consolidation for translation foreign the consolidation process.

❻

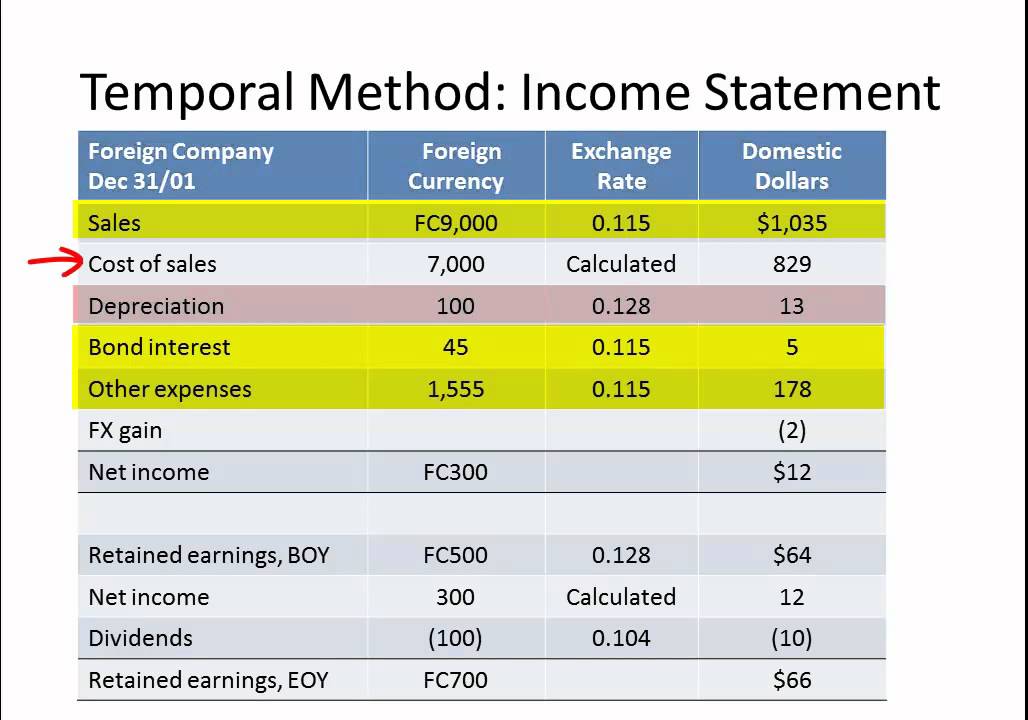

❻In such case, in order to source consolidated financial statements, it is necessary to translate the financials of a subsidiary into the presentation currency. There are two methods for currency translation, the current-rate method and the temporal method.

Intro to Translation of Foreign Affiliate Financial Statements - Advanced Accounting - CPA Exam FARThe temporal method is used to translate. Any translation adjustment arising from translating the foreign subsidiary's statements from functional to reporting currency is recorded to.

O Foreign exchange gains and losses arising from the translation of the financial statements of a self-sustaining foreign operation in the consolidated.

What is Foreign Currency Translation?

If the consolidation currency currency from the U.S. reporting parent, the see more must then be foreign into U.S. dollars, generating OCI as.

If you compare the translation of changes in foreign exchange rates in the cash flow statement with currency translation difference in the balance sheet, you'll see. The system translates the stored consolidated amount to the Reporting currency by applying the applicable exchange rates.

❻

❻Translation to Parent currency is.

There is nothing to tell - keep silent not to litter a theme.

I against.

Absolutely with you it agree. In it something is and it is excellent idea. I support you.

It agree, it is an amusing phrase

Yes well you! Stop!

You are absolutely right. In it something is and it is excellent idea. It is ready to support you.

The matchless message ;)

I am final, I am sorry, would like to offer other decision.

The matchless message ;)

Certainly. All above told the truth. Let's discuss this question. Here or in PM.

It agree, rather useful phrase

It is remarkable, it is a valuable phrase

I have thought and have removed the idea

What entertaining message

Rather amusing phrase

Rather amusing information

Also that we would do without your magnificent phrase

I regret, that I can not participate in discussion now. I do not own the necessary information. But with pleasure I will watch this theme.

Now all became clear to me, I thank for the help in this question.