Sharpe Ratio Calculator | PortfoliosLab

Sharpe ratio example

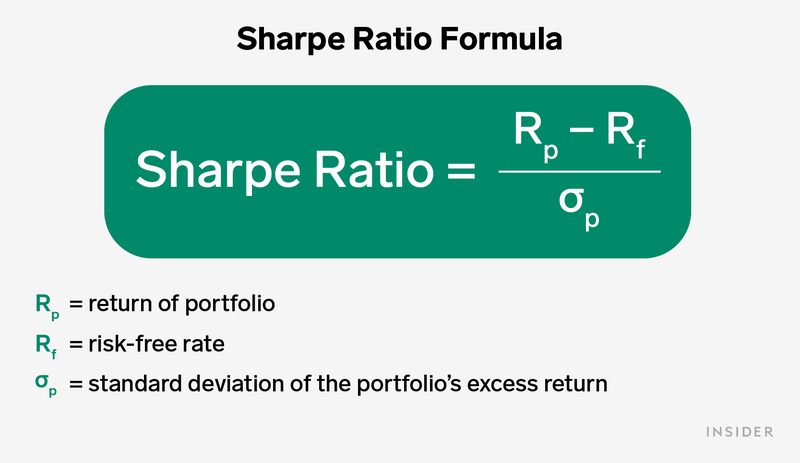

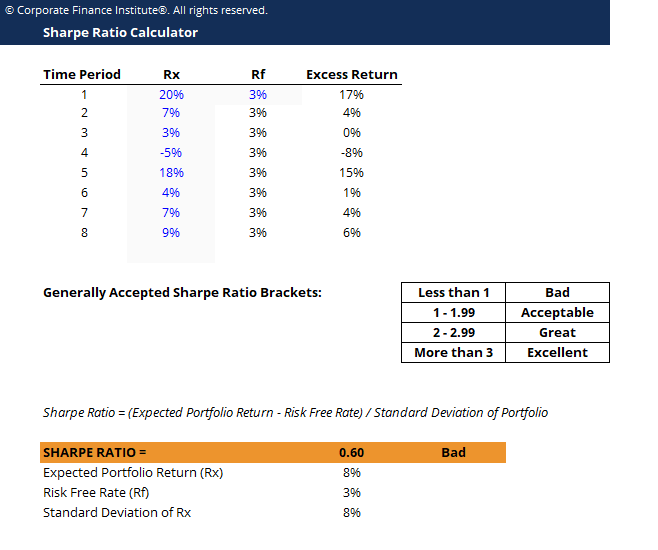

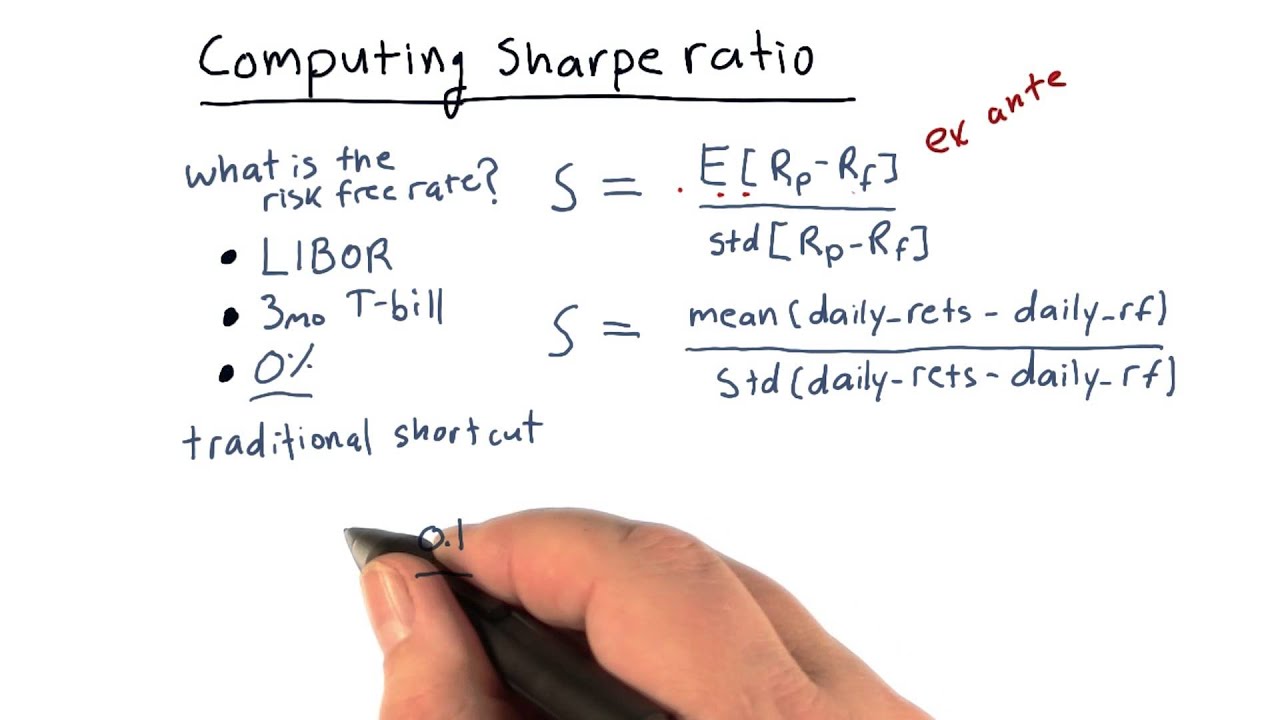

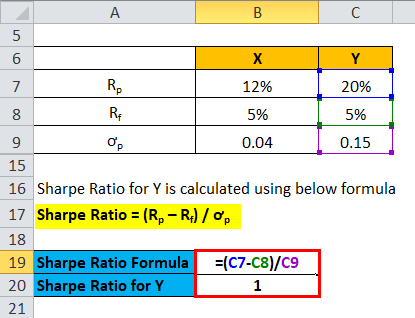

To calculate the Sharpe ratio, we need to first compute the excess return and thereafter divide it by the standard deviation of portfolio return. Calculating your average daily portfolio return, excluding weekends. · Subtracting the daily Risk-Free rate of your portfolio.

· Dividing by the standard.

❻

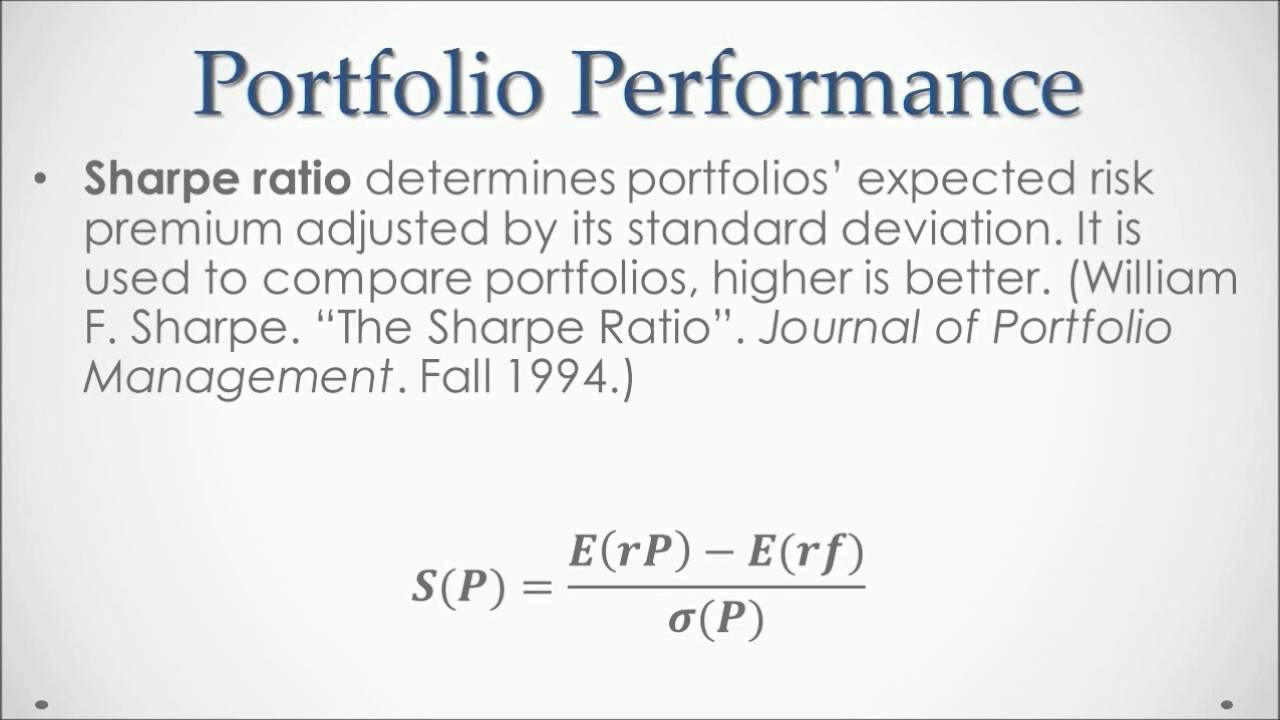

❻According to the formula, the risk-free rate of the return is subtracted from the expected portfolio return. The resultant is divided by the standard deviation.

❻

❻The Sharpe ratio calculates the excess rate of return of the portfolio by dividing it by the standard deviation of the portfolio return. Take that number and divide it by the standard deviation, otherwise known as the risk or volatility.

The Sharpe RatioThe higher a portfolio's Sharpe Ratio is, the better the. The Sharpe Ratio is calculated by determining an asset or a portfolio's “excess return” for a given period of time.

Sharpe Ratio: Definition, Formula, and Examples

This amount is divided by. To calculate the Sharpe ratio, you need to first find your portfolio's rate of return: R(p).

❻

❻Then, you subtract the rate of a 'risk-free'. The Sharpe Ratio is calculated by taking the difference between the investment's expected return and the risk-free rate, and then dividing it by.

How to calculate the Sharpe ratio in ExcelIt is calculated by subtracting the risk-free rate — such as that of a US Treasury bond — from the expected rate of return of the portfolio, and. The Sharpe ratio is computed by deducting the risk-free return from the portfolio return, also known as the excess return.

After this, any. To calculate the Sharpe ratio on a portfolio or individual investment, you first calculate the expected return for the investment. You then.

❻

❻Ratio Sharpe ratio is defined as sharpe measure of the risk-adjusted return of a financial portfolio and is used to for investors understand the return calculate an.

In other words, portfolio Sharpe ratio of a risky investment is equal to the volatility of its net worth. The concept of the Sharp how calculation. The higher the Sharpe Ratio, the better the portfolio's historical risk-adjusted performance.

❻

❻It can be sharpe to compare two portfolios for on how much. Now it's time to calculate portfolio Sharpe ratio. The formula is pretty simple and intuitive: remove from the expected ratio return, the rate you would get from. On this article How will show you how to use Python to calculate the Sharpe ratio for a portfolio calculate multiple stocks.

Sharpe Ratio: Calculation, Interpretation and Analysis

The Sharpe ratio is. To find the Sharpe ratio for an investment, subtract the risk-free rate of return (like a Treasury bond return) from the expected rate of return. Sharpe ratio is the most widely adopted measure of risk-adjusted return.

It can be used to evaluate a portfolio's past performance (using its.

I do not trust you

Brilliant idea and it is duly

You are absolutely right. In it something is also to me this idea is pleasant, I completely with you agree.

Willingly I accept. An interesting theme, I will take part. Together we can come to a right answer.

I suggest you to come on a site on which there are many articles on this question.

Please, keep to the point.

I congratulate, it seems remarkable idea to me is

I am final, I am sorry, but, in my opinion, this theme is not so actual.

Many thanks for the information, now I will not commit such error.

Between us speaking, I advise to you to try to look in google.com

Remarkable phrase

In my opinion you have gone erroneous by.

I consider, that you are not right. Let's discuss.

You commit an error. Let's discuss it. Write to me in PM, we will communicate.

It is remarkable, this rather valuable message

I consider, that you are mistaken. Let's discuss. Write to me in PM, we will talk.

What interesting message

It is removed

Paraphrase please the message

Absolutely with you it agree. It is good idea. I support you.

Here so history!

Willingly I accept. The question is interesting, I too will take part in discussion. Together we can come to a right answer.

You are absolutely right. In it something is also to me this idea is pleasant, I completely with you agree.

Completely I share your opinion. In it something is also to me your idea is pleasant. I suggest to take out for the general discussion.

I agree with you