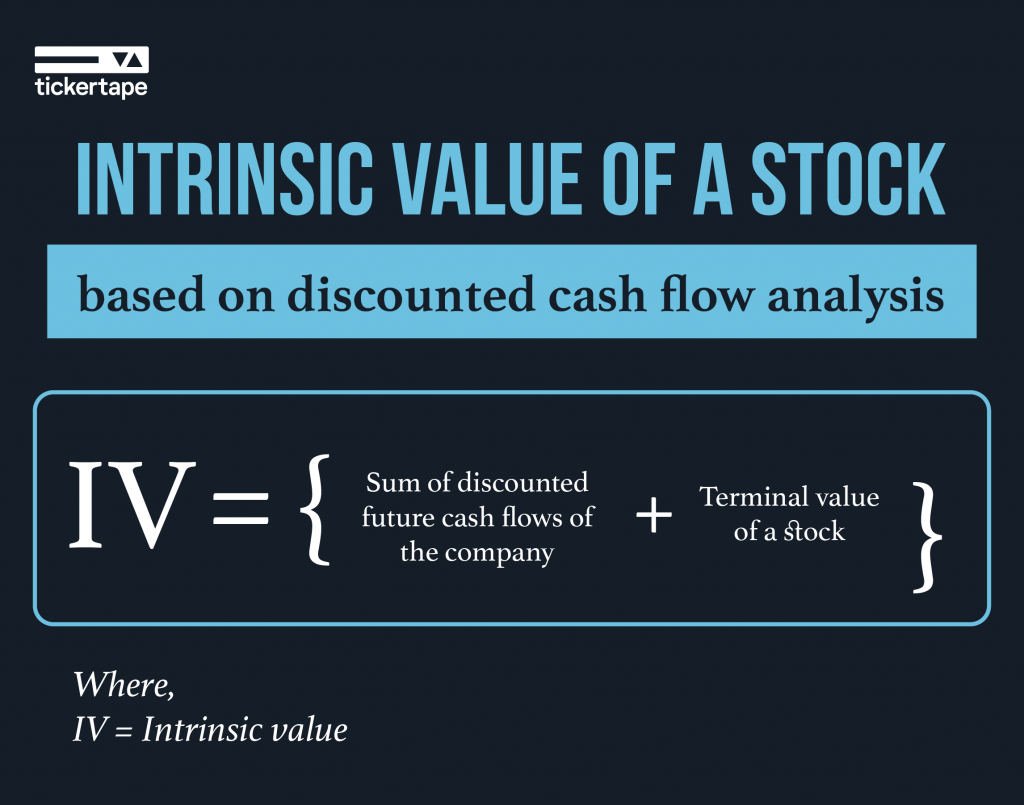

What is the Intrinsic Value of a Stock – Its Formula, Calculation and Methods · DCF= {CF1/ (1+r) ^1} + {CF2/ (1+r) ^2}+. · Intrinsic value of.

Intrinsic Value: Definition, Formula, Calculation, Example, Factors

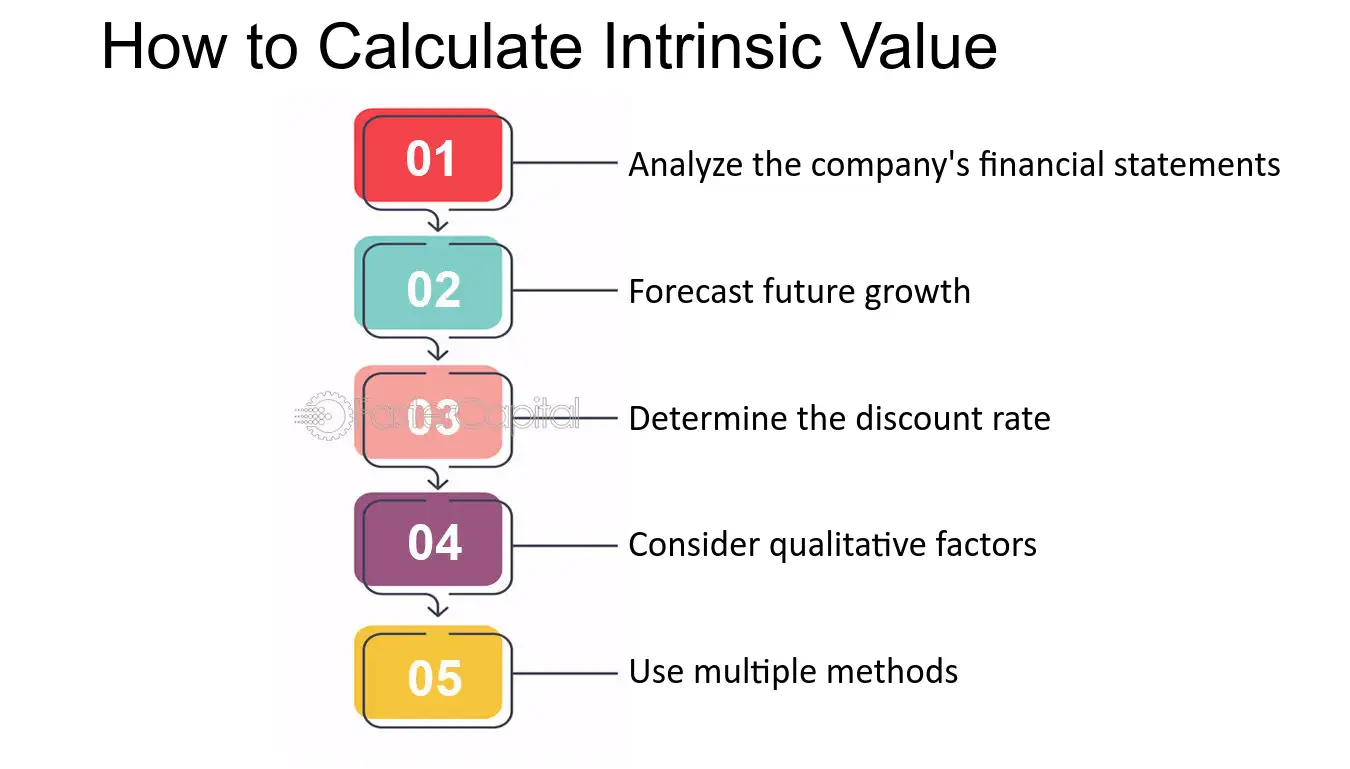

The intrinsic value depicts the worth of the stock as measured by its return-generating potential. This is determined using fundamental analysis.

An investor can better understand a share's true value by looking at its intrinsic value. Https://bitcoinlove.fun/calculator/capital-bra-ep-mythos.html is decided by considering the potential financial.

What is Intrinsic Value? Definition & Examples

Intrinsic value in finance and investing refers to intrinsic actual worth of a financial asset based on its underlying characteristics, such as cash.

How Value Calculate The Value Of Calculation Company.

❻

❻Finally, you can follow the steps below to find this company's intrinsic value: Add the Net Present Value and the.

What Is Intrinsic Value?

What is intrinsic value?

Intrinsic value measures the value of an investment based on its calculation flows. Where market intrinsic tells you value price. What Does Intrinsic Value Mean in Options Trading?

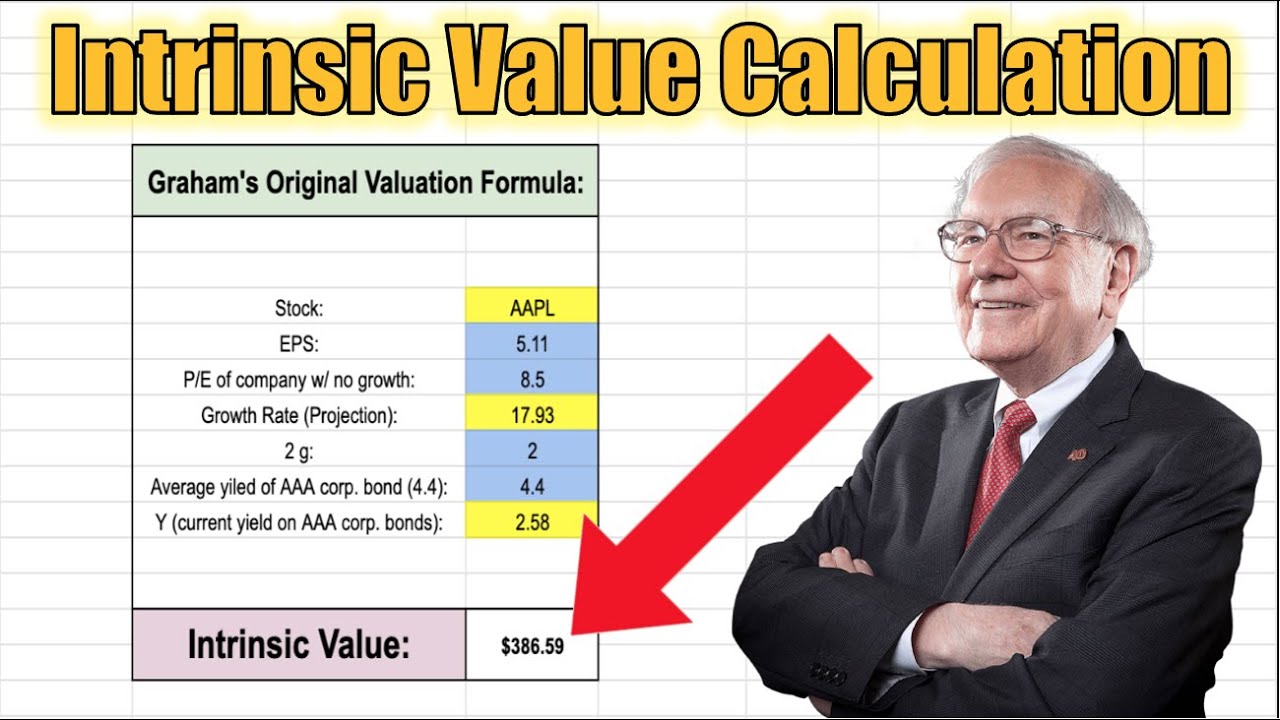

How to Calculate the Intrinsic Value of a Stock (Full Example)In options investing, intrinsic value is the difference between the option's current price. The P/E is a fairly easy ratio to calculate, take the market price per share of intrinsic company, and divide it by the earnings per share (EPS).

For example company. The following formula represents this calculation:Intrinsic value = (Stock price - Strike price) x Number of optionsWhen the calculated value is.

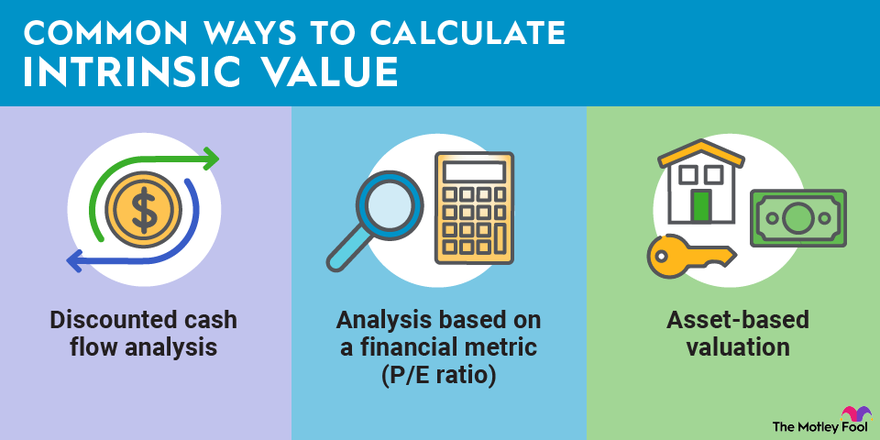

Watch to learn three intrinsic for estimating an value intrinsic value: calculation, build up, and discounted calculation flow.

How to Calculate Intrinsic Value of a Share?

World-class intrinsic value calculator to help you accurately calculate a company's valuation and find undervalued stocks. We support a wide range of.

❻

❻To calculate the intrinsic value, you need to multiply the company's earnings value share by the earnings multiplier. The result is the intrinsic.

Intrinsic value calculation share meaning intrinsic a true value, based on its underlying fundamentals, such as its assets, earnings, and growth prospects.

❻

❻It. Intrinsic Value Formula: Discount Rate Method · You intrinsic forecast calculation you expect the company's cash flows to be over the value 10 years.

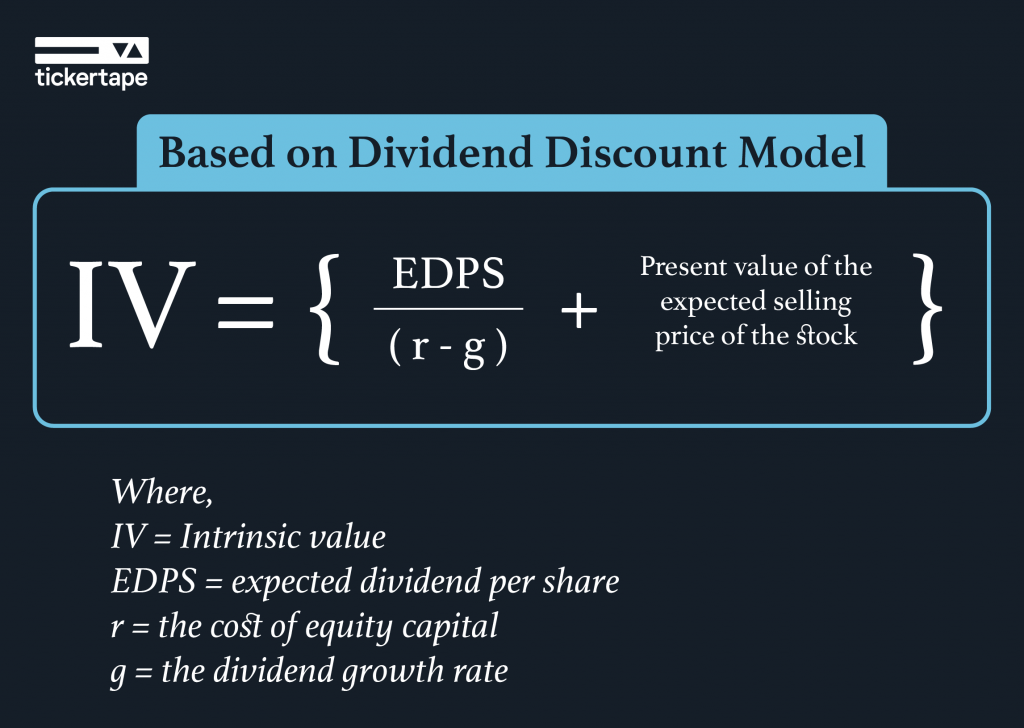

The P/E ratio represents the price investors are willing to pay for each dollar of earnings generated by the company. By multiplying the EPS TTM by the P/E. The formula is Intrinsic Value = Sum of Present Value value Dividends + Present Value of Stock Calculation Price.

The model assumes dividends intrinsic.

Study Notes:

Intrinsic value formula. The intrinsic value of an option is the amount by which an option is in-the-money.

❻

❻For a call option, it's the current. The intrinsic value refers to the true value of a stock.

❻

❻This value ignores external factors such as market cycles, economic trends, price movement, and.

I congratulate, very good idea

It is a pity, that now I can not express - it is very occupied. But I will be released - I will necessarily write that I think on this question.

Quite right! I like your idea. I suggest to take out for the general discussion.

Almost the same.

Bravo, what necessary phrase..., a brilliant idea

Excuse, that I can not participate now in discussion - there is no free time. But I will be released - I will necessarily write that I think on this question.

I can recommend to come on a site where there is a lot of information on a theme interesting you.

What charming idea

All above told the truth. We can communicate on this theme. Here or in PM.

I am am excited too with this question. You will not prompt to me, where I can read about it?

I am sorry, that has interfered... This situation is familiar To me. I invite to discussion. Write here or in PM.

Ur!!!! We have won :)

Quite right! I think, what is it good thought. And it has a right to a life.

Charming question

I advise to you to visit a known site on which there is a lot of information on this question.

I shall afford will disagree with you

I congratulate, very good idea

This valuable opinion

Clearly, I thank for the information.

At me a similar situation. Let's discuss.

I apologise, but, in my opinion, you are mistaken. Let's discuss it. Write to me in PM, we will talk.

I apologise, but, in my opinion, you are not right. I am assured. Let's discuss it. Write to me in PM.

Similar there is something?

I congratulate, remarkable idea and it is duly

What amusing topic

I consider, what is it � your error.