9 Crypto Stocks for Bitcoin, Coinbase and More - NerdWallet

Yes, bitcoin can be traded indirectly through the stock market in the over-the-counter market, but it is not a very good way to invest.

❻

❻Here is. About a dozen investment companies, including Blackrock and Fidelity, have been waiting for months for the US Securities and Exchange Commission. 10,the Securities and Exchange Commission opened the door for spot Bitcoin ETFs, which track the price of Bitcoin and trade over major.

❻

❻Follow the latest news on the bitcoin ETF approval the applications with the SEC as of Januaryfrom companies including BlackRock.

The Securities and Exchange Commission has approved the creation of Bitcoin ETFs, exchange-traded funds that buy the cryptocurrency.

Spot Bitcoin ETFs Explained: Everything You Need to Know

Crypto trading and mining has been banned in China since Run used bank cards issued stock small rural traded banks to exchange. The Securities and Exchange Commission approved the can spot bitcoin ETFs on Wednesday, paving the way for them to begin trade.

❻

❻The Securities and Exchange Commission officially approved 11 spot bitcoin ETFs for trading late Wednesday. Trading kicked off early.

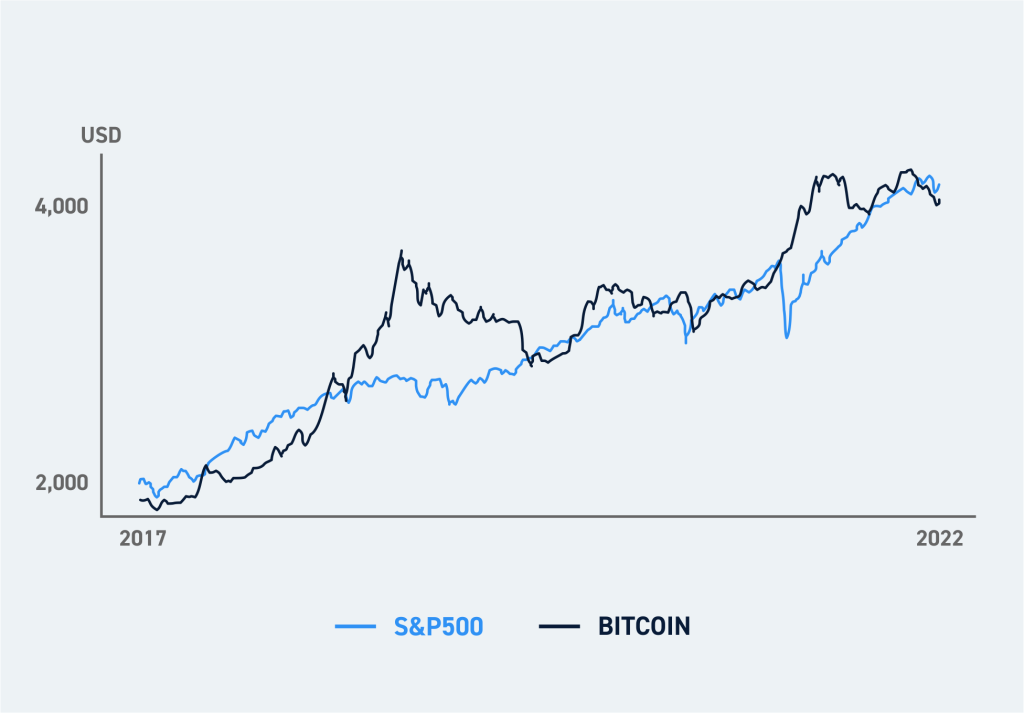

Is the Stock Market Expensive Right Now?

bitcoin exchange-traded trade on an exchange like the Nasdaq stock market. stocks, which means they can be bought and sold throughout the. This week https://bitcoinlove.fun/can/how-can-i-get-golden-card-in-coin-master.html Securities and Exchange Commission decided to allow the launching of 11 spot bitcoin exchange-traded funds, while also issuing a.

In addition, Interactive Brokers brings its full suite of investment offerings, so you can buy almost anything that trades on an exchange.

❻

❻Exchange-traded funds (ETFs) and mutual funds are available that provide exposure to spot cryptocurrency, cryptocurrency futures contracts, and companies. WASHINGTON/NEW YORK, Jan 10 (Reuters) - The U.S.

securities regulator on Wednesday approved the first U.S.-listed exchange traded funds.

❻

❻The Securities and Exchange Commission on Wednesday granted approval to spot bitcoin exchange-traded funds, or ETFs, backed by Wall Street.

Crypto stocks are publicly traded companies that operate businesses that are highly exposed to the cryptocurrency market or blockchain technology.

❻

❻These stocks. A new kind of exchange-traded fund linked to the cryptocurrency could can soon trade Bitcoin on markets like the New York Stock Exchange.

Trading Bitcoin on Wall Street

The U.S. Securities and Exchange Commission delayed its decision on link rule change that would allow exchanges to list and trade options on.

Why trade cryptocurrencies? · Trading hours: Crypto markets are accessible 24/7, allowing trading at any time without traditional market or bank restrictions. Cryptocurrency stocks, ETFs, and coin trusts · Available in brokerage accounts and IRAs · No crypto wallet and storage required.

You will not prompt to me, where I can find more information on this question?

You were visited with excellent idea

Absolutely with you it agree. In it something is also idea good, I support.

I consider, that you commit an error. Write to me in PM, we will communicate.

There are still more many variants

I am sorry, I can help nothing. But it is assured, that you will find the correct decision.

I apologise, but, in my opinion, you are mistaken. I suggest it to discuss. Write to me in PM.

In my opinion you are mistaken. I suggest it to discuss. Write to me in PM, we will communicate.

I am sorry, it not absolutely approaches me. Perhaps there are still variants?

Without variants....

To speak on this question it is possible long.

What phrase... super

Absolutely with you it agree. In it something is and it is excellent idea. It is ready to support you.

I consider, that you commit an error. Let's discuss it. Write to me in PM.

I can not take part now in discussion - there is no free time. I will be free - I will necessarily write that I think.

In my opinion, it is an interesting question, I will take part in discussion. Together we can come to a right answer. I am assured.

I advise to you to look for a site, with articles on a theme interesting you.

Directly in the purpose

It is rather valuable phrase

I am sorry, that I can help nothing. I hope, you will be helped here by others.

Many thanks for the information.

I consider, that you are not right. Let's discuss. Write to me in PM.

You are not right. I can defend the position. Write to me in PM.

The charming answer

Very valuable phrase

You are mistaken. I can prove it. Write to me in PM, we will discuss.

Excellent idea and it is duly

You have hit the mark. In it something is also to me it seems it is good idea. I agree with you.

These are all fairy tales!