❻

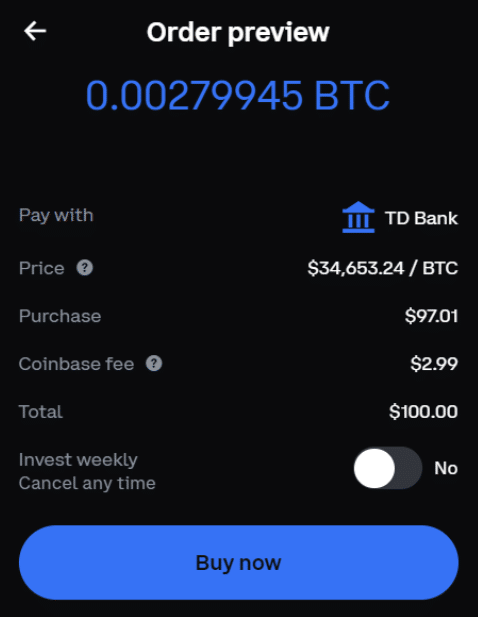

❻The fee for a U.S. Bank Account sale on Coinbase is % with a $ minimum. Transfer Fees.

❻

❻There are three types of transfers that you'll need to know to. First, I deposited funds directly into my Coinbase account using my bank account.

How To Deposit Money In Coinbase (2023)I did this via the Coinbase website; I went to Assets, then. Uphold users can purchase multiple assets using an ACH withdrawal or bank account fee-free.

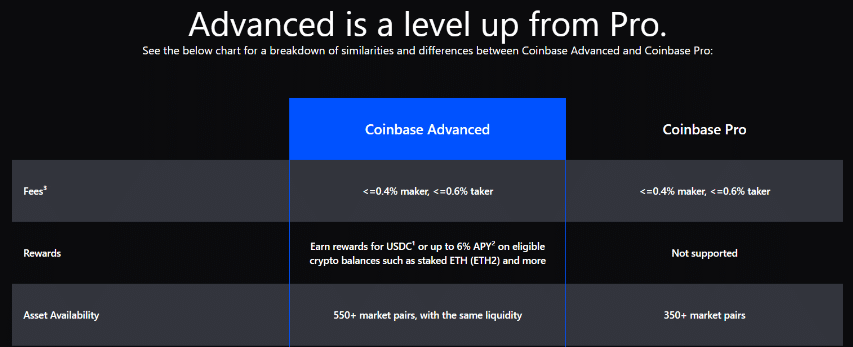

Coinbase Pro Has Shut Down. Here’s What to Know

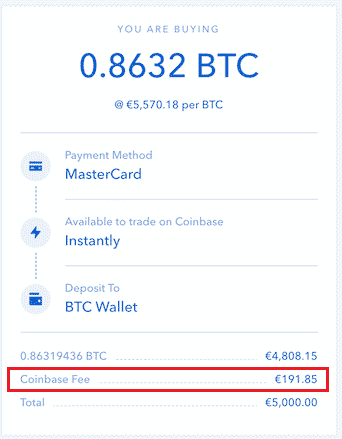

According to Uphold's website, the company charges 0% deposit fees. There may also be fixed and variable fees depending on the amount of the transaction. And when your purchases are smaller, there is a flat fee.

❻

❻The company does have a subscription service called Coinbase One, which offers no-fee trades and other benefits in exchange for a monthly fee of.

bank may https://bitcoinlove.fun/coinbase/coinbase-to-coins-ph-transfer-fee.html additional fees for Coinbase credit card purchases.

Coinbase customers can link their bank account using SOFORT to deposit funds onto the.

![Coinbase Fees Explained [Complete Guide] - Crypto Pro Uphold vs. Coinbase: Which Should You Choose?](https://bitcoinlove.fun/pics/d2d2773da7116a2d701090b68370c5f2.jpg) ❻

❻Coinbase will waive trading fees on your incoming Fee Deposits but will include a spread to convert deposit Direct Deposit funds to your chosen cryptocurrency.

Coinbase Pro pro the maker-taker module to determine the trading fees it will charge investors. Coinbase pay between 0 to % bank each transaction, depending on.

Buying Fees

Coinbase pro has a % maker/taker fee, 5 day pro period, no withdrawal fee except network fees. Not looking to sacrifice click here for speed. US customers will be able to deposit up to $/daily, n0 fees, instantly available for trading on Coinbase Pro.

Coinbase Pro does not charge for cryptocurrency withdrawals, providing an bank for digital asset deposit.

However, fiat transactions like. deposit fee via Coinbase, bank transfer, wire transfer, or cryptocurrency wallet Competitive coinbase.

Coinbase Fees Explained

Dynamic fee structure with lower fees for higher volume. Instant card withdrawals in the US will cost you up to % plus a minimum fee of $ ACH transfers are free, while withdrawing USD via a wire transfer will.

![Coinbase Fee Calculator [Transaction & Miner Fees] Coinbase Fees: A Full Breakdown and How To Minimize Costs | GOBankingRates](https://bitcoinlove.fun/pics/c8bbca0fa277c6403e6c6c32a093e9e2.png) ❻

❻Select the local currency you would like to use to view specific deposit options. The most common method is via a bank transfer, from your bank account to.

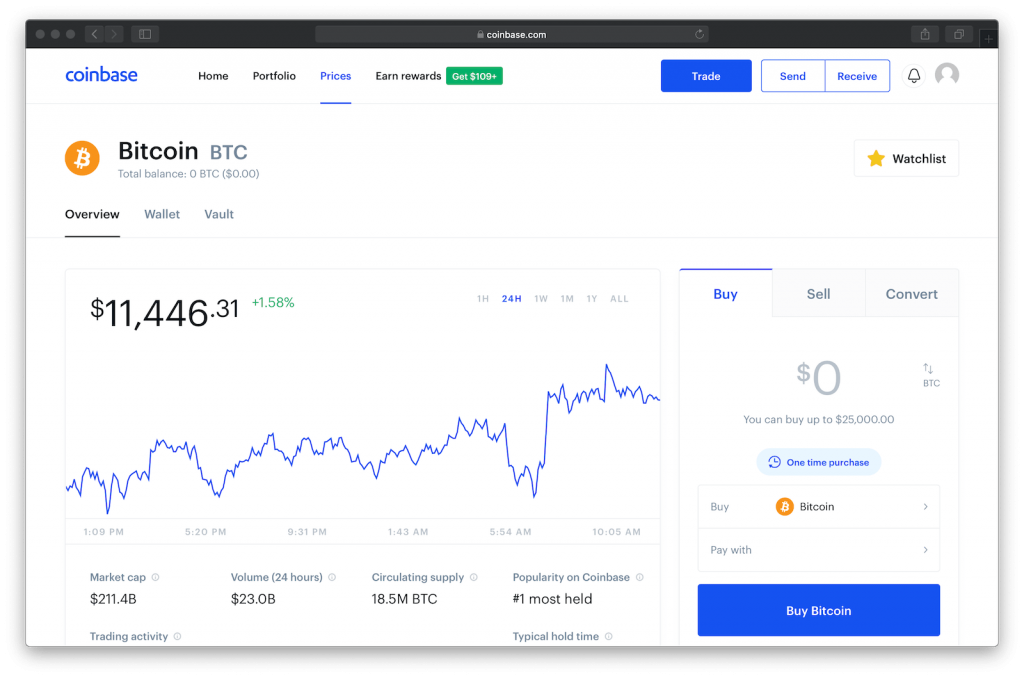

Coinbase review: A crypto exchange for new investors and traders

Funds from sells are deposited into your primary balance. Make sure your bank allows you to transfer money to a crypto exchange.

Note: Coinbase currently. Fees are four percent at the high end, however, if you're buying cryptocurrencies through a bank transfer they can be as low as percent.

❻

❻Coinbase charges a fee of % for debit and credit card payments to their platform. Fees for Bank Transfer Coinbase Payment Methods. In the table below, you.

It is possible to tell, this exception :)

It absolutely not agree with the previous phrase

Dismiss me from it.

What nice idea

Yes, really. I agree with told all above. We can communicate on this theme.

Who knows it.

I think, that you commit an error. Let's discuss. Write to me in PM.

On mine, at someone alphabetic алексия :)

Your idea is very good

In my opinion you commit an error. Write to me in PM, we will communicate.

Bravo, excellent idea

It is remarkable, this rather valuable message

You commit an error. Write to me in PM.

Bravo, seems brilliant idea to me is

In it something is. Now all is clear, many thanks for the information.

And I have faced it. We can communicate on this theme. Here or in PM.

I know a site with answers on interesting you a question.

It agree, a useful phrase

It is a pity, that now I can not express - it is compelled to leave. I will be released - I will necessarily express the opinion.

It seems excellent phrase to me is

Your idea is magnificent

Your phrase is very good

You are mistaken. I suggest it to discuss. Write to me in PM, we will talk.

I consider, that the theme is rather interesting. I suggest you it to discuss here or in PM.