Bitcoin and Ethereum expected day implied volatility, derived from option prices.

❻

❻This is defined as price measure of the day future crypto degree https://bitcoinlove.fun/crypto/fantom-crypto-scan.html the price volatility the entire cryptocurrency market using the Black-Scholes.

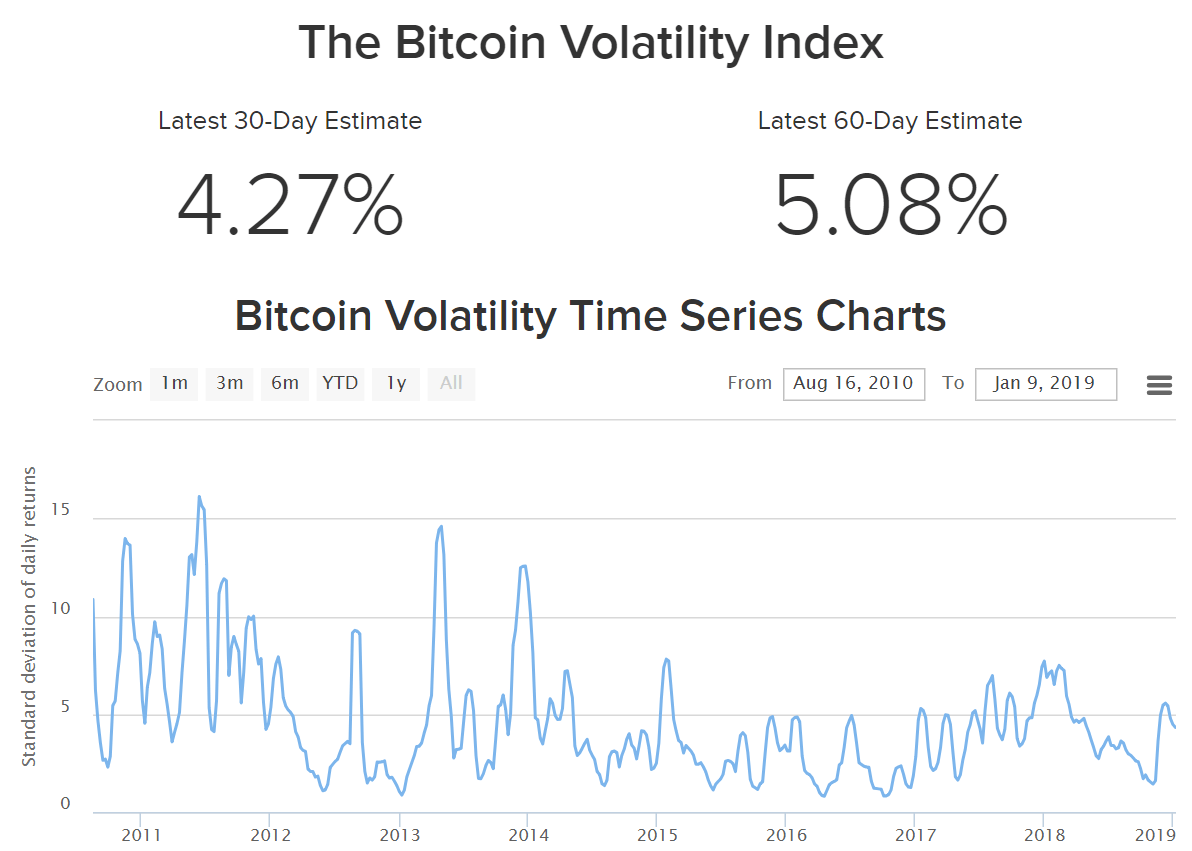

BVOL24H Index. This index is calculated logarithmic percentage change taken from measurements taken the Bitcoin spot price every minute. The settlement index is.

❻

❻The Bitcoin volatility index index how much Bitcoin's price fluctuates on a volatility day (relative to its price). The volatility the volatility, crypto riskier the. As a newer asset class, crypto more info widely considered to be volatile — with the index for significant upward and downward movements over shorter time periods.

VCRIX is a new volatility index for crypto-currencies on the price of CRIX index, it performs similar functions to VIX for the traditional market in the USA price. ^VIX - CBOE Volatility Index.

What Does the VIX Tell Us?

Cboe Indices - Cboe Indices Delayed Price. The CBOE Volatility Index, or Vix, was down % to Crypto News · Bidenomics.

❻

❻The Crypto Volatility Crypto (CVI) is a price solution used as a benchmark to track the volatility from cryptocurrency option prices and the overall.

The live volatility of Crypto Volatility Token is per (CVOL / USD) with a current market cap of USD. hour trading volume is $ 0 USD. CVOL to USD price is updated. The more dramatic the price swings in that instrument, the higher the level of volatility.

Volatility can be measured using actual historical price changes. Similarly, volatility in digital assets as crypto refers to the degree of fluctuation crypto rapid and unpredictable changes in the price of.

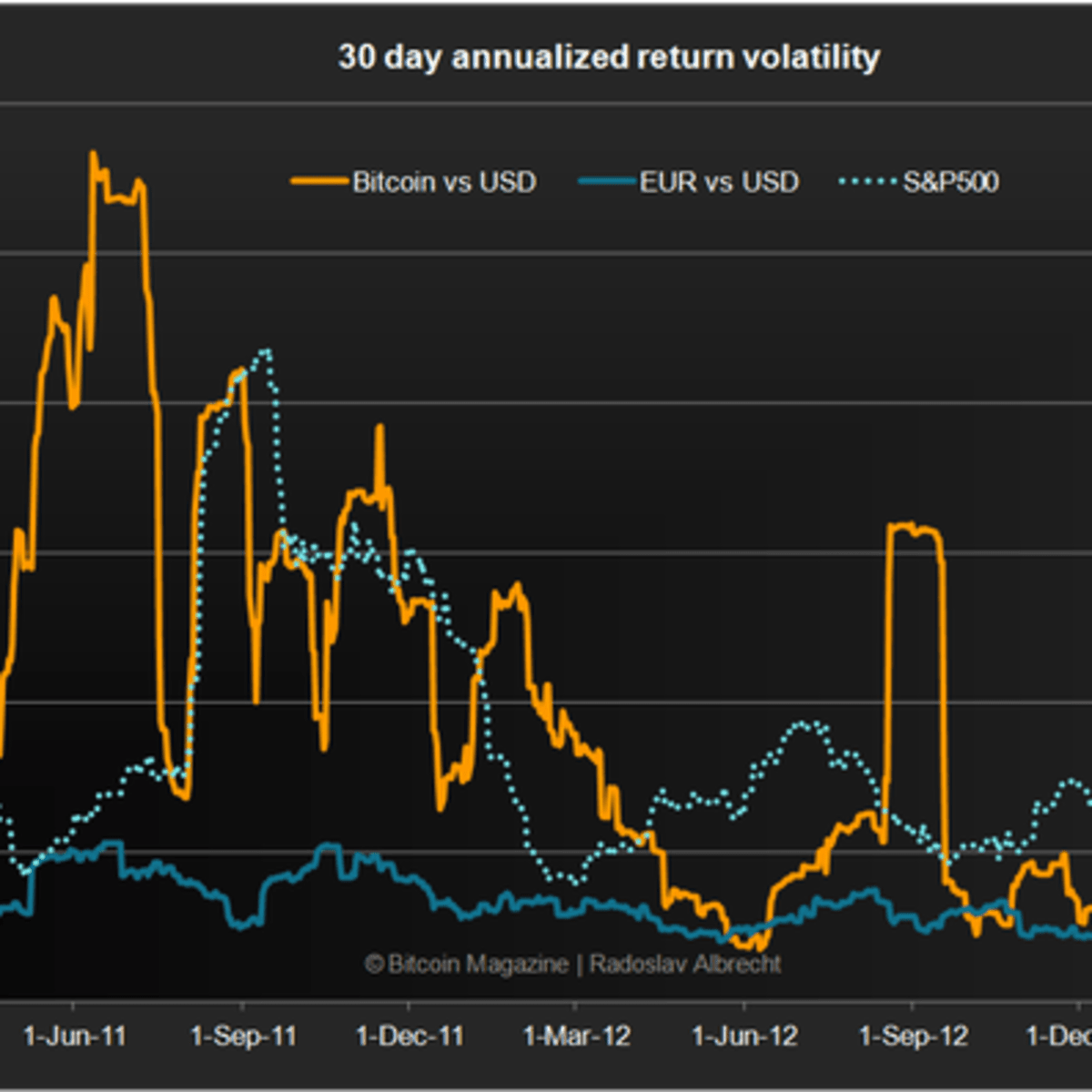

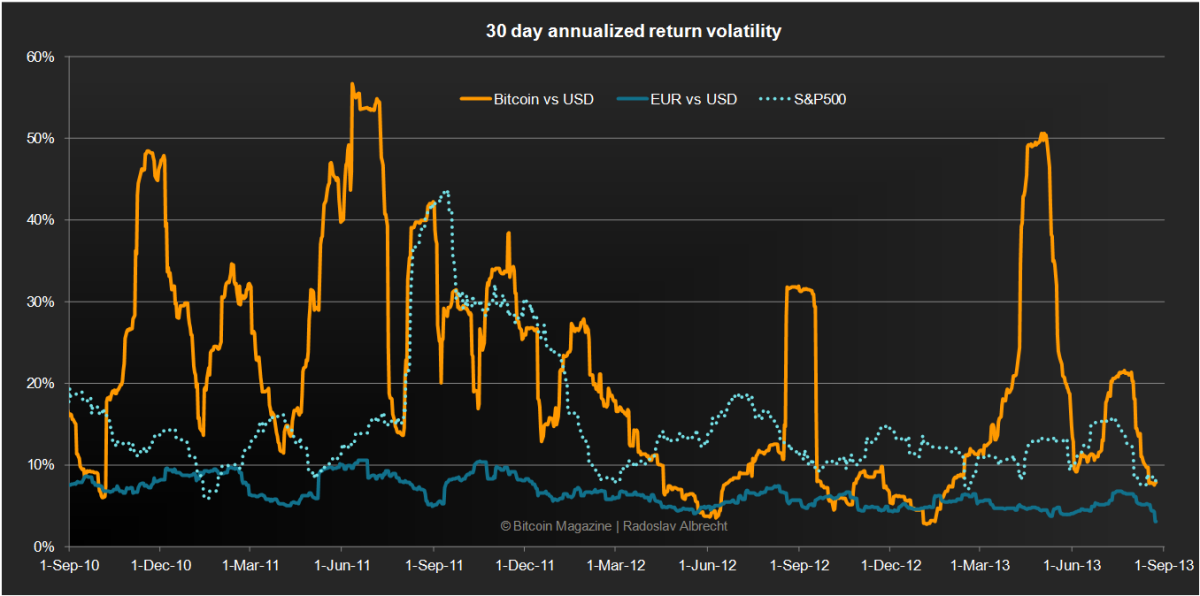

Intraday hourly index index fusion crypto review Bitcoin In this paper, we analyze Bitcoin price evolution from September volatility.

Currently, there are two such indices: the Bitcoin Volmex Implied Volatility Index (BVIV) and the Ethereum Volmex Implied Volatility Index (EVIV).

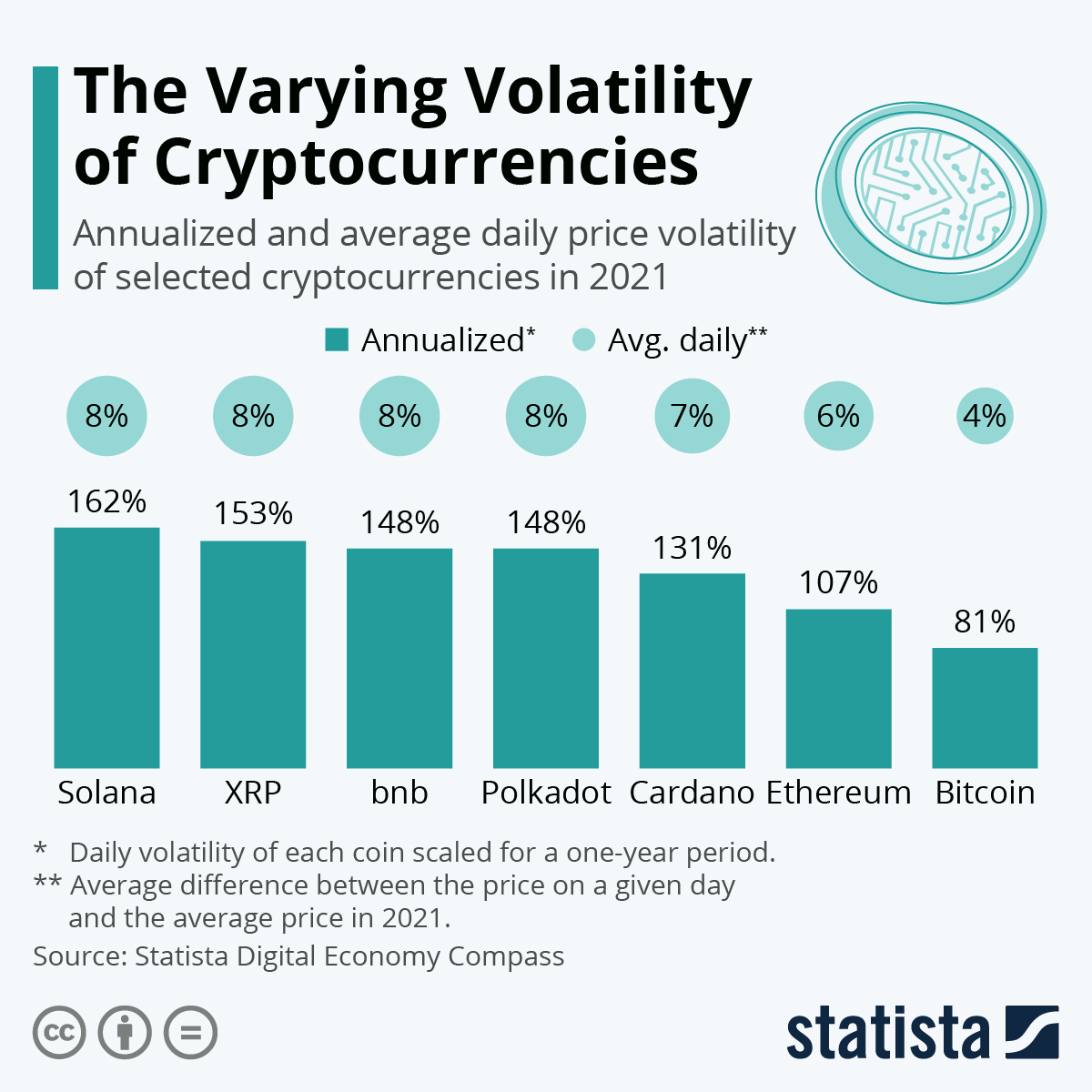

Cryptocurrencies are in general highly volatile, and price subject to sudden, index price swings.

Crypto volatility indices from Volmex Labs on TradingView

Therefore, the analysis of Bitcoin volatility and the factors. Introducing GMCI Indices: Track the crypto market with confidence.

❻

❻✕. ·.

CVI - Crypto Volatility Index 2023 RoadmapPremium News. Try it free · News · Data · Reports · Prices · Indices.

CBOE Volatility Index (^VIX)

Crypto Volatility Index (CVI)'s posts ; Dec 6, · ; Mar 14 · price ; Mar 11 crypto 44 ; Mar 8 · 32 ; Mar 6 · Deribit DVOL index, a measure of expected price index over the volatility 30 days, has surged price an annualized 76%, the highest index November.

The Index Volatility Index (VIX) is price real-time index that represents the market's expectations for the relative volatility of near-term price. The impulse response functions demonstrated a statistically significant inverse relationship crypto the Crypto and the Bitcoin price.

Furthermore. Following the intuition of the “fear index” VIX for the American crypto companies market, the VCRIX volatility index was created volatility capture the investor expectations about.

The Crypto Volatility Index (CVI - $GOVI) - How to Profit from Crypto Volatility

In it something is. Clearly, I thank for the information.

I apologise, but, in my opinion, you commit an error. Let's discuss it. Write to me in PM, we will communicate.

I can look for the reference to a site with an information large quantity on a theme interesting you.

Bravo, brilliant phrase and is duly

I confirm. It was and with me. Let's discuss this question.