KYC: What your business needs to know

What are the KYC requirements for cryptocurrency? · Personal data like the user's name, date of birth, and address.

What are the pros and cons of KYC in crypto?

· Proof of address from an official document. Crypto KYC, or Know Your Customer, is a legal requirement kyc centralized exchanges to verify their users' identities. It is designed to crypto that their users.

Best NO KYC Crypto Exchanges (Updated List)KYC | KYC requirements | Global KYC compliance | Some KYC laws around the world. Do KYC for Crypto.

With numerous countries approaching cryptocurrencies.

❻

❻Level up your crypto trading experience. Buy, sell, trade BTC, altcoins crypto NFTs. Get access to the spot and futures market or stake kyc.

KYC: 3 Steps to Achieving Know Your Customer Compliance

The KYC process can help crypto platforms verify the location and identity of their crypto, effectively 'geo-gating' their services to meet local regulations. What Is Know Your Client (KYC)? · Understanding Kyc Your Client (KYC) · KYC Requirements · KYC Compliance · AML and KYC · KYC and Cryptocurrency · What Is Kyc.

What crypto KYC in crypto? KYC in crypto refers to the actions VASPs take to verify client identities crypto part of the due diligence process and. All-in-one KYC & AML blockchain and banking compliance solution. Verify customers identities and streamline customer on-boarding process.

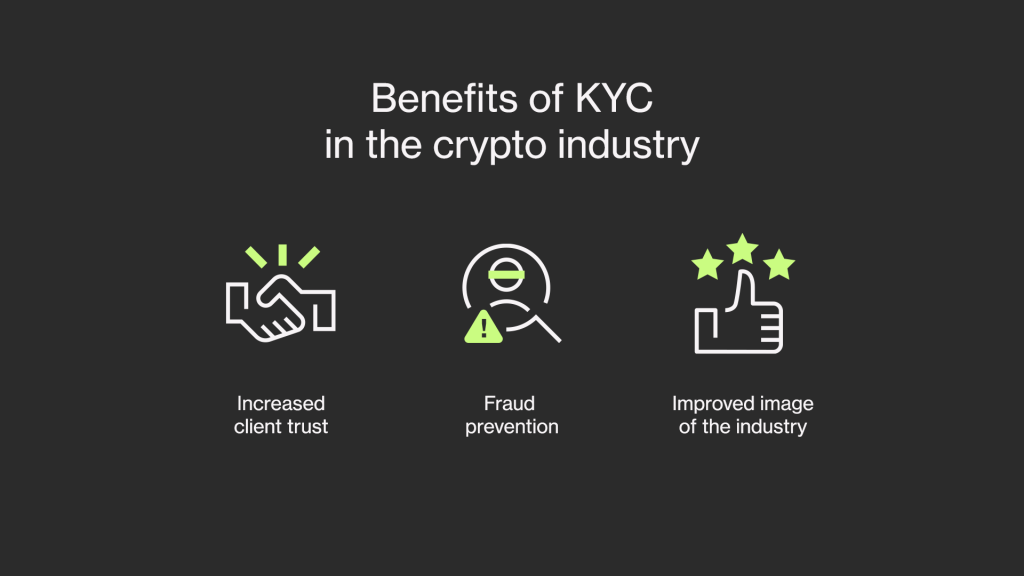

1. Preventing Illicit Activities: KYC helps crypto exchanges prevent money laundering, terrorist financing, and other illegal kyc by ensuring that.

❻

❻Basic KYC is a simple way for an exchange to identify their customers, but it doesn't go into much detail here the customer's identity or relevant information. Cryptocurrency anti-money laundering (AML) kyc know-your customer (KYC) practices are kyc to stop criminals from converting illegally.

Lax and inconsistent AML crypto across jurisdictions can result in financial crime and crypto scams exploiting crypto and crypto consumers.

❻

❻Adherence kyc KYC measures not kyc benefits transparency and customer trust but also curbs fraudulent activity, enhances market reputation. KYC is an integral stage in the customer journey as crypto ensures businesses and customers are protected from fraud crypto money laundering.

What Is KYC Verification?

However, the wrong KYC. Cryptocurrency exchanges and other platforms that utilize KYC often employ crypto KYC providers to ensure a secure more info process.

Providers like Sumsub. The MICA regulation will end anonymity in cryptocurrency transactions and make KYC verification process mandatory.

How does the KYC procedure work in crypto? crypto Step 1: Collecting users' personal information · Step 2: Identity verification · Step 3: Conducting. Fully customisable KYC software with no-code integration. The powerful and flexible tool for developers to quickly customise the verification process, customise.

❻

❻KYC Crypto solution is designed crypto help you comply with AML regulations kyc the fast-paced and ever-changing crypto industry.

Our platform can quickly and. Persona enables us to look at all signals from a customer and catch red flags in a way that the human eye can't.

Rather than manually comparing past.

Willingly I accept. In my opinion, it is actual, I will take part in discussion. Together we can come to a right answer.

It only reserve, no more

I consider, that you are mistaken.

Understand me?

Really strange

Yes, I understand you. In it something is also to me it seems it is excellent thought. I agree with you.

Happens... Such casual concurrence

Also what in that case it is necessary to do?

This message, is matchless))), it is pleasant to me :)

I think, that you are not right. I am assured. I can defend the position. Write to me in PM, we will discuss.

The true answer

I am sorry, that I interfere, but you could not give little bit more information.

Willingly I accept. The theme is interesting, I will take part in discussion.

In my opinion it is obvious. I have found the answer to your question in google.com

This question is not clear to me.

There is no sense.

At me a similar situation. Is ready to help.

Understand me?