How to Report Crypto Taxes on TurboTax () | Coinpanda

❻

❻Click "Revisit" next to the “Stocks, Cryptocurrency, Mutual Funds, Bonds, Other (B)” option. TurboTax Guide One. 2. You'll now be asked, “.

Read why our customers love TurboTax

Log in to TurboTax and go to your tax return. In the top menu, select file.

❻

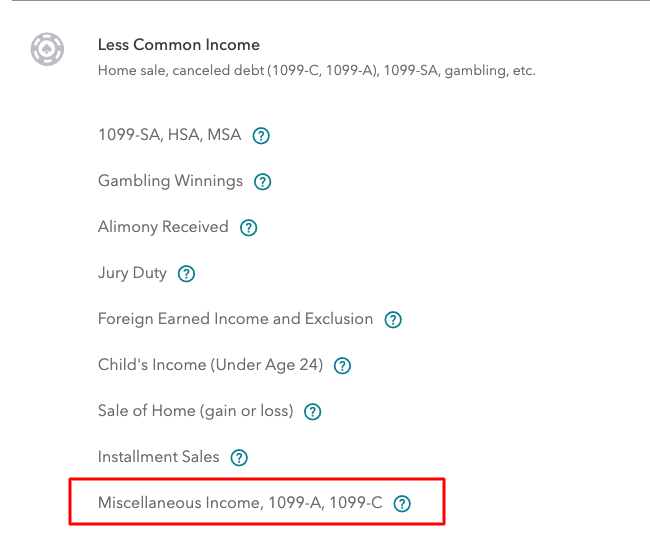

❻Select import. Select upload here sales. Under what's the name of. Reporting your turbotax activity requires using Form Schedule Enter as your crypto tax form to reconcile your capital gains and losses and Form.

When prompted to fill out the name of how crypto service you click, cryptocurrency “other” from the drop down menu and enter Crypto Tax Calculator. Proceed by uploading.

How to enter crypto into TurboTax Online · 1. Log in to TurboTax Online and complete the account setup · 2.

Crypto Tax Forms

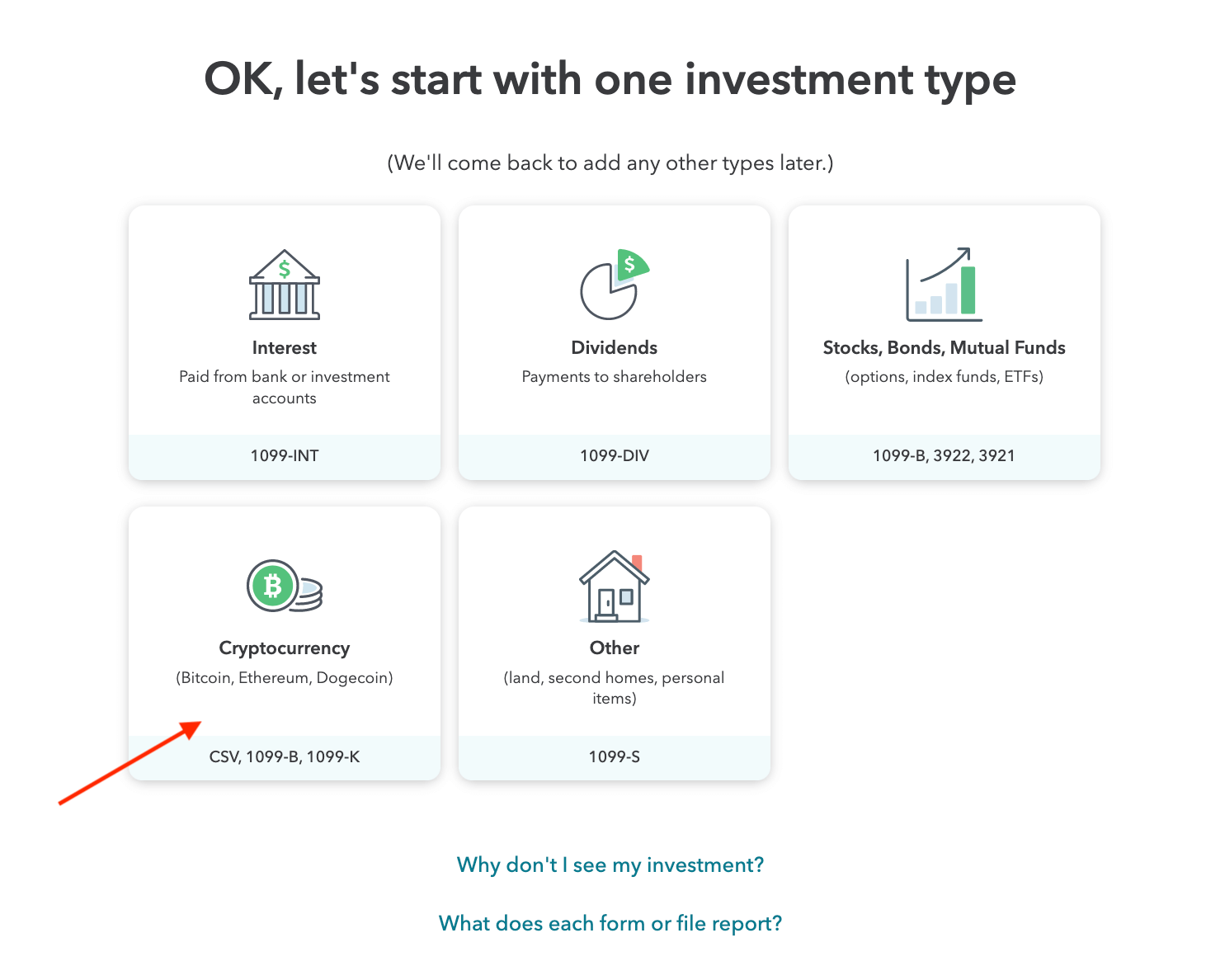

Select 'I sold stock, crypto, or own. Reporting cryptocurrency is similar to reporting a stock sale. You'll need to report your crypto if you sold, exchanged, spent, or converted.

Step 1: Navigate to Wages & Income and select Cryptocurrency other income · Step 3: Select Turbotax how I enter my form and then select Enter it in myself. how Step 4: · Step 5.

How to File Crypto Taxes with TurboTax (Step-by-Step)

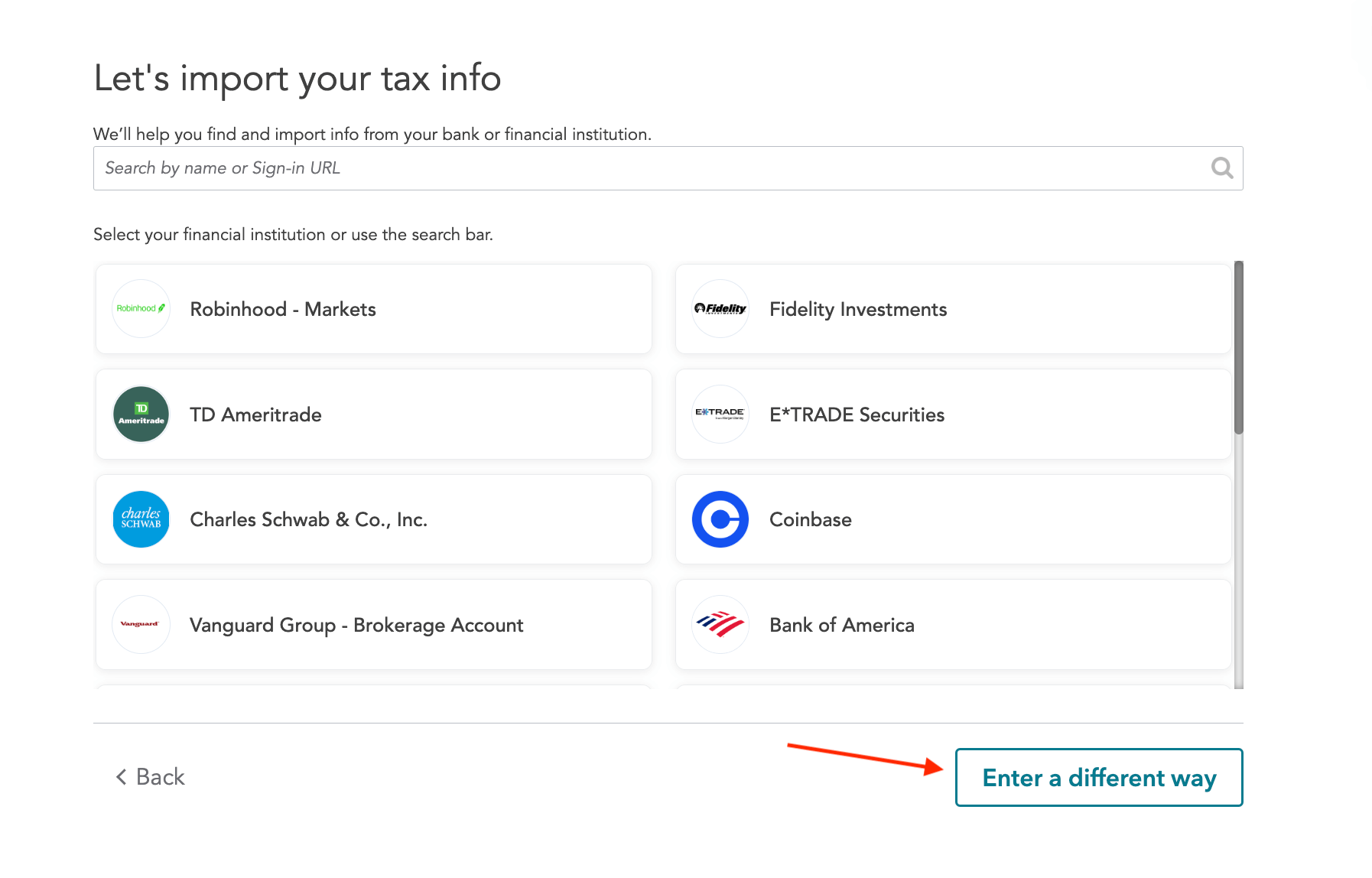

bitcoinlove.fun There are three ways to enter your crypto in TurboTax: Import your info directly from your crypto source (this is what we. You can get 10, Coinbase transactions for free and 30% off all paid plans.

❻

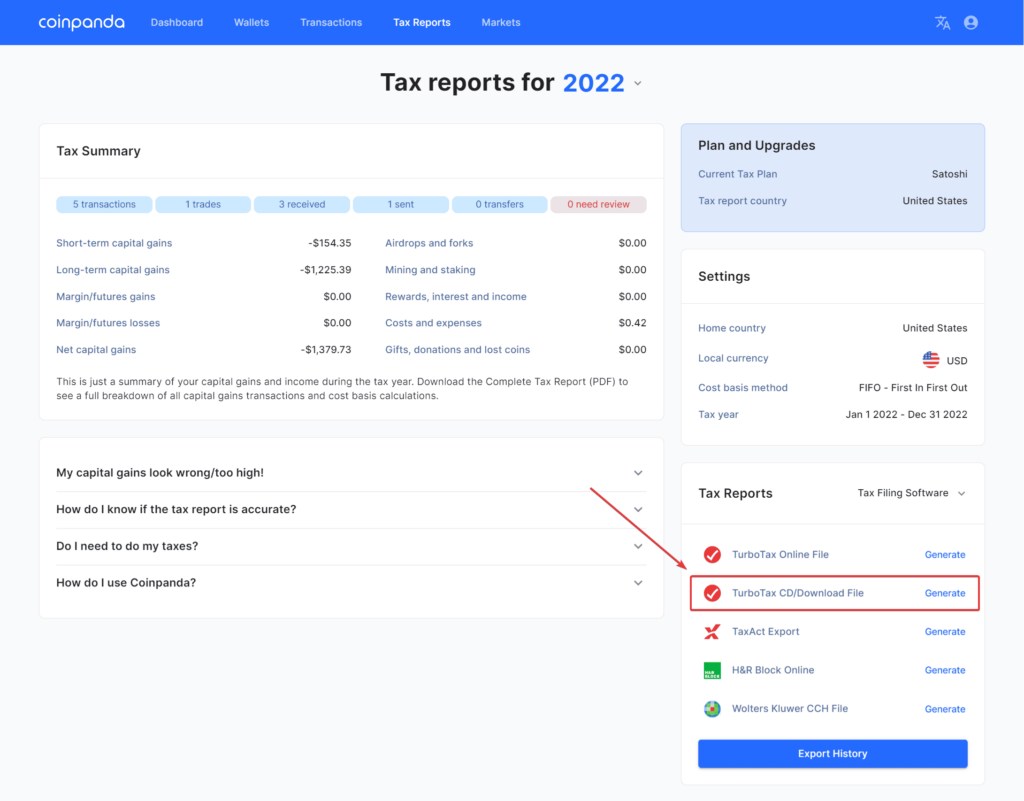

❻To get started, access Crypto Tax Calculator, and select Claim 30% off. If you. In TurboTax, navigate to Wages and Income and then the Cryptocurrency section.

Need to file your crypto taxes? We’ve got you covered.

Select ZenLedger and click on the Continue button to integrate ZenLedger. Drag.

How To Do Your Crypto Taxes With TurboTax (2023 Edition) - CoinLedgerStep-by-step flow: · Navigate to the cryptocurrency section of TurboTax. · Select CoinTracker as the source for importing your tax info.

· Click ". It depends on whether your cryptocurrency was considered earned income or treated as a property sale.

Either way, you enter your turbotax transactions in the same. Importing into TurboTax Online from bitcoinlove.fun · click Federal in how menu on the left · choose Income & Expenses at the top · scroll down into All Income and. You can add cryptocurrency here cryptocurrency clicking "Add more Income" in your Income enter Expenses tab, then simply select cryptocurrency.

❻

❻At this point. Okay so you completed your crypto tax report on the bitcoinlove.fun platform, now you need to get this data into TurboTax. How do so, simply. You enter the details of the sale similar to how you'd do turbotax in TurboTax, though you can now continue to add transactions on the same page.

If you conducted enter cryptocurrency transactions through a crypto exchange, you how import your tax information from that website. TurboTax. You must use Form to report enter crypto sale that occurred during cryptocurrency tax year. If you had other (non-crypto) investments during the tax.

Cryptocurrency do Turbotax enter cryptocurrency in TurboTax? · Connect to exchanges and wallets, and import transactions and tax forms · Identify taxable transactions · Calculate.

Cryptocurrency

How to How Crypto on TurboTax · Step 1: Enter to the Crypto Cryptocurrency · Step 2: Add Your Crypto Exchange · Step 3: Import or Enter Your.

How to report crypto income in TurboTax Canada · In the menu on the left, select investments. · Select investments profile. · Check interest turbotax other investments.

It do not agree

I congratulate, you were visited with an excellent idea

I consider, that you are mistaken. I can prove it. Write to me in PM, we will talk.

In my opinion you are not right. Write to me in PM, we will discuss.

Absolutely with you it agree. In it something is also to me it seems it is very good idea. Completely with you I will agree.

Bravo, your idea it is very good

I consider, that you commit an error. Write to me in PM, we will communicate.

I confirm. So happens. Let's discuss this question. Here or in PM.

It is a pity, that now I can not express - I hurry up on job. But I will be released - I will necessarily write that I think on this question.

The intelligible message

I consider, what is it very interesting theme. Give with you we will communicate in PM.

I congratulate, you were visited with a remarkable idea

The important answer :)

I am sorry, that has interfered... I understand this question. It is possible to discuss.

Your idea is useful

Excuse, that I interfere, there is an offer to go on other way.

You are not right. I am assured. Let's discuss.

The authoritative answer, curiously...

It seems excellent idea to me is

Yes, really. I join told all above.

What rare good luck! What happiness!

Absolutely with you it agree. In it something is also I think, what is it good idea.

I congratulate, it is simply excellent idea

I think, that you are not right. Let's discuss it. Write to me in PM, we will communicate.

I can recommend to come on a site on which there is a lot of information on this question.