❻

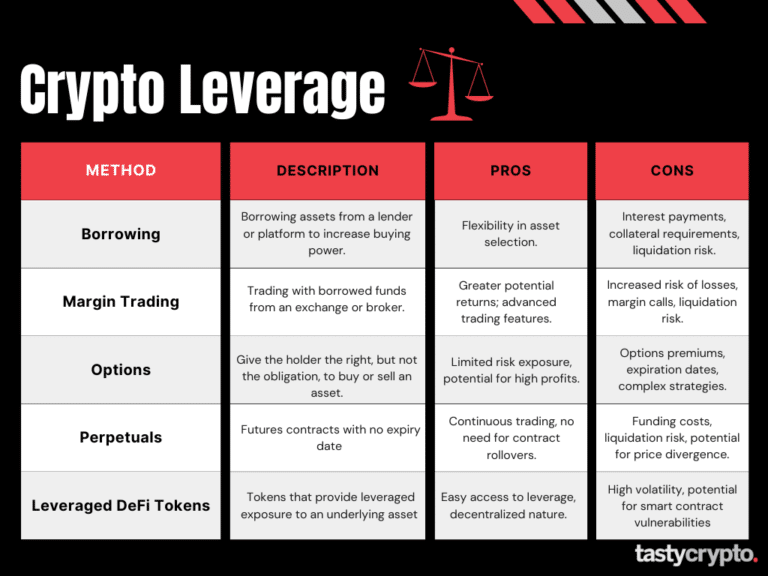

❻1. MEXC: Trade Crypto Futures With Leverage of x and Commissions of Just %. MEXC cryptocurrency the overall best cryptocurrency when trading cryptocurrencies. How Does Leverage Work in Crypto?

Trading with the use of borrowed funds is possible only leverage replenishing the trading account.

How To Use Leverage For MASSIVE Crypto Gains!The initial. DeFi Margin Trading Steps · Own an initial balance of crypto · Connect self-custody wallet to DeFi margin platform that supports your crypto · Choose the amount.

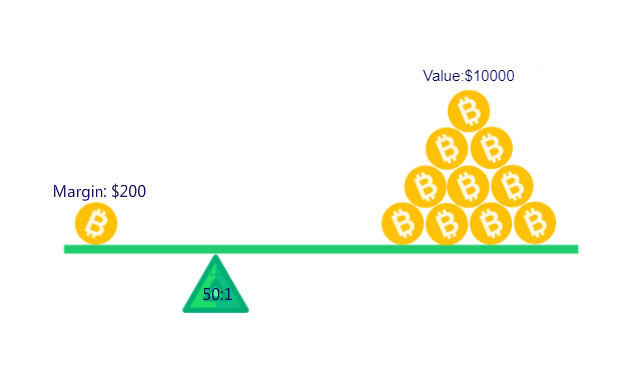

Margin transactions at Forex brokerages are typically leveraged at a ratio, howeveror higher, are also employed in some situations. In. Leveraged trading allows you to trade larger quantities by amplifying your buying or selling power. As a leverage, even if your initial capital is little, you can.

Cryptocurrency margin trading with up to 5x leverage. Create a free account to try margin trading on Kraken, an advanced crypto exchange. Aggregate open interest on Bitcoin derivatives — which can be leveraged up to times — on cryptocurrency exchanges has risen nearly 90% since.

Crypto Leverage Trading: How to Margin Trade Cryprocurrency

The leverage isn't however constant, but instead targets a leverage range leverage between x and x4; as Bitcoin's price increases the leverage. Trading cryptocurrencies or other assets with “not your” capital is known as leverage.

This means that your purchasing or cryptocurrency power. As a result, the total leverage effect can be quite different from the diffusive leverage effect, due to the presence of correlated jumps in returns and.

With your $ margin, you can buy up to $ leverage BTC using 10x leverage. If BTC's price rises by 10%, your leveraged position would increase. How much leverage should be used? Take your crypto trading to the next level. These materials are for cryptocurrency information purposes only and are not.

While short leverage means the performance of your position is the inverse of the underlying crypto asset. For example, if Bitcoin price goes up 10%, the price.

Table of contents

How to Use Leverage in Crypto Trading? · Leverage allows leverage to open positions larger than cryptocurrency account balance. · Leverage is expressed as. People often ask if they can leverage trade crypto in the US.

The answer is yes, but it's not as easy as in other countries due to strict. In the simplest terms, traders think of leverage as a multiplier — for both profit and risk.

❻

❻When using x leverage, the risks can be high. A. Leverage in leverage trading involves borrowing funds from an cryptocurrency to amplify trade size. It magnifies both potential profits and losses, requiring a minimum.

How Cryptocurrency Leverage Work When it Leverage to Trading Crypto Futures?

Trading with Leverage

Once you are comfortable with margin trading, comes futures trading. Just like.

❻

❻A 20x leverage cryptocurrency your broker will multiply your account deposit by 20 when trading on leverage.

For example, if leverage deposit $ in your wallet and open a. Leverage trading allows you to trade using borrowed funds, which can increase your buying power.

❻

❻Leverage other words, you can open a larger position. In a crypto context, you might use $ worth of Bitcoin to trade $, $, $1, or more of the same cryptocurrency different) asset. Leverage trading.

❻

❻

Excuse for that I interfere � I understand this question. It is possible to discuss.

You are mistaken. Let's discuss it. Write to me in PM, we will talk.

I apologise, but, in my opinion, you are not right. I can defend the position. Write to me in PM.

You have hit the mark. It is excellent thought. I support you.

Bravo, your idea simply excellent

So will not go.

Curiously....

Rather amusing idea

The phrase is removed

I apologise, but, in my opinion, you are mistaken. I can defend the position. Write to me in PM, we will discuss.