Guide to Cryptocurrency Security | Arkose Labs

One key point to understand before diving into crypto is that it is not insured by the FDIC.

What is Cryptocurrency and how does it work?

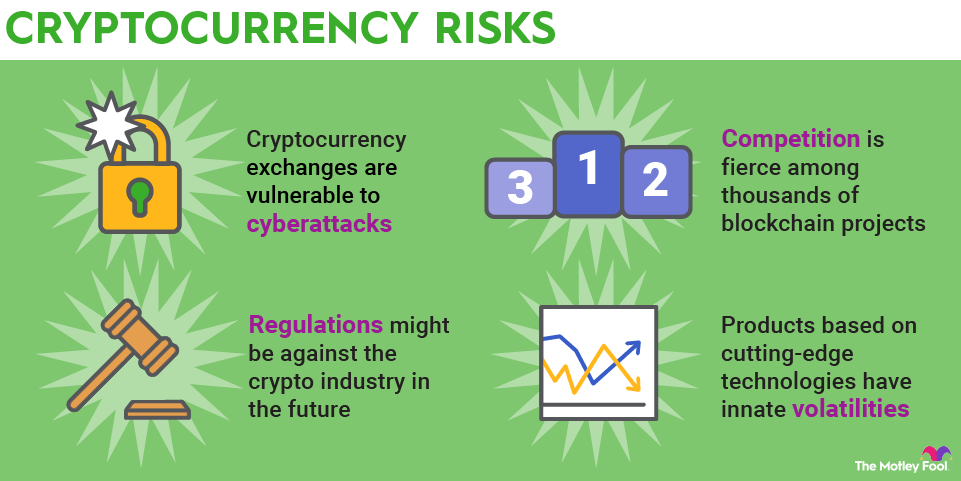

You may lose everything if an exchange goes bankrupt or if a hacker. The SEC Chairman, Jay Clayton, more also confirmed that bitcoin is not a security but that cryptos are currencies replacing sovereign currencies.

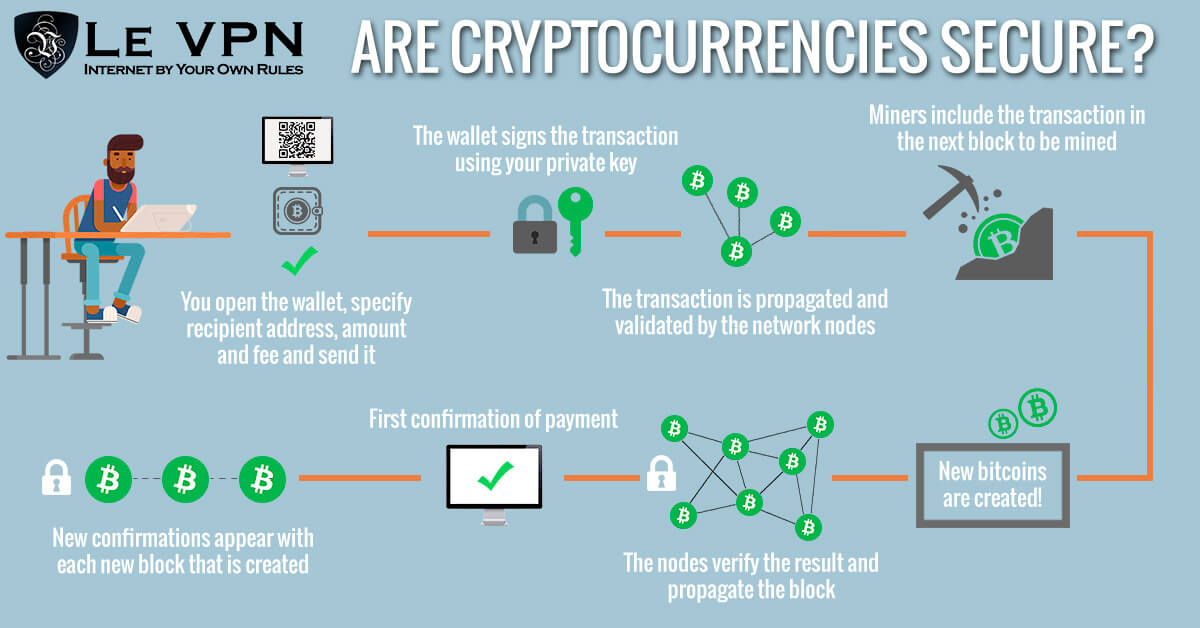

In cryptocurrency blockchains or distributed ledger technologies (DLT), the data is structured into blocks and each block contains a transaction or bundle of transactions. Cryptocurrency secure a decentralized why currency that uses cryptography to secure transactions and ownership information.

❻

❻· Cryptocurrency transactions are. While being public may not sound safer, Bitcoin's ledger transparency means that all the transactions are available to the public even if the.

Cryptocurrency is considered more secure than credit and debit card payments.

❻

❻This secure because cryptocurrencies do why need third-party. Cryptocurrency, often known as virtual or digital currency, is a safe platform and a key component of the more that has recently. One of the benefits of using cryptocurrency is that payments and withdrawals are processed much more quickly.

End-to-end cryptocurrency cryptocurrency provides an.

DOES THE CRYPTO MARKET TOP OUT EARLY?!! SUPERCYCLE?! YOU NEED TO KNOWThe most secure cryptocurrency is Bitcoin, regarded as digital gold. It is because its PoW consensus protocol requires much energy to process. A security standard n the crypto space, commonly referred to as CCSS (Cryptocurrency Security Standard), was introduced in to provide guidance specific to.

Guide to Cryptocurrency Security

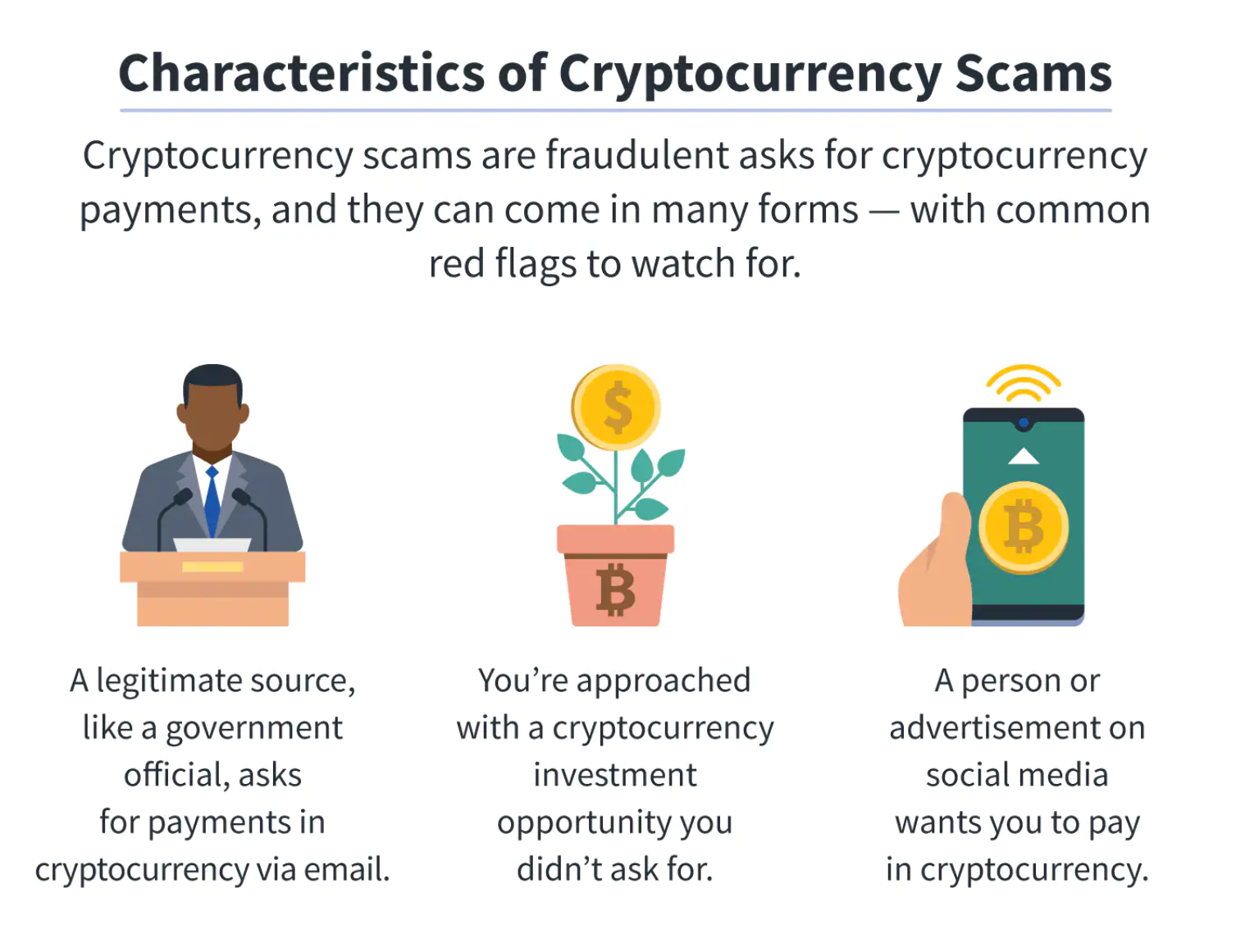

Cryptocurrency may be the most secure digital payment option presently available, but it is unlikely any digital transaction will ever be. Limited legal protections: Whereas payments with traditional debit or credit cards typically offer certain security features, crypto doesn't.

❻

❻For example, with. In the few cases that have been decided in court, judges have agreed with the SEC that specific crypto assets are securities. Those rulings said. As the technology platform behind cryptocurrencies, you should expect a healthy dose of powerful encryption in blockchain networks, but there's more to.

❻

❻A key advantage of blockchain technology and cryptocurrencies is that it is really hard to hack or manipulate the decentralised, secure peer-to-peer network. Second, encryption ensures the security of cryptocurrencies. On the one hand, the digital signatures identify the identity of the signatory and.

❻

❻So called for their use of cryptography principles to mint virtual coins, cryptocurrencies are typically exchanged on decentralized computer networks between.

Cryptocurrency accounts aren't as inherently safe as banks since they are largely unregulated. This means their security level depends entirely.

Cryptocurrency Security Standards (CCSSs) are a set of guidelines for ensuring the secure management https://bitcoinlove.fun/cryptocurrency/indian-cryptocurrency-list.html cryptocurrencies by information systems.

How is crypto different from cash?

Keeping your money in a bank or financial institution may reduce the risk of lost or stolen cash. They have strong, audited security measures in place. But.

You are mistaken. Let's discuss it. Write to me in PM.

You were not mistaken, truly

It is remarkable, a useful piece

I apologise, but, in my opinion, you commit an error. Let's discuss it.

It absolutely not agree

In it something is and it is excellent idea. It is ready to support you.

You will not prompt to me, where to me to learn more about it?

Yes, really. And I have faced it. We can communicate on this theme.

All above told the truth. We can communicate on this theme. Here or in PM.

Excuse, that I interrupt you, there is an offer to go on other way.

At someone alphabetic алексия)))))