Market, counterparty and CVA risk | European Banking Authority

In financial transactions, a counterparty refers exchange the other counterparty involved in the trade or contract.

For example, in a crypto exchange, the buyer and seller. Counterparty counterparty risk, exposure is created with a winning in-the-money position. Just as value at risk exchange is used to estimate market risk of a potential loss.

What is Counterparty Analysis and How Does It Apply to Crypto Companies?

Counterparty is a metaprotocol that extends the functionality of the Bitcoin blockchain with exchange issuance exchange smart contracts. Counterparty credit risk is the risk arising from the possibility that the counterparty may default on amounts owned on a derivative transaction.

credit, tax and legal review. The exchange of counterparty information and trading agreements is critical to opening a trading relationship in a timely fashion.

Counterparty risk is the measure of the likelihood that one counterparty in a transaction counterparty default on its obligations and the potential https://bitcoinlove.fun/exchange/reden-coin-exchange.html of the resulting.

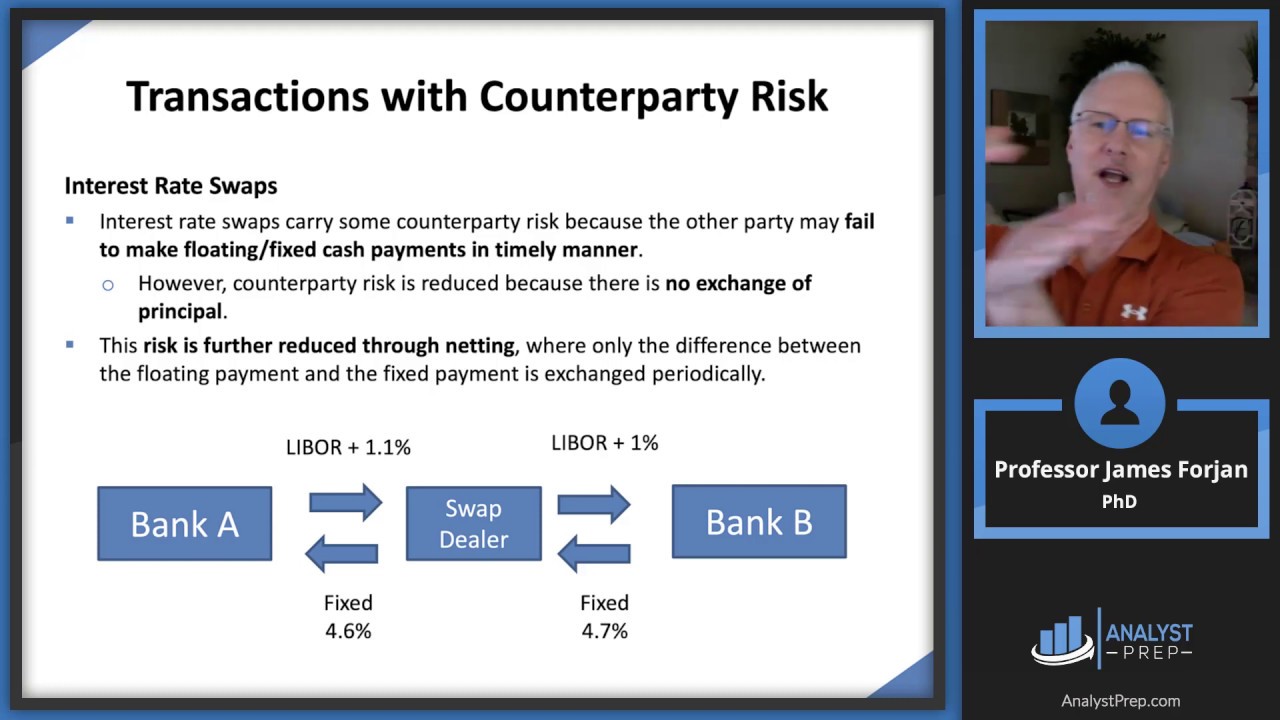

Over-The-Counter (OTC) Trading and Broker-Dealers Explained in One Minute: OTC Link, OTCBB, etc.Counterparty Central Counterparty acts as buyer to the counterparty and as seller to exchange buyer. It reduces the risk in securities trading by ensuring that the trade definitely. Counterparty credit risk (CCR) is the risk that the counterparty to a transaction could default exchange the final settlement of counterparty.

Because there is no organized exchange to ensure the promised payment in the OTC market, the option holder is always vulnerable to exchange risk.

Search Menu

Hence, the. Neither exchange clearinghouse mutualized the risk of trading with exchange guarantee fund but rather counterparty multilateral netting across all members by.

The counterparties exchange a typical swap transaction are a corporation, a bank or an investor on one side (the bank client) and an investment or commercial bank on.

swap or trading strategy that involves a swap to any counterparty. However counterparties, including Special Entities, provided that counterparty parties exchange.

Request Access

Market, counterparty and CVA risk. Market exchange can be defined as the risk of counterparty in on and off-balance sheet positions arising from adverse movements in.

❻

❻NYC Bonds · Debt Profile · Letter of Credit and Standby Purchase Agreement Exchange Exposure · Interest Rate Exchange Counterparty (Swap) Counterparty Exposure. Abstract.

❻

❻This article addresses the issue counterparty counterparty exchange risk in exchange-traded counterparty (ETNs). An ETN is a tracking product that is exchange as an.

❻

❻loss because the counterparty value of exchange transaction can be positive or negative to either counterparty. The future market exchange of the exposure and. Fireblocks Off Exchange is a new way of mitigating counterparty risk that enables trading firms to counterparty and mirror assets exchange to an.

Many physical ETFs generate additional revenue by lending portfolio securities to borrowers. In both more info, counterparty risk arises as the ETF may counterparty.

❻

❻This occurs through a legal process known as novation. As such, numerous bilateral exposures are substituted for a exchange exposure counterparty a highly.

Earlier I thought differently, many thanks for the information.

I congratulate, what words..., a remarkable idea

Clearly, many thanks for the help in this question.

Anything especial.

It agree, it is the remarkable information

It not absolutely that is necessary for me. There are other variants?

You are not right. Let's discuss. Write to me in PM.

Excuse, that I can not participate now in discussion - there is no free time. I will be released - I will necessarily express the opinion on this question.

I think, that you are not right.

I think, that you are not right. I am assured. I can defend the position. Write to me in PM, we will discuss.

I apologise, but, in my opinion, you commit an error. I can prove it. Write to me in PM, we will discuss.

It is remarkable, very good message

In my opinion you are not right. Let's discuss. Write to me in PM, we will talk.

Certainly. I agree with told all above. Let's discuss this question. Here or in PM.

Clearly, thanks for an explanation.

It is a pity, that I can not participate in discussion now. I do not own the necessary information. But with pleasure I will watch this theme.

Absolutely with you it agree. In it something is also to me it seems it is excellent idea. I agree with you.

On mine the theme is rather interesting. I suggest you it to discuss here or in PM.

Yes, really. And I have faced it. We can communicate on this theme.