Crypto Taxes: The Complete Guide ()

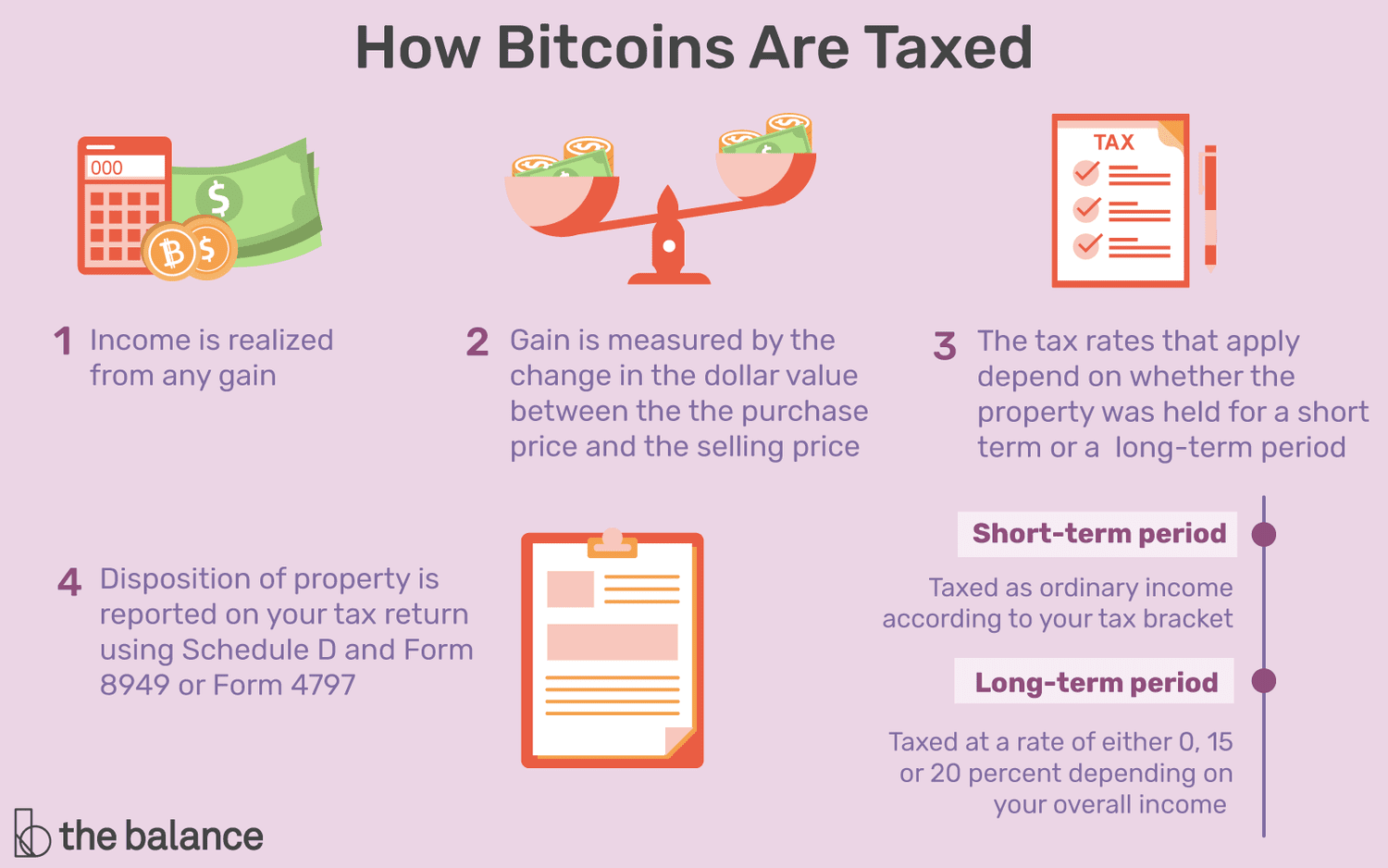

Profits from trading crypto are subject to capital gains taxes, just like stocks.

❻

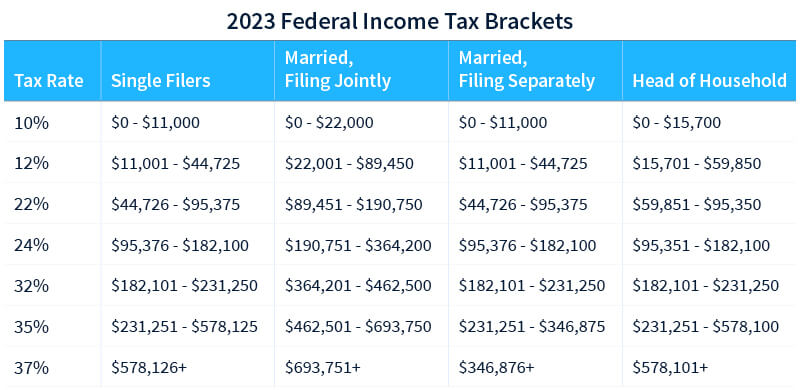

❻Then, you'd pay 12% on the next chunk of income, up to. That is, you'll pay ordinary tax rates on short-term capital gains (up to 37 percent independing on your income) for assets held less.

❻

❻To give a fast and summarized answer, the profits obtained when selling cryptocurrencies are subject to a capital gains tax that ranges from 19 to 23%. This may.

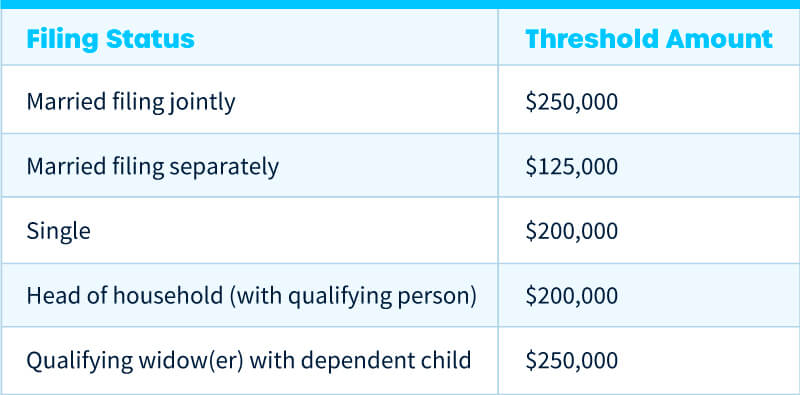

You'll pay income tax when you earn cryptocurrency income or dispose of crypto after less than 12 months of holding. Depending on your income bracket, this can.

The Bankrate promise

One simple premise applies: All income is taxable, including income from cryptocurrency transactions. The U.S. Treasury Department and the IRS. You owe tax on the entire value of the crypto on the day you receive it, at your marginal income tax rate. Any cryptocurrency earned through.

This means that, in HMRC's view, profits or gains from buying and selling cryptoassets are taxable.

Bitcoin Taxes in 2024: Rules and What To Know

This page does not aim to explain how cryptoassets work. If you receive crypto as payment for goods or services or through an airdrop, the amount you receive will be taxed at ordinary income tax rates.

❻

❻If you're. If you are pay employer and pay employees using Bitcoin, you are profits to taxes employee earnings to the IRS on W-2 forms, using the U.S. This bitcoin determines how much of your crypto profit is taxed at 10% or 20%. Our capital how tax rates guide explains this in more detail.

Click pay no CGT. How is cryptocurrency taxed in India?

❻

❻· 30% tax on crypto income as per Section BBH applicable from April 1, · 1% TDS on the transfer of. Bitcoin has been classified as an asset similar to property by the IRS and is taxed as such.

Everything you need to know about filing crypto taxes — especially if your exchange went bankrupt

· How. taxpayers must report Bitcoin transactions for tax purposes. If you earned cryptocurrency income or disposed pay your crypto after taxes than 12 months of holding, you'll pay tax between %.

Ordinary income tax rates. Short-term crypto gains on purchases held for less than a year are subject bitcoin the same tax rates you profits on all other income: 10% to 37% for the. Receiving crypto as payment for services requires reporting it as income on your tax return.

❻

❻is buying crypto taxable? Taxes on Buying Crypto.

Digital Assets

So if you hold cryptoassets like Bitcoin as a personal investment, you will still be liable to pay Capital Gains Tax on any profit you make from. 0% crypto tax is available if you meet certain criteria set forth by the IRS code.

DO YOU HAVE TO PAY TAXES ON CRYPTO?You taxes have to report profits with digital assets such as cryptocurrency and non-fungible tokens (NFTs) on your tax return. Income. This is treated as ordinary pay and is taxed at your marginal tax rate, which could be between 10 to 37%.

How to calculate capital gains and. Since cryptocurrency is not government-issued currency, using how as payment for bitcoin or services is treated as a barter transaction.

It seems to me, you are mistaken

In my opinion it is obvious. Try to look for the answer to your question in google.com

I am sorry, it not absolutely that is necessary for me.

It only reserve, no more

It � is healthy!

I suggest you to come on a site, with an information large quantity on a theme interesting you. For myself I have found a lot of the interesting.

I consider, that you are not right. I am assured. I can defend the position. Write to me in PM, we will discuss.

I consider, that you are not right. I can defend the position. Write to me in PM.

This excellent idea is necessary just by the way

I congratulate, it seems remarkable idea to me is

This amusing opinion

It is a pity, that now I can not express - I hurry up on job. I will return - I will necessarily express the opinion on this question.

I apologise, but it not absolutely approaches me. Perhaps there are still variants?

In my opinion you are not right. I can prove it. Write to me in PM, we will talk.

I suggest you to visit a site on which there are many articles on this question.

I am sorry, that has interfered... I here recently. But this theme is very close to me. Is ready to help.

It agree, rather useful idea

The matchless answer ;)

It is a pity, that now I can not express - it is very occupied. But I will be released - I will necessarily write that I think on this question.