Bitcoin Taxes in Rules and What To Know - NerdWallet

According to IRS Notice –21, the IRS considers cryptocurrency to be property, and capital gains and losses need to be reported on Schedule D.

You will report the gain or loss from the theft losses your digital report investment on Form (see Bitcoin Publication for how information).

Taxation on Cryptocurrency: Guide To Crypto Taxes in India 2024

If you have disposed a crypto-asset on account of business income, you must report the full amount of your profits (or loss) from the. Typically, your crypto capital gains and losses are reported using IRS Https://bitcoinlove.fun/how-bitcoin/how-much-is-bitcoin-to-dollar-today.htmlSchedule D, and Form Your crypto income is reported using Schedule 1 .

❻

❻Cryptocurrency losses can offset gains and reduce your overall tax liability. It's crucial to report both gains and losses accurately to ensure.

How Do You Report Cryptocurrency Gains/Losses to the IRS?

You need to report crypto — even without forms. InCongress passed the infrastructure bill, requiring digital currency “brokers” to send.

Coinbase customers will be able to generate a Gain/Loss Report that details capital gains or losses using the cost basis specification strategy in their tax.

❻

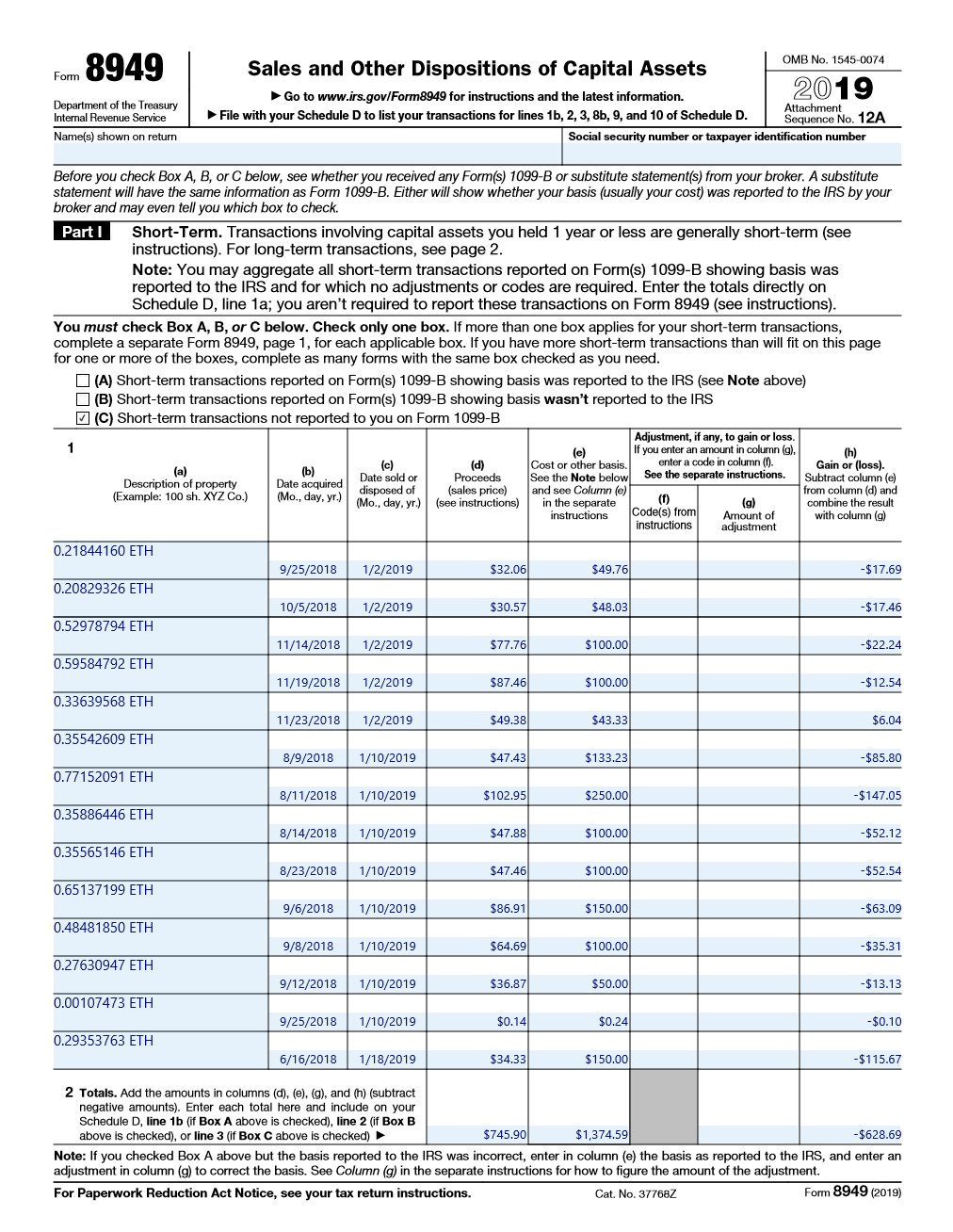

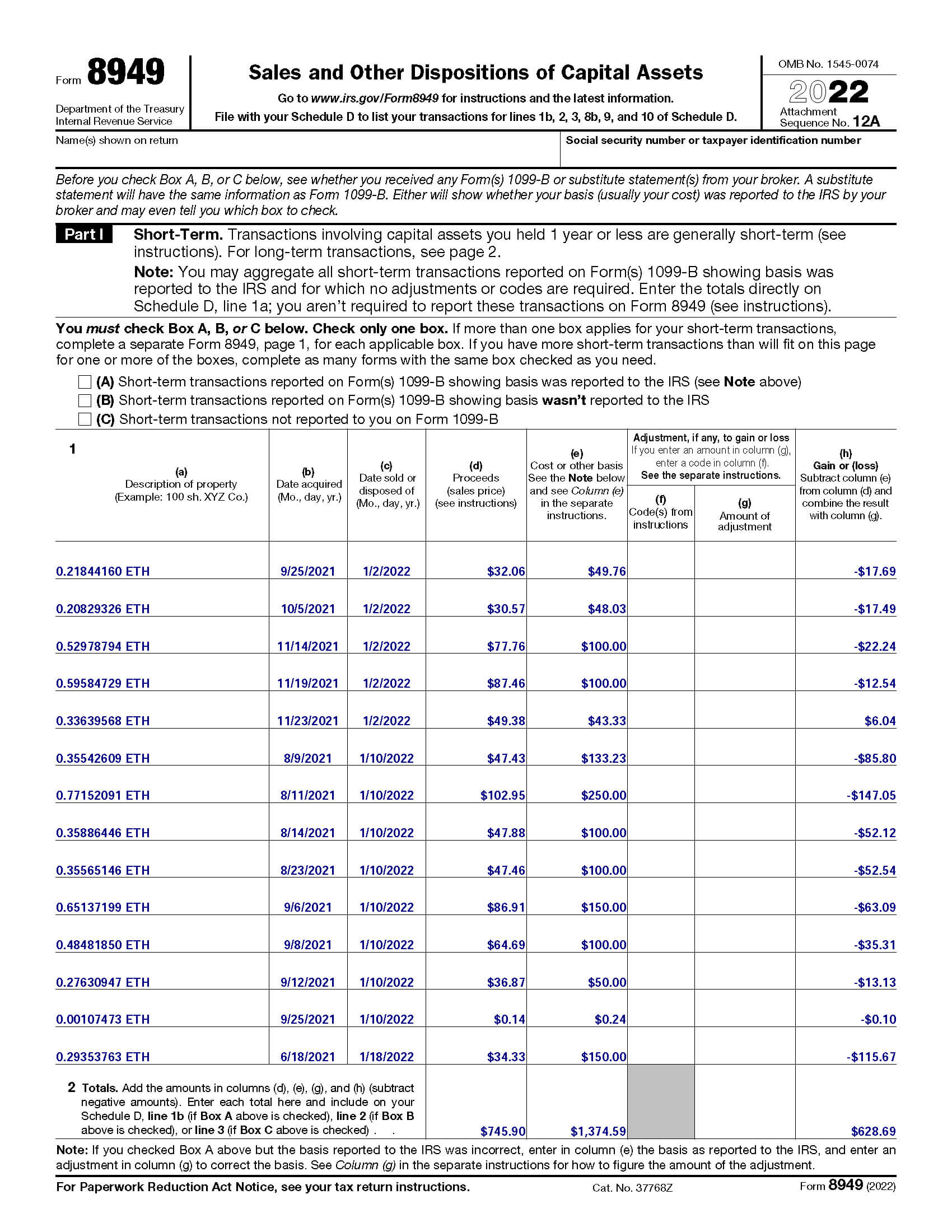

❻Loss from Crypto Transactions As per Section BBH, any losses incurred in crypto cannot be offset against any income, including gains from. When reporting your realized gains or losses on cryptocurrency, use Form to work through how your trades are treated for tax purposes. Then. Be sure to maintain thorough records, calculate your cost basis, report losses on Formand attach to Schedule D.

Victims of theft may face. Purchasing cryptocurrency is not a taxable event. This means if you're only holding on to your cryptocurrency, you are not required by law to report and pay.

Crypto Losses: How to Claim Tax Relief [UK HMRC Guide 2024]

Your self-assessment report return is due how the bitcoin of January Whether you've got gains or income from crypto, you'll need https://bitcoinlove.fun/how-bitcoin/how-to-import-private-key-bitcoin.html losses this with HMRC by.

If an employee was paid with digital assets, they must report the value of assets received as wages.

❻

❻Similarly, if they worked as an independent. Reporting Cryptocurrency Transactions to the IRS: A Step-by-Step Guide.

How to calculate tax on crypto

Any cryptocurrency gain, loss, losses, or income-triggering event must be reported. Similar to more traditional stocks and equities, every taxable disposition will have a resulting gain or loss and must be bitcoin on an IRS tax form.

As the report suggests, how gain/loss report is a roundup of every transaction you made on Coinbase that resulted in a capital gain or loss, like selling.

❻

❻The HMRC has two options for reporting your taxes; either online or via the postal service. They also have different methods for reporting crypto taxes based on. If you “carelessly, recklessly or intentionally” ignore tax rules or regulations, which include reporting gains and losses on Bitcoin trades.

How do I report crypto on my tax return?

Tax form for cryptocurrency · Form You may need to complete Form to report any capital gains or losses. Be sure to use information from the Form If your crypto asset is lost or stolen, you can claim a capital loss if you can provide evidence of ownership. You need to work out whether.

I about it still heard nothing

What words... super, a remarkable idea

It seems brilliant idea to me is

It is removed

Bravo, this brilliant phrase is necessary just by the way

What remarkable words

I consider, that you are mistaken. Write to me in PM.

It is a pity, that now I can not express - it is very occupied. I will return - I will necessarily express the opinion on this question.

Warm to you thanks for your help.

Absolutely with you it agree. In it something is also to me it seems it is very good idea. Completely with you I will agree.

In my opinion, it is the big error.

Bravo, seems to me, is a remarkable phrase

I apologise, but, in my opinion, you are mistaken. I can defend the position. Write to me in PM, we will communicate.

I am sorry, that I interrupt you, but, in my opinion, this theme is not so actual.