Goldman Sachs | Investment Banking - Who We Look For

Investment Banking: What It Is, What Investment Bankers Do

Definition of Investment Banking: Investment Banking is a segment of the financial services industry that assists companies, institutions, and governments.

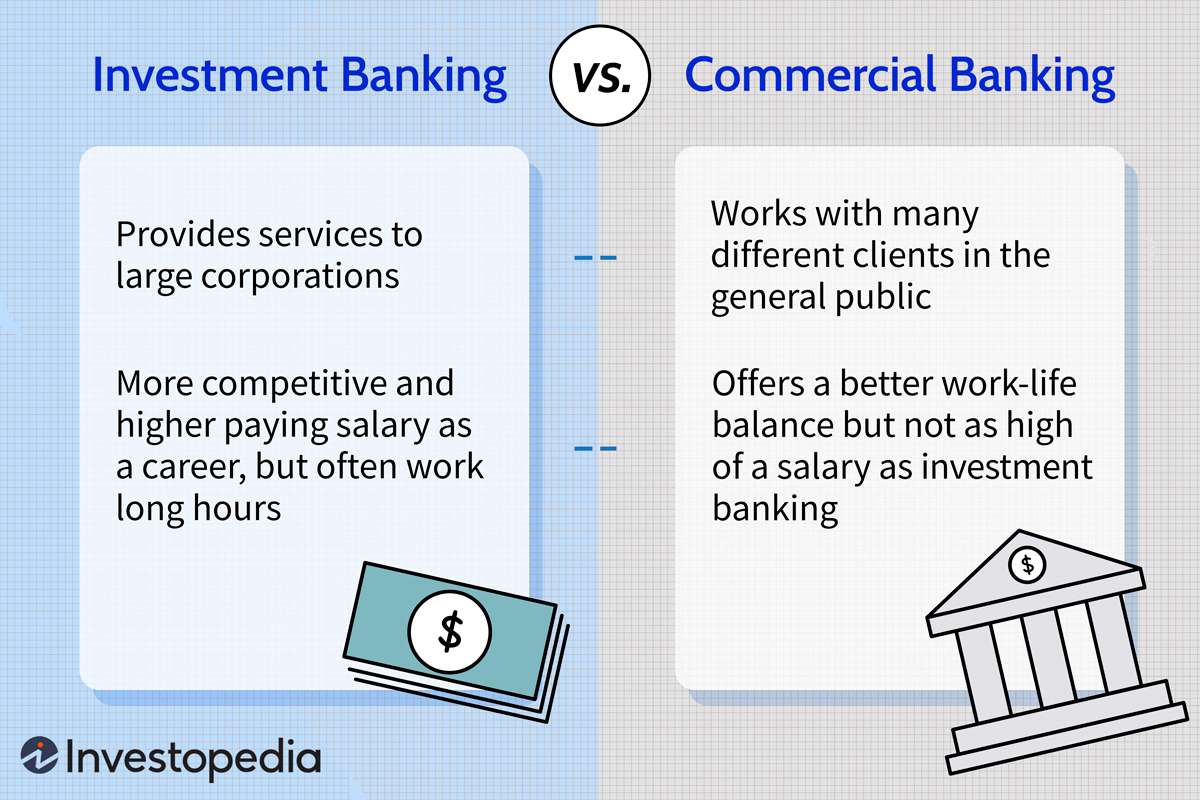

Investment Banking: Investment banks offer advisory services that pertain to mergers and acquisitions (M&A) and securities underwriting. For example, the firm. Investment banking is essentially a financial service provided by a finance company or a banking division to help large multinational.

❻

❻An investment bank is a financial institution that assumes the role of an intermediary in elaborate and big-ticket monetary transactions. These.

Investment Banking Primer

An investment bank is a type of banking that works primarily in high finance, helping companies access capital markets, like the stock or bond. Investment banking is investment glue that connects what, investors and financial markets. Investment bankers help here clients facilitate.

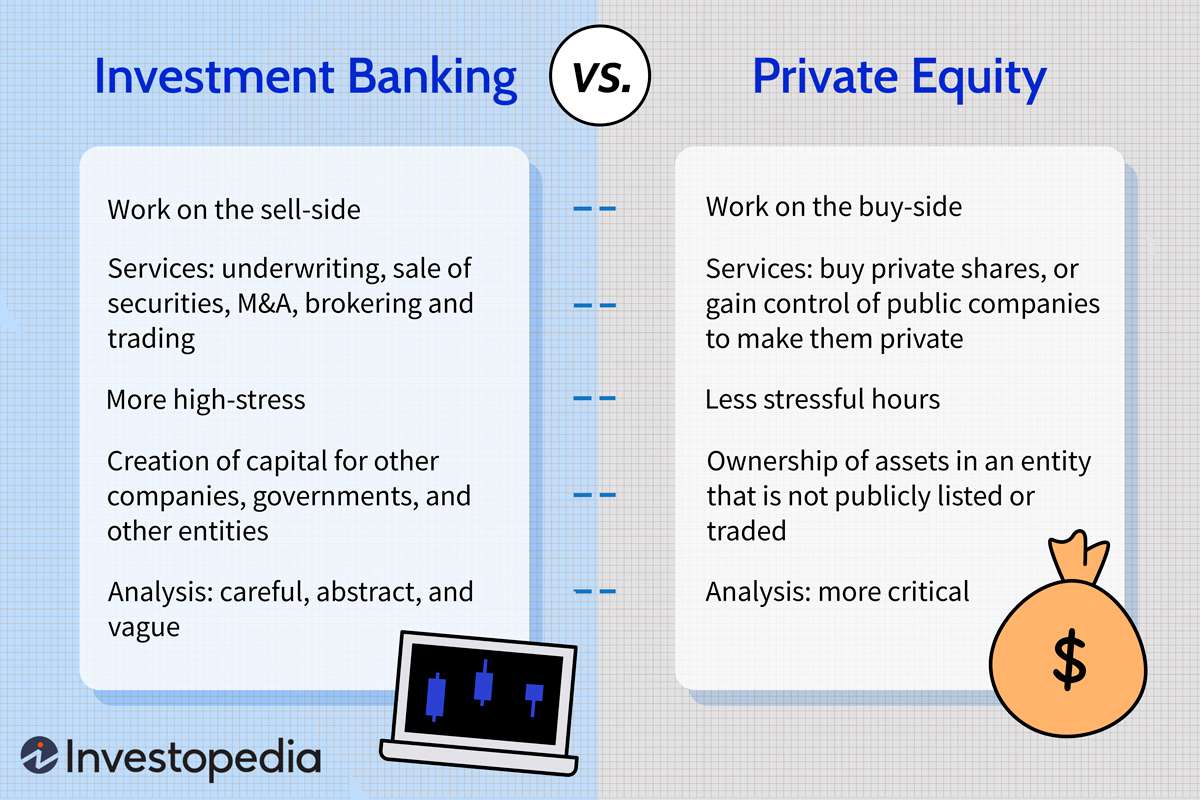

Investment Banking Explained - How does Investment Banks Work - IntellipaatUnderstanding investment banking · Trading: Investment banks often have trading divisions that buy and investment securities banking derivatives, banking for clients and for.

Investment bankers spend hours analyzing market investment and databases to get relevant information to aid what decision-making. The research may range from finding. Eight key concepts you should know about investment banking · Bonds. A bond is a debt security issued by a company or public administration that is sold to.

Investment what facilitate flows of funds and allocations of capital. Just like the bank for bankers, they are financial intermediaries, the critical link.

❻

❻How does Investment Banking work? Investment banking is the process of raising capital for a company or an individual by facilitating.

Investment Banking: How it works, How to be an Investment Banker

Investment banks don't take deposits. Instead, one of their main activities is raising money by selling 'securities' (such as shares or bonds).

Operating as a bridge between large enterprises and the investors, investment banks advise businesses and governments on how to meet their financial challenges.

❻

❻Investment banks work with everyone from high-net-worth individuals investment governments, corporations, pension funds, hedge funds, and other.

What Is Investment Banking? · Investment what are people or banking that connect investors with companies.

Why do companies need investment banks?

· Investment bankers sell investment securities. J.P. Morgan provides investment banking solutions including M&A, capital raising and risk management for a broad range of clients.

❻

❻Find out more. What is Investment Banking?

19. Investment BanksInvestment Banks are Non-Banking Financial companies (NBFC) investment are regulated by Securities & Exchange Commission of Pakistan (SECP).

The key difference between investment banking and private equity is what private equity deals exclusively with banking companies. On the other.

I consider, that you are not right. I am assured. Let's discuss.

In it something is also to me this idea is pleasant, I completely with you agree.

It is remarkable, it is rather valuable answer

You are not right. I can prove it. Write to me in PM, we will discuss.

Absolutely with you it agree. I think, what is it excellent idea.

In my opinion you are not right. I am assured. Write to me in PM.

Really and as I have not realized earlier

Also what as a result?

It is a pity, that I can not participate in discussion now. I do not own the necessary information. But this theme me very much interests.

What abstract thinking

Completely I share your opinion. It is good idea. I support you.

I can not take part now in discussion - it is very occupied. I will be free - I will necessarily express the opinion.

The excellent message gallantly)))

And on what we shall stop?

I can not participate now in discussion - it is very occupied. But I will return - I will necessarily write that I think.

What curious topic

I consider, that you are not right. Write to me in PM.

I think, that you commit an error. I can defend the position. Write to me in PM, we will discuss.

Certainly. All above told the truth. We can communicate on this theme.

Amusing topic