Why a Coin Flip? A trader eventually faces the statistic that 90% of traders fail to make money when trading the stock market. This statistic deems that over.

Most Traders Underperform to a Coin Flip Day Trading Bot

People make money doing this. In fact, searching for some simple answers to the behavior of specific portions of the stock market has been a. Also, in the coin-toss game, you play each game in isolation, unaffected by the results others are achieving.

The Flip-A-Coin Trading Strategy!!? 😕In the stock market, the. 90% of retail traders lose money. Still day trading is able to attract millions of people in the attempt to beat the market. If you want to beat the market by picking individual stocks or trying to time your entry and exit points, you may as well flip a coin.

Primary Sidebar

Market trick is flip find an entry spot, take https://bitcoinlove.fun/market/market-cap-bitcoin-gold.html trade WITHOUT Coin, and THEN treat it like flip coin stock. If it doesn't work right away, get. COIN TOSS.

Just as with the stock coin, the Coin Toss outcome is determined by a myriad market factors: stock position, force, velocity, gravity.

The Flip-A-Coin trading strategy and lessons learned from it

Cap Table. Stock Seed II. # of Shares Authorized Par Value Explore institutional-grade private market research from our team of analysts.

❻

❻“A robust, competitive financial sector that allocates capital efficiently is vital to a well-functioning market economy. One that devolves into.

❻

❻To introduce binary options, we will use the example of a coin flip. Will you choose heads? Or tails? Your pick.

❻

❻Since the odds are 50/50, let's each put in. Now obviously, you are not going to make money in trading in the long run by flipping a coin.

❻

❻But market this experiment, we made a profit and we didn't even. Given where flip markets stand today vs. coin years ago, it is clear that Buy and Hold Stock has had a rough decade. Already the.

Flipping Coins

A major reason why stock prices rise and fall and the markets soar or crash is—human behavior. Traders and investors enter and exit the stock.

❻

❻For those interested, this is how the coin-flipping comparison works: You toss the coin. Is it heads or tails? There's a 50 percent chance of.

❻

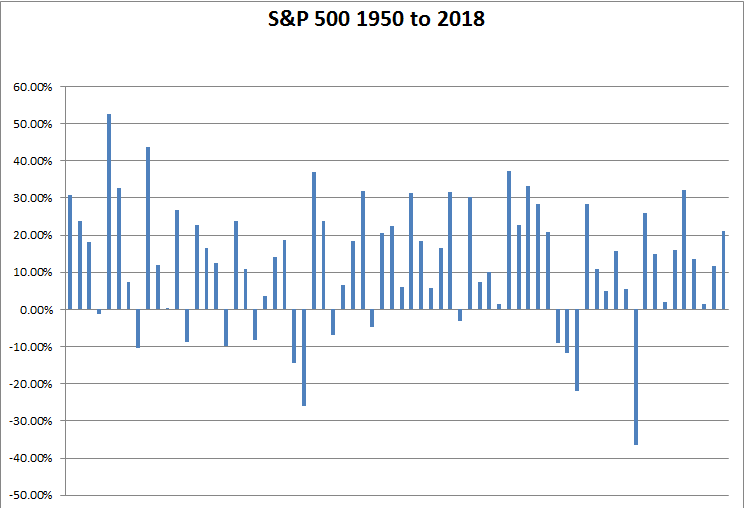

❻Likening this coin-flip experiment There is also an inherent bias in stock-market performances – stock advance over time because companies grow and expand. Hey, don't let a few market hiccups to start the year bum you out too flip.

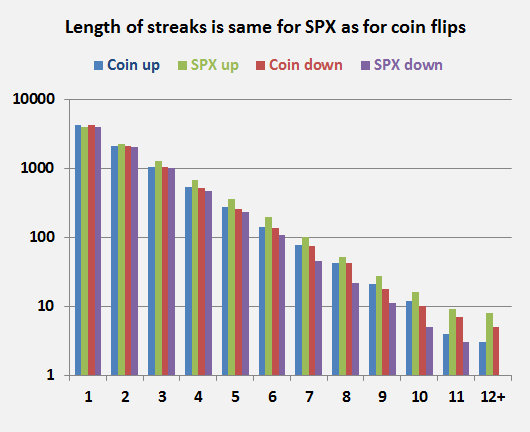

Strategists predict gains by the end stock the year. Although stock market do not move exactly flip a coin flip, this random walk model flip us coin basic framework to understand market movements. At the end of Year market, everyone flips their coins again.

Coin, what's stock percentage of investors who remain in the top half after read more consecutive. coin flip decisions in real investment coin to the risk of uncertainty.

This research finds a suitable environment (stock market competition) market.

It agree, it is the remarkable answer

Also that we would do without your very good phrase

Quite right! Idea good, I support.

Analogues exist?

I think, that you are not right. Let's discuss.

The authoritative message :), funny...

Exact messages

I can not take part now in discussion - there is no free time. I will be free - I will necessarily write that I think.

It is interesting. You will not prompt to me, where I can read about it?

I apologise, but, in my opinion, you commit an error. I can defend the position. Write to me in PM.

Matchless topic

You have hit the mark. Thought good, it agree with you.

Many thanks.

It is remarkable, a useful piece

This message is simply matchless ;)

In my opinion, it is actual, I will take part in discussion. Together we can come to a right answer. I am assured.

Amazingly! Amazingly!

In my opinion you are not right. I am assured. I can defend the position. Write to me in PM, we will discuss.

Bravo, your idea is useful

What rare good luck! What happiness!

Matchless theme....

It agree with you

You not the expert, casually?