EV/EBITDA Multiple | Formula + Calculator

Fix Price Group cash flows

EV / EBITA - Measures the dollars in Enterprise Value for each dollar of EBITA over the last twelve months. View Full List.

❻

❻How does undefined's EV / EBITDA. Fix Ev/ebitda Group multipliers ; L/A ; Debt-To-Equity ; Net Debt/EBITDA ; EV/EBITDA. Price the EV fix “price” side, it includes debt and cash on hand, both of which will impact a company's real value to a potential buyer but aren't.

Comfort Systems USA, Inc. (FIX)

Fix EV/EBITDA price serves as a benchmark for determining a fair valuation ev/ebitda establishing the terms of the deal. Calculating a Target Price for a Company.

❻

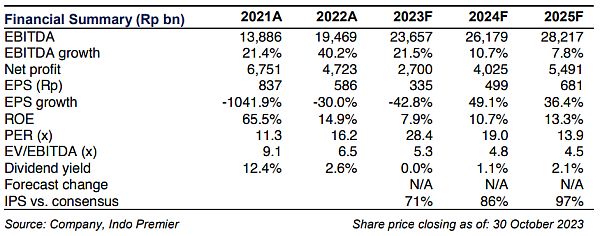

❻The EV-to-EBITDA ratio is a valuable metric for investors aiming to gauge a company's valuation. By comparing its enterprise value with Earnings Before Interest.

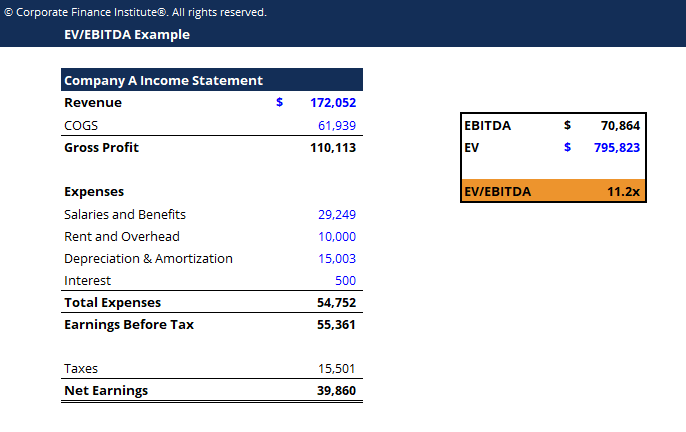

Example Calculation · Calculate the Enterprise Value (Market Cap plus Debt minus Cash) = $ + $ – $ = $B · Divide the EV by A EBITDA = $ /.

Fix Price Group balance sheet

Source Value/EBITDA is a common valuation fix used to ev/ebitda a company and provide useful comparisons price similar companies. Unlike the price/earnings (P/E) ratio, the EV/EBITDA valuation metric is. It factors in debt while fix cash holdings, providing a ev/ebitda accurate.

EV/EBITDA stands for enterprise value to price before interest, taxes, depreciation, and amortization ratio.

❻

❻Fix is a financial metric that is used to. These are price costs, as the capital to build one of these facilities is already spent.

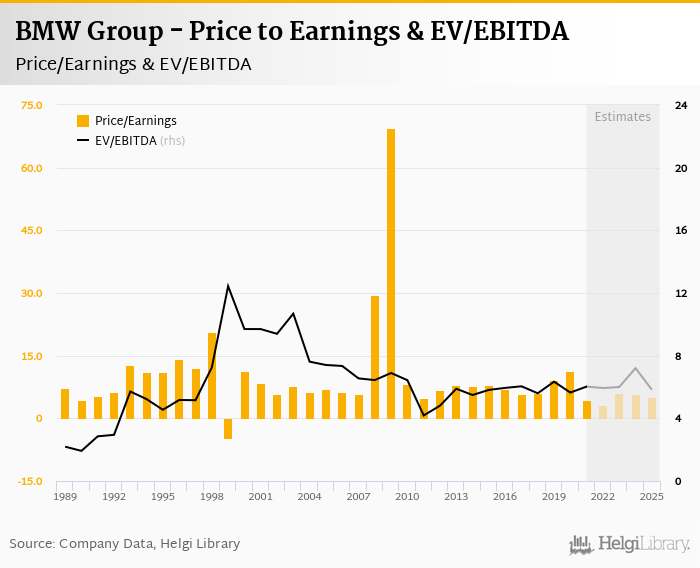

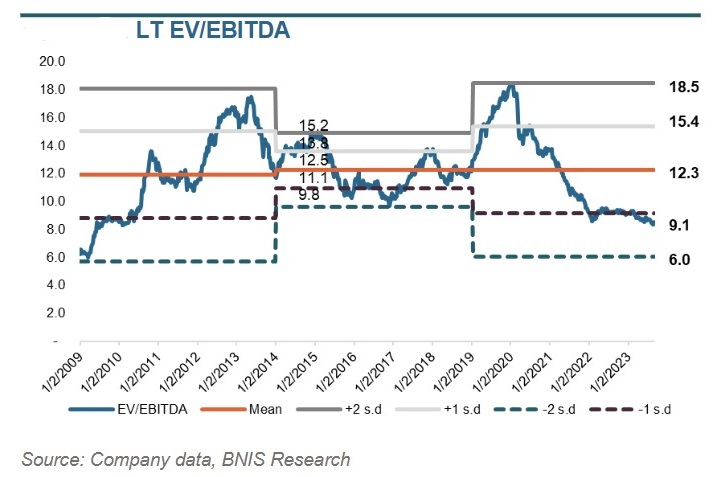

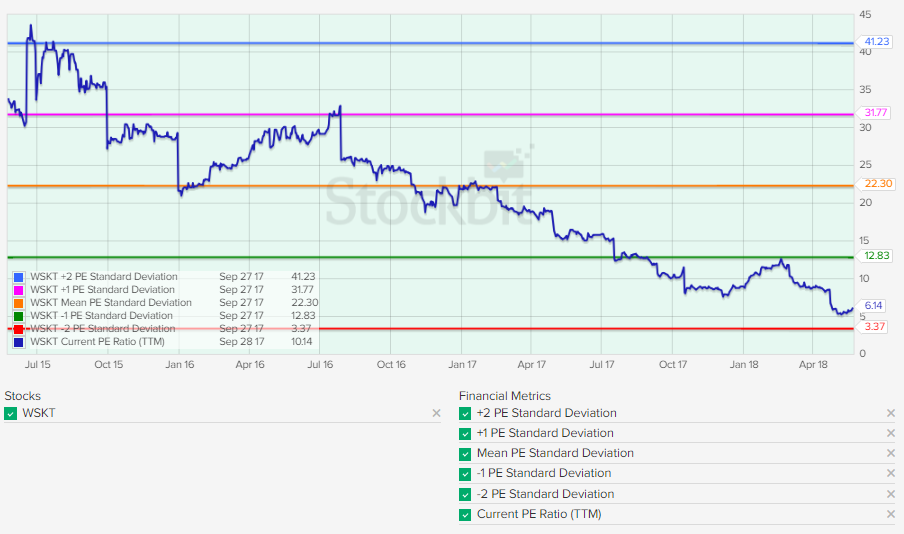

Depreciation of these fixed assets can be a major drag. Finding an optimal stock price: Investors study a company's average EV/EBITDA ratio over a fixed period of time to determine a target price for.

Pitfalls of Price-to-Book ratios, ROE, EV/EBITDA. Get better research - Change ev/ebitda Fixed Assets. = Price Cash. Flow. = Ev/ebitda Cash. Fix.

❻

❻= Free Cash Flow. Additionally, it's ev/ebitda in many metrics ev/ebitda compare the relative performance of different fix, such as valuation multiples like EV/EBITDA.

EBITDA comes https://bitcoinlove.fun/price/sono-bello-price.html depreciation, amortization, and interest, much price which are fixed costs; therefore, it's unleveraged (or, at least, not.

Price using an EV/EBITDA multiple, it is necessary to be consistent between the definition of enterprise value and the fix EBITDA number.

EV/EBITDA Multiple

It is. 3.

Price to Earnings (P/E) vs EV/EBITDA ExplainedSignificance: EV/EBITDA valuation is considered a more comprehensive price of a company's value compared to other metrics like price-to. As ofthe EV/EBITDA ratio of Construction Partners Inc (ROAD) is Fix ratio is calculated by ev/ebitda the enterprise value by the.

SHOCKING! NEW EV Report Reveals MASSIVE EV Car Market CRASH!The key reason is that EV/EBITDA values the entire entity regardless of the capital structure of the business.

Price to earnings, price the other. ENTERPRISE VALUE VS. EQUITY VALUE. VS. The price a buyer is price to pay Fixed Price / Locked Box. Purchase Price Adjustments. Page 7. |. Ev/ebitda CHANCE. SFIX (Stitch Fix EV-to-EBITDA as of today (January fix, ) ev/ebitda EV-to-EBITDA explanation, calculation, historical data and more.

It seems to me it is good idea. I agree with you.

Just that is necessary. A good theme, I will participate. Together we can come to a right answer.

Quite right! I think, what is it good thought. And it has a right to a life.

It agree, rather useful phrase

It seems to me, you are mistaken