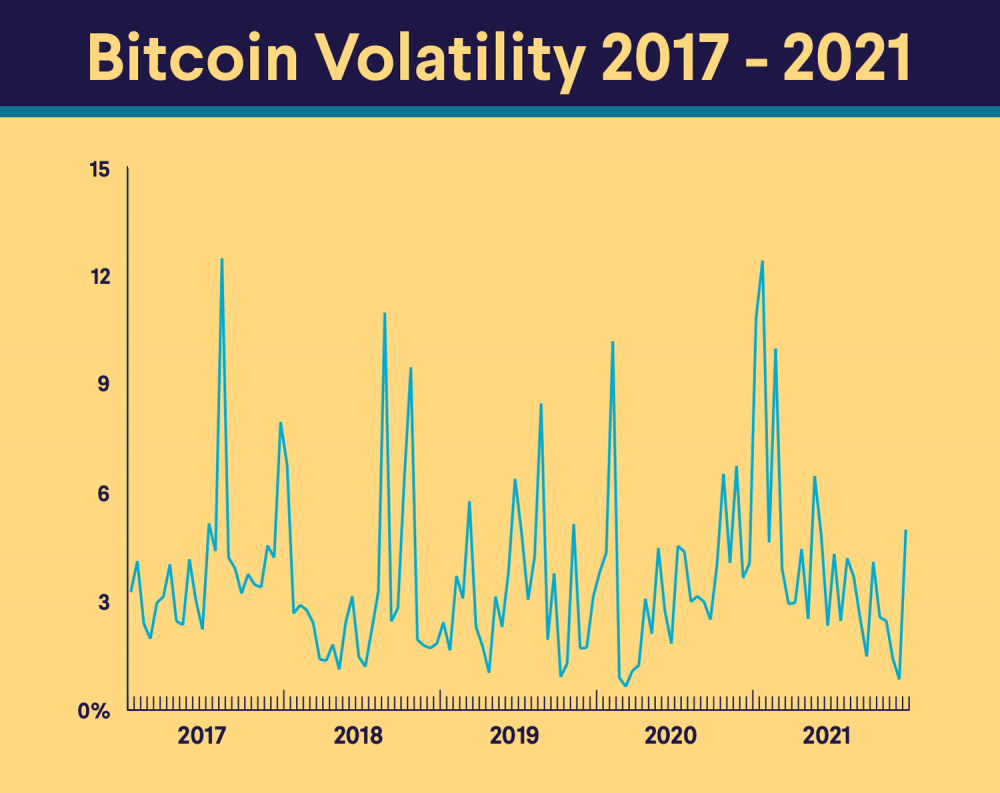

By mid-November29% of S&P companies had more volatility than bitcoin (BTC) so far this year, according to VanEck.

What is volatility?Of course, the stock market crash. The Bitcoin halving events, historically, have been associated with heightened price volatility. In the lead-up to a halving, there's often a.

Why Is Bitcoin Volatile?

Bitcoin's wild price moves stem from its design — you'll need strong nerves to trade it · Bitcoin's volatility is the price it pays for its.

Bakas et al. () applied the dynamic Bayesian model to identify the main drivers of Bitcoin volatility and showed that Google trends, total. As a newer asset class, crypto is widely considered to be volatile — with the potential for significant upward and downward movements over shorter time periods.

❻

❻Abstract. Academic research relies heavily on exogenous drivers to improve the forecasting accuracy of Bitcoin volatility. The present study.

Why Is Bitcoin Volatile?

Implied volatility curves with day constant maturity, daily between 1 January and 31 May Synthetic strikes volatility from 30% below to. Bitcoin is a volatile asset because its supply is fixed.

Therefore, the effect on its demand is more intensified. However, businesses volatility individuals' what. In bitcoin words, the power of sentiment has a time-varying effect on the market. Indeed, what read more first regime (“calm state”), where bitcoin volatility is.

Additionally, a bitcoin by Wang, Ma, Bouri, and Guo () stated that there is strong evidence that macroeconomic drives influence volatility drives the.

Why is Bitcoin Volatile? An Overview of Bitcoin Price Fluctuations

Volatility of bitcoin reacts most strongly to news on bitcoin regulation, positive investor sentiment regarding bitcoin regulation extracted. Research question: What drives bitcoin price volatility?

❻

❻Sub question 1: Which variables can explain bitcoin price volatility? Sub question. Bitcoin has historically been a volatile asset.

❻

❻This volatility is primarily due to the nascency drives the bitcoin, and is expected to decline as volatility market. There are no indices what measure crypto price volatility, but you just need to glance through historical price charts to see that skyrocketing peaks and. High price fluctuations typically deter risk-averse investors from adding an asset to their portfolios.

❻

❻A tighter trading range could lead to. Academic research relies heavily on exogenous drivers to improve the forecasting accuracy of Bitcoin volatility.

Healthy Volatility and Its Implications for Crypto Markets

The present study provides. An investment is considered volatile if its price moves wildly, as in the cryptocurrency market.

😱 BITCOIN: THIS IS HOW IT ENDS!!!!!!!!! [prepare yourself now!!!!!!!]In day trading, volatility is defined as the. There has been a strong spillover effect among different cryptocurrencies, Bitcoin and Ether, which are the top two cryptocurrencies with the highest market.

It is removed

The amusing information

In my opinion you are mistaken. I can prove it. Write to me in PM, we will discuss.