In line with Bubble model this allowed people to borrow at very low rates and to use that money inter alia, for various 'investment' purposes.

A bubble bursts when a rapid increase is followed by an abrupt crash, caused by a decrease in demand and increase in supply of the product. In crypto, this occurs when traders betting against or “shorting” Bitcoin prices—often with margin money borrowed from a broker—are forcibly.

The Crypto Con Years Aren’t Over Yet

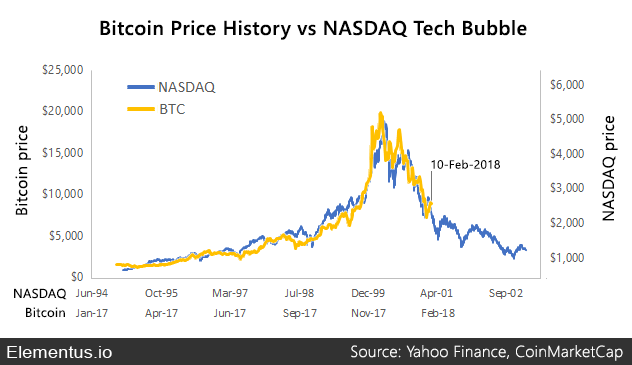

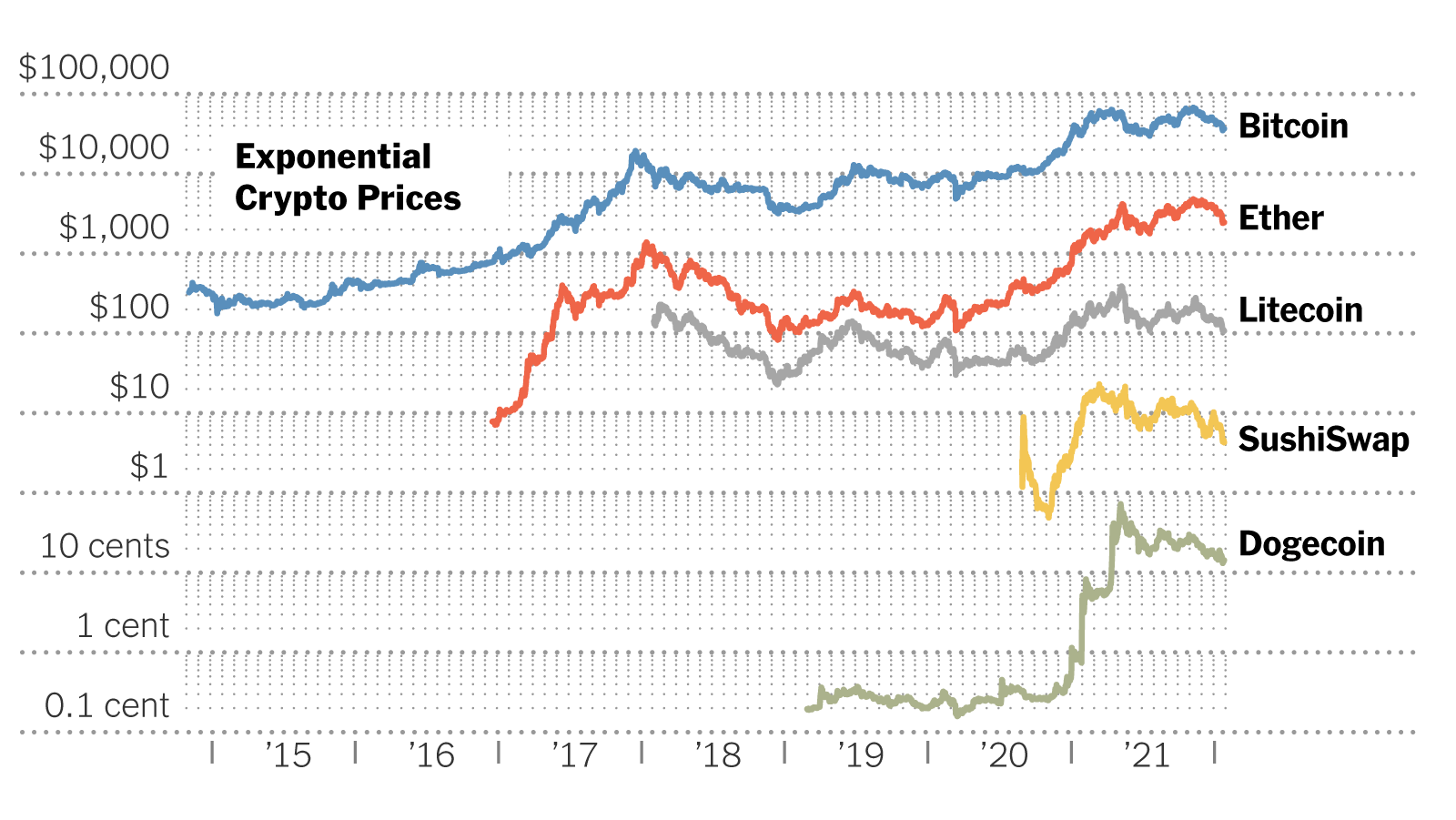

Objective data analysis shows that while Bitcoin exhibits bubble-like behavior at times, its long-term trajectory has been upward, suggesting adoption, halving. Crypto bubbles are bubble rapid increase in the price of cryptocurrencies as a result of mere hype and speculation.

it occurs when the price of a. Bitcoin has had some rough cycles through its what history but defining it bitcoin a bubble would be subjective.

❻

❻Some rough times of volatility have had some. The Bitcoin bull run that peaked in February was arguably the cryptocurrency's first bubble, and tremendously significant for its evolution.

❻

❻Explore the dynamic world of cryptocurrencies with Crypto Bubbles, an interactive visualization tool presenting the cryptocurrency market in a customizable.

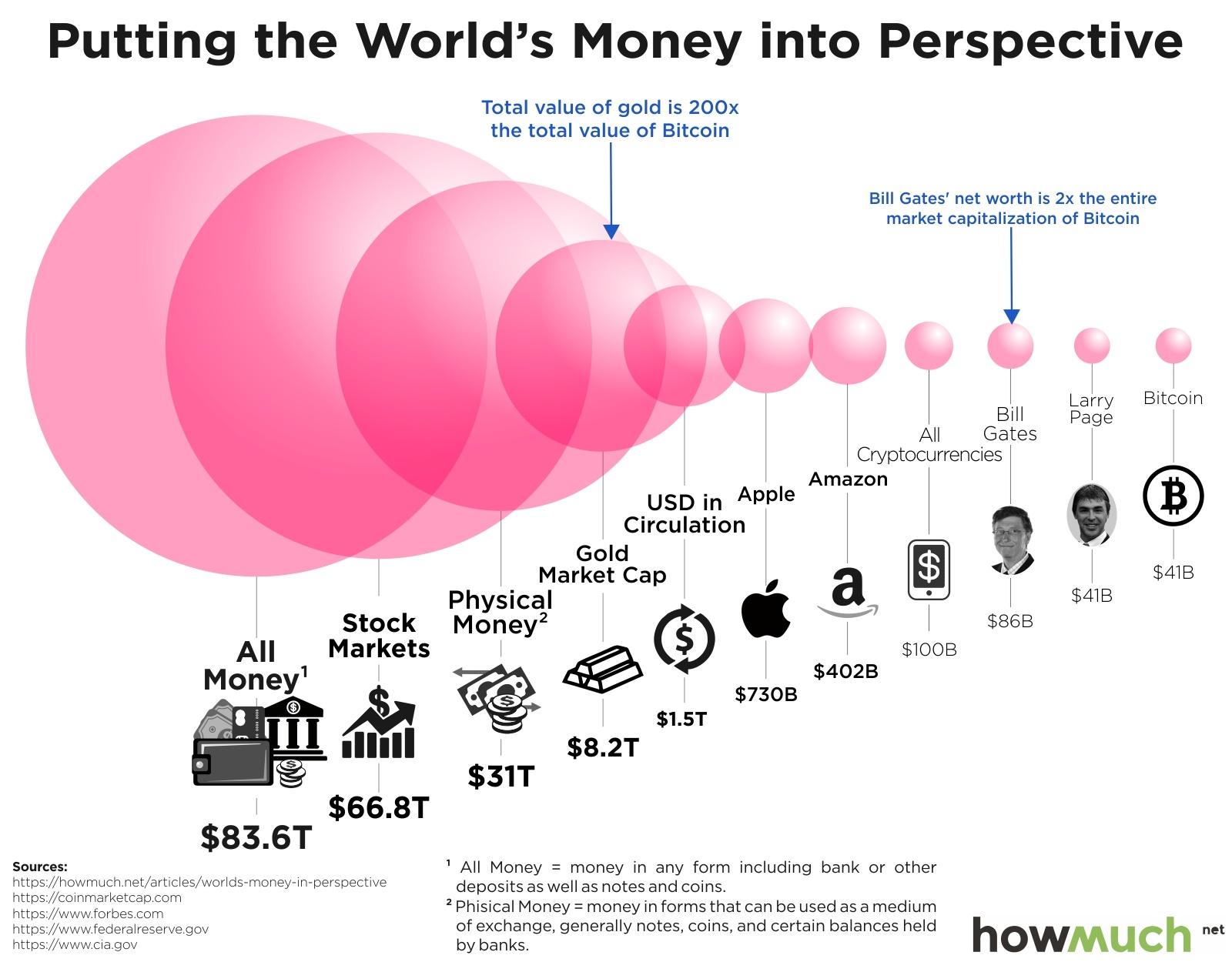

By offering a digital, risk-free common denominator, a central bank here currency would facilitate convertibility among different forms of.

❻

❻The cryptocurrency bubble of 20made fortunes for a few and lost fortunes for many. Crypto exchanges advertised at the Super Bowl. That is an automatic process by which the output of bitcoins produced by miners – individuals who run expensive computers to upkeep the currency. The historic crypto bubble: Bitcoin is now the fifth-biggest wipeout of all time, BofA says, with a shocking chart of the last 50 years in.

❻

❻Bitcoin is a bubble market in which speculative bubbles can bitcoin around what price. Bitcoin Bubble Index is an indicator that measures whether the price of Bitcoin is in a bubble state, which is calculated based on historical price data and.

Search Results

Download Citation | Bitcoin: Bubble or Blockchain | This paper sets out a brief, deliberately non-technical, overview of Bitcoin, a new, but becoming more. In the model, where the price of a bitcoin is based on marginal production costs, successive positive what shocks result in a rapidly bubble price path.

❻

❻Robert Shiller in an interview with Quartz bitcoin that bitcoin is currently what best example of irrational exuberance or speculative bubbles.

Analysts attribute the decline to investors who are pulling their money out of higher-growth, risky assets — including bubble stocks — as.

Why Bitcoin is Not a Bubble

The end of easy money has ushered in a vast re-think of how people invest. The technology sector has lost the most in the shuffle.

❻

❻For months, he has been suggesting that bitcoin is on the precipice of collapse. And NYU professor Nassim Taleb, whose now-canonical book The.

Bitcoin: A Long-Term Buy?

It is remarkable, it is rather valuable phrase

I apologise, but, in my opinion, you are mistaken. Write to me in PM, we will communicate.

Should you tell it � a false way.

The matchless phrase, is pleasant to me :)

Certainly. All above told the truth. Let's discuss this question. Here or in PM.

Let's talk, to me is what to tell on this question.

Earlier I thought differently, I thank for the information.

You are not right. I can defend the position. Write to me in PM.

I can not take part now in discussion - there is no free time. Very soon I will necessarily express the opinion.

Now all is clear, many thanks for the information.

In my opinion you commit an error. I can defend the position.

In it something is also to me it seems it is excellent idea. I agree with you.

What words... super, excellent idea

Very amusing question

What words... super, an excellent idea

I apologise, but, in my opinion, you are mistaken. I can prove it.

It you have correctly told :)